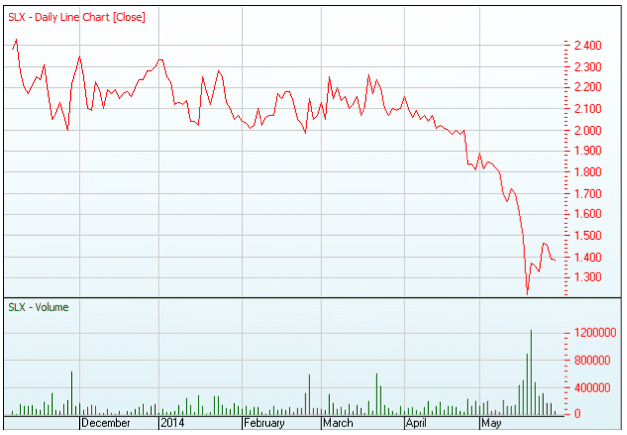

ASX-listed cleantech company Silex Systems has named the federal government’s changes to the Australian Renewable Energy Agency (ARENA) – long-feared and finally confirmed with the delivery of the federal budget earlier this month – as a key contributor to the halving of the company’s share price over the past month.

In a letter to shareholders, published via the ASX last week, Silex CEO Michael Goldsworthy said the “unexpected erosion” of the company’s share price to a 52-week low of $1.21 was due partly to uncertainty created by the ARENA changes – more specifically, the status of the Agency’s conditional funding contribution towards Silex’s planned development of a 100MW concentrating solar PV power station in Victoria.

The 100MW Mildura facility, originally slated to be built by Silex subsidiary Solar Systems late this year, was to follow the successful demonstration of the company’s technology at its 1.5MW Mildura plant – Australia’s largest concentrated photovoltaic (CPV) solar power plant – which was launched last October.

The 100MW Mildura facility, originally slated to be built by Silex subsidiary Solar Systems late this year, was to follow the successful demonstration of the company’s technology at its 1.5MW Mildura plant – Australia’s largest concentrated photovoltaic (CPV) solar power plant – which was launched last October.

Back in then, Goldsworthy said the planning phase for the 100MW project was well underway, with construction commencement subject to successful operation of the demonstration facility and finalisation of funding arrangements – which at that stage included a further $35 million from the Victorian government and $65 million pledged by ARENA (originally via the Low Emissions Technology Demonstration Fund).

But in his letter to shareholders last week, Goldsworthy sought to reassure investors that, despite its plans to demolish ARENA, the federal government had confirmed that $1 billion of funding for “existing priority projects” would remain available.

“We understand that the $75 million conditional funding commitment for the Mildura 100MW Solar Power Station Project, planned by Silex subsidiary Solar Systems Pty Ltd, is included in the “existing priority projects” funding and therefore remains available,” he wrote.

This funding and the fate of ARENA depends on the passage of legislation through the Parliament (in particular the Senate) which is still uncertain. In the meantime, the company continues to proceed with the Mildura project planning and awaits additional advice from ARENA.”

Despite its main line of business being in nuclear power technology – making Japan’s recent Fukushima disaster another likely factor in the share price plunge – Silex has been bullish about its solar technology, predicting last year that the levelised cost of energy for its dense array CPV plants could fall below 10c/kWh within a few years, making it cost competitive with a range of competing technologies such as wind and peaking gas.

Goldsworthy said in October 2013 that, if large volumes were assumed, the company’s CPV technology could be deployed straight away at a LCOE of between 15c/kWh and 20c/kWh – which accords to similar predictions by thin film panel producers such as First Solar.

In his letter to shareholders, Goldsworthy was again bullish, noting that “with current cash reserves of approximately $67 million, zero bank debt

and low overheads,” Silex remained in a strong financial position to progress its technologies to market.

He listed demonstration of cost competitiveness and bankability of Solar System’s utility-scale CPV projects in target markets like Australia, the Middle East and the US as Silex’s key priority over the next 12-18 months, as well as progressing towards “a strategic partnership during FY15 with a view to achieving a value-creating transaction during or soon after that timeframe.”

Interestingly, Silex’s share price – which fell from around the $2 mark in April to a 52-week low of $1.21 on May 19 – has rallied somewhat since the CEO’s letter was released on May 20, and sits at $1.40 at the time of writing.

As you can see in the ASX chart above, however, Silex shares have been charting a steady decline since last June, when they hit the lofty heights of $3.12.