Australia’s electricity grids are undergoing a profound transformation, with large-scale batteries rapidly emerging, already moving from ancillary to central roles, and progressively by-passing the need for gas.

These batteries are evolving from supporting roles to becoming central components of the energy system, in reducing the reliance on gas-fired generation.

This change is evident not only in energy dispatch patterns, but also in the way market prices are set, as storage technologies allow renewables to influence prices for the majority of the year and push gas generation to the periphery.

Changing Price Dynamics with Battery Integration

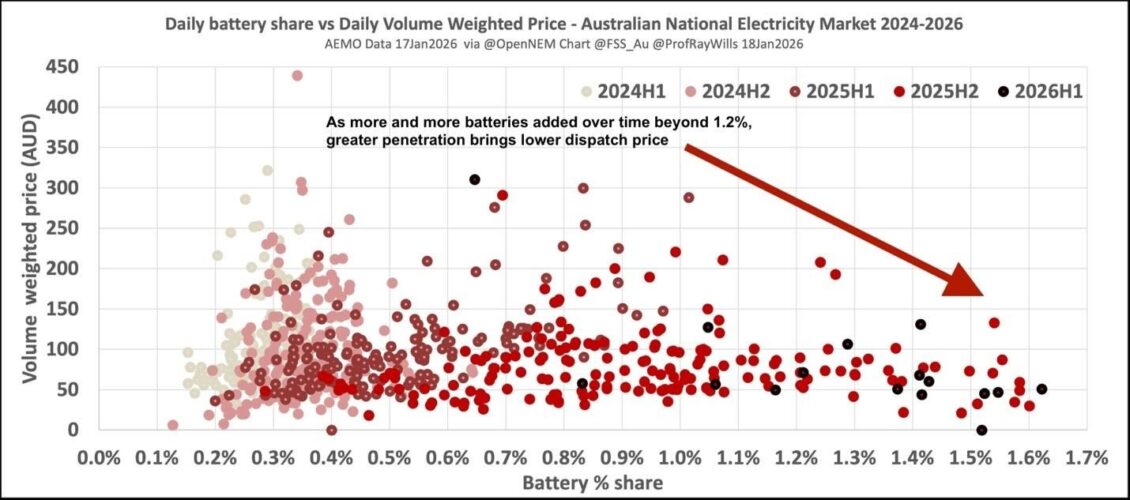

The initial evidence of this structural shift can be seen by analysing volume-weighted prices alongside the battery share of National Electricity Market (NEM) generation over 2024–25 (Figure 1).

Figure 1. Volume‑weighted NEM prices versus battery dispatch share, 2024–2026.

In early 2024, batteries supplied only less than 0.5% of energy, during which market prices frequently exceeded A$200/MWh. This was due to limited storage capacity and a heavy dependence on gas for peak supply and system firming.

However, by the second half of 2025, as battery deployment increased and their share of dispatch rose to 1.5–1.7 per cent, prices became noticeably lower and less volatile. The data shows a clear correlation: higher battery penetration leads to reduced prices and fewer price spikes.

