Distribution network companies are pushing hard for changes to National Electricity Market rules that will allow them to “evolve their capability” beyond poles and wires and into non-traditional services like owning and operating medium and big batteries and hosting large-scale wind and solar.

In submissions to the National Electricity Market (NEM) Review, distribution network service providers (DNSPs) from New South Wales, Queensland and South Australia have called for the loosening or removal of regulatory barriers to unleash the full potential of their networks and deliver that they say would be more efficient grid and consumer outcomes.

They are particularly keen to be able to install, own and operate what are nominally called “community batteries,” the medium-scale “shared” energy storage systems being rolled out on distribution grids to help soak up excess solar generated on suburban rooftops in the middle of the day and shift it into the evening peak.

Under normal ring fencing rules, overseen by the Australian Energy Regulator to avoid distortion in competitive markets, DNSPs – being regulated monopolies – this is not allowed; apart from through a temporary waver in 2023 that gave DNSPs access to federal Labor’s Community Batteries scheme.

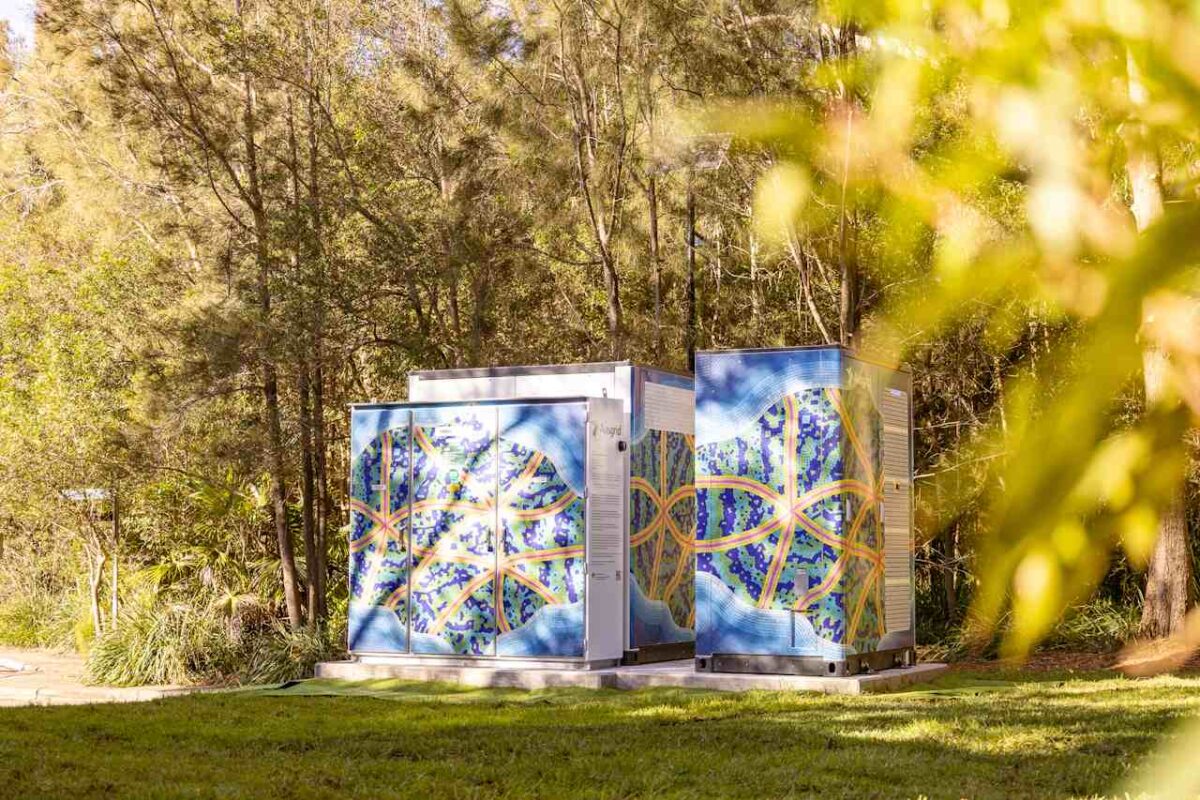

But New South Wales DNSP Ausgrid – which has so far installed 19 community batteries, totalling 2 MW/4MWh in capacity – says these rules stand in the way of a much broader battery rollout that promises to deliver multilevel network and customer benefits.

“Batteries are a versatile tool capable of addressing multiple network and system management challenges – with up to 35 different use cases for Ausgrid batteries. Yet existing ring-fencing rules stand in the way and restrict DNSPs from building batteries and leasing out spare capacity,” Ausgrid says in its submission to the NEM Review.

“If funding and regulatory barriers are alleviated, our analysis indicates 5MW community batteries could be rolled out to over 200 sites across our network, which has the potential to meet over 80% of our customers’ expected individual battery demand. By 2030, this has the potential to result in over 1GW of storage across Ausgrid’s network.

“By rolling out these batteries at existing Ausgrid sites, this storage capacity would have limited impacts on the community and the environment, enabling faster implementation than installing storage at Greenfield sites,” it says.

“Ausgrid is also exploring opportunities for the deployment of larger ‘grid-scale’ batteries at Ausgrid locations and has entered a bid for two grid-scale batteries under the Capacity Investment Scheme Tender 3 (NEM Dispatchable).”

More broadly, the network companies argue that their role in the energy market – to deliver electricity between the transmission network and customers and from consumer resources, like rooftop solar, back to the grid – has been undervalued and overlooked in the transition so far, as well as in forward planning for a renewables dominated grid.

They say that despite being at what once might have been called the “coal-face” of the consumer led transition to renewables, this is not being reflected in the current market rules, or even in the comprehensive Integrated System Plans put together by the Australian Energy Market Operator.

“Distributed generation, and the associated distribution network capacity to host that generation, is not placed on an equal basis with large-scale generation and transmission capacity in any long-term system planning process in the NEM, despite the potential for more efficient consumer outcomes,” says Ben Birch, head of strategy, innovation and growth at South Australia Power Networks (SAPN), in that company’s submission to the review.

“Distributed generation, including [consumer energy resources], should be both an input and output of AEMO’s modelling, with equal opportunity provided for distributed and large-scale generation to be included in an identified least-cost generation mix.”

In the case of Ausgrid – which currently has around 275,000 rooftop solar installations and an estimated 20,000 behind the meter battery installations, but expects this to grow to 570,000 and 270,000 by 2035 and by 2050 to 900,000 and 575,000 – there are plans to develop separate distribution level ISPs.

“We are … working with the other NSW DNSPs to create a ‘Distribution ISP’ for the state, to identify opportunities on the distribution network and quantify their benefits to consumers,” Ausgrid’s submission says.

“This will add detail to how distribution network capabilities can support energy system planning activities.”

In their own submission to the Review, Queensland network companies, Energex and Ergon call for the development of a Distribution Market or markets, and establishment of Distribution System Operators (DSOs).

These bodies could be “central to increasing the integration of CER and customer participation, and may provide answers to some of the broader challenges being assessed and discussed as part of this NEM Review,” the submission says.

“These markets could supplement limitations in the NEM and enhance opportunities at a more granular level, providing overall system and customer benefits.”

“We consider