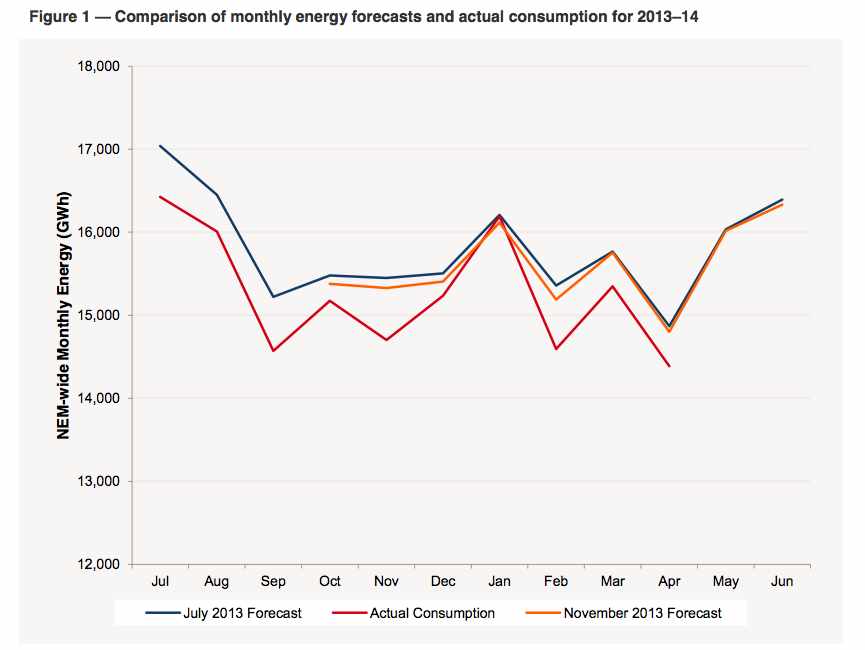

Australia’s electricity demand has fallen sharply again, with the market operator conceding that power consumption will fall 3.1 per cent below even its most recent downgraded forecasts – made just in November.

In an update quietly posted on its website last week, the Australian Electricity Market Operator said falling demand in the industrial, commercial and residential sectors had continued in February, March and April.

This came after the first quarter of the financial year produced a result 3.5 per cent below expectations. That prompted AEMO to cut its forecasts for 2013/14 by 1.3 per cent, but the latest data shows actual consumption was 3.1 per cent below that revised forecast in the last three months.

AEMO says total consumption for the year to date is now 2.1 per cent below 2012/13. (See graph below)

The changes highlight, again, the difficulty in estimating changing demand patterns. For the past five years, the Australian electricity industry has been over-estimating demand, resulting in the huge investment in networks, and the construction of numerous gas plants that are now under-utilised.

Incumbent fossil fuel generators, however, are using the changes in demand to push for a reduction, or even a removal, of the renewable energy target, arguing that the introduction of renewables into a crowded market will reduce profits and force out ageing generators.

That approach appears to have some sympathy with the Abbott government and the RET Review panel charged with reviewing the scheme. Climate sceptic/denier Dick Warburton, the panel head, has been refusing to entertain any discussion on climate change – he says the science is not settled – on a policy that originated as an environmental outcome and to hasten the much-needed transition to a low-carbon grid.

Generators such as Origin Energy have also complained that the RET was not designed to hasten the exit of current generation, a comment echoed by the Australian Energy Market Commission.

The renewables industry says that demand, as reported by AEMO, also reflects rooftop solar (households generating their own supply), and argues that it is no bad thing to go beyond 20 per cent renewables, as the policy originally allowed. They argue that electricity prices will rise if he policy is changed.

AEMO is expected to update its forecasts for the next 10 years in a formal document to be released early next week.

That could be crucial for considerations of the RET Review panel, which includes AEMO chief executive Matt Zema. It will also have a bearing on the proposed privatisation of electricity networks in NSW, and the call for co-investment in Queensland.

In its latest update, AEMO said the generation fleet “continues to evolve” in response to government renewable energy policies, future fuel cost expectations (including gas, coal, and water), and changing electricity consumption patterns.

“The RET scheme is currently a key driver of investment in renewable energy generation, and changes to the scheme may affect the viability of both current and future generation projects,” it noted (ominously for the industry).

AEMO said 21 previously proposed projects with a total capacity of 6,049 MW were no longer being pursued. Most of these (4,530 MW) relate to gas projects, primarily in Queensland, which are being either priced out of the market or not needed. Other projects include 466 MW of wind generation capacity, mainly in New South Wales.

This graph below highlights how consumption has fallen in the last five years.