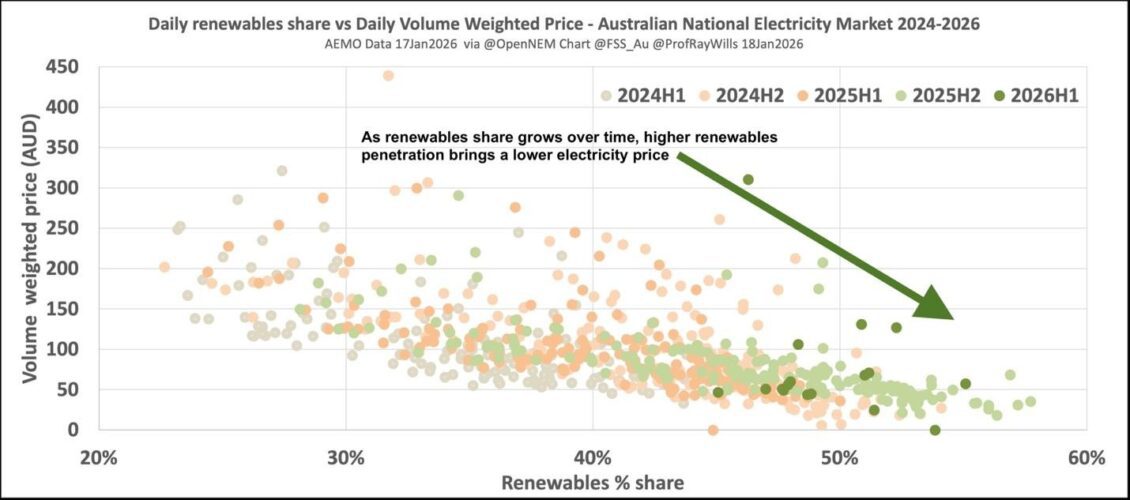

The Broader Impact of Renewables

Renewables overall demonstrate a similar trend. In 2024, most trading intervals had a renewable share between 20 and 40 per cent, typically corresponding with relatively high prices.

By the second half of 2025, this distribution shifted upwards to the 40–60 per cent range, where prices are consistently lower and less volatile. This pattern aligns with broader analyses that indicate a significant regime change as renewables move from a minority to a majority share of the generation mix.

Figure 2. Volume‑weighted NEM prices versus renewable energy share, 2024–2026.

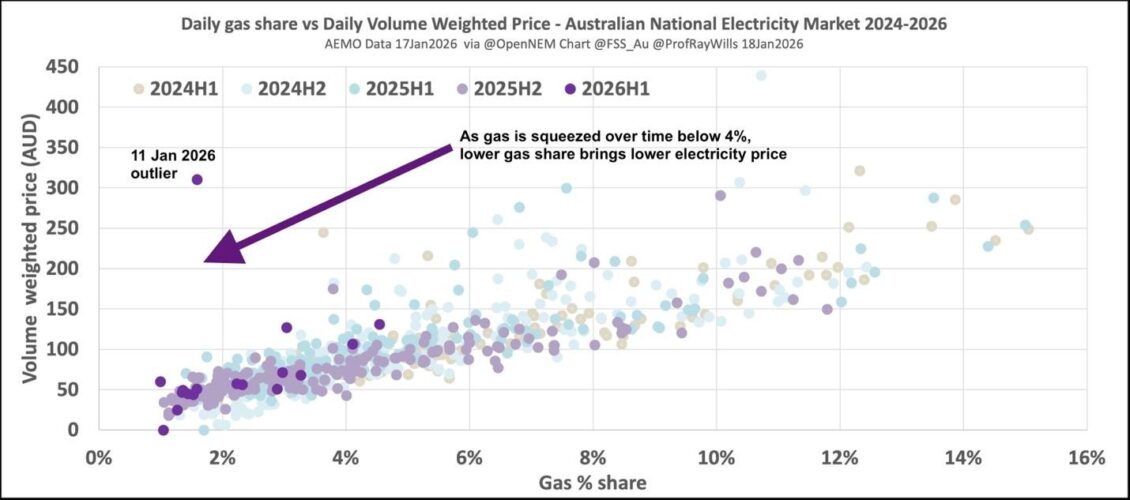

Gas Generation in Decline

The evolution of gas generation mirrors these changes. During 2024–25, the relationship between gas share and price shifted leftwards and downwards, indicating that gas is being squeezed out of the mix and now plays a much smaller role in price setting.

By late 2025, high-priced outliers are rare at any given gas share, reflecting increased competition from batteries during peak hours and better ramping support from wind and solar generation.

Figure 3. Volume‑weighted NEM prices versus gas generation share, 2024–2026.

Note – the unique outlier (11 Jan 2026) price excursion caused by a high demand and evening volatility event in NSW impacting gas pricing https://wattclarity.com.au/articles/2026/01/10jan-nsw-overview/)

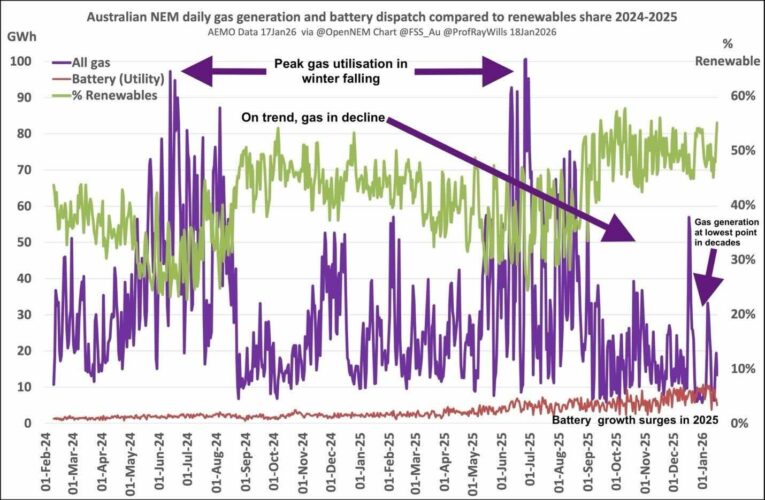

Time-Series Evidence of Transition

Examining time-series generation data for the NEM over this same period highlights the broader transition. Renewable generation continues to grow strongly, gas generation retreats to its lowest levels in a decade, and battery dispatch rises sharply, particularly in the past year.

Batteries are now closely aligned with evening peak demand and contingency events. This marks a shift in the NEM’s character, transitioning from a coal-and-gas-dominated system with some renewables to a renewables-plus-storage system, with fossil fuels playing only a residual backup role.

Figure 4. NEM generation by gas, renewables and battery dispatch, 2024–2026.

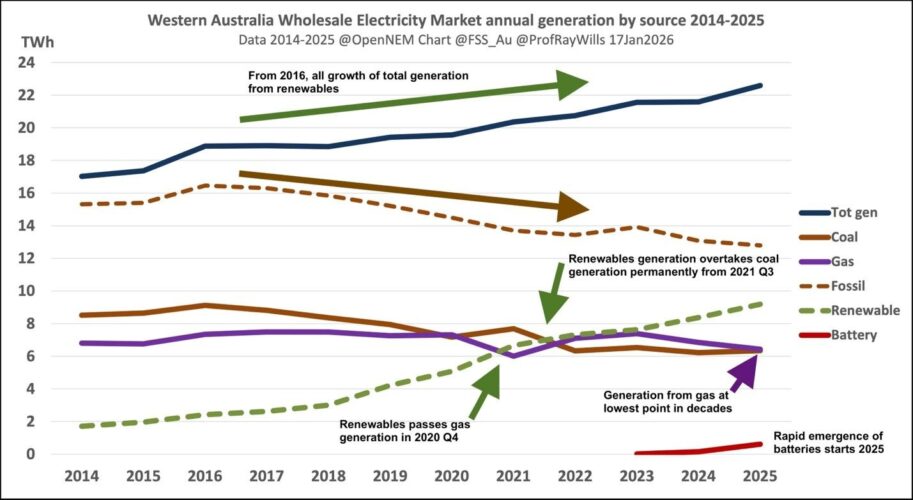

Western Australia’s Accelerated Progress

On the Western Australian Wholesale Electricity Market (WEM), these trends are even more pronounced. Over the past two years, gas generation has declined while renewables have surged to supply around 55 per cent of annual electricity, as we’ve reported in RenewEconomy.

New utility-scale batteries now on occasion exceeding more than 25 per cent of evening peak demand. In this isolated grid, without interconnectors, batteries and high renewable penetration are already displacing gas, demonstrating that a transition away from gas is both technically and economically viable.

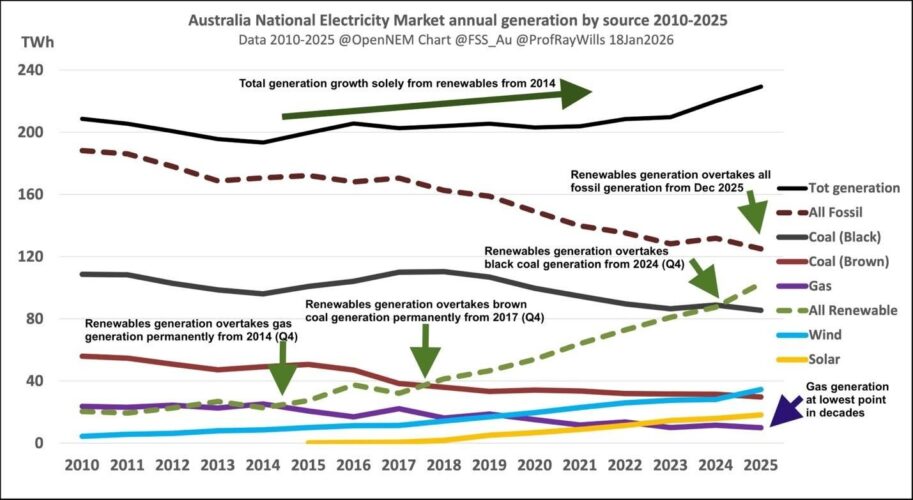

Long-Term Trends: 2010–2025

Long-term data from the NEM, spanning 2010 to 2025, reinforces the conclusion that batteries are replacing gas for firming duties (Figure 6). As wind and solar power expand and coal exits, gas initially fills some of the gap. However, from the early 2020s onward, battery dispatch increases while gas use declines.

Whether viewed annually or monthly, the trend is clear: renewables plus storage are rising, gas is falling, and fossil fuels are playing a diminishing role in both energy provision and price formation.

Figure 6. Generation by source including total generation in the NEM, 2010–2025.

Similarly, the WEM’s record from 2014 to 2025 (Figure 7) shows continuous growth in total generation, significant recent expansion in renewables, and increasing evidence that batteries are managing a greater share of balancing and peak supply, and now the first few occasions where battery dispatch has exceeded gas generation.

Gas output is simply no longer growing with demand, but rather, it has been declining as wind-solar combinations and a rapid rise of batteries meet the system’s needs.

Figure 7. Generation by source including total generation (Tot gen) and battery dispatch in the WEM, 2014–2025.

Batteries Outperform Their Modest Share

Although batteries still account for a modest share of total energy, they are exerting a disproportionate influence in both the NEM, and especially the WEM. Batteries reduce volume-weighted prices by eliminating the small fraction of very high-priced intervals that used to push up annual averages.

They support higher renewable penetration by smoothing out ramps and displace gas generation through the merit-order effect, which prioritises low-marginal-cost resources.

Conclusion: A Storage-Led Energy Transition

Australia’s electricity grids are now firmly in a storage-led transition. Since 2024, rapidly increasing battery installations have driven down prices and sidelined gas by enabling renewables to set the market price more often.

In the NEM, the second half of 2025 marks a major turning point: renewables reach roughly 50 per cent, batteries out-dispatch gas peakers, and gas generation falls to about half its 2024 peak levels. Meanwhile, the WEM is already operating with 55% renewables and significant battery support during peak demand.

The evidence points towards a net-zero future where batteries firm variable renewables more efficiently than gas, reducing fossil reliance faster than anticipated. This transition is occurring faster than many planning exercises have anticipated, if policy and regulation keep pace with these operational developments.

To maximise the benefits of this rapid transformation, planning and investment frameworks should be designed for a renewables-plus-storage future, rather than a system centred on gas. We must continue to move quickly to take best advantage of the fastest energy transformation in human history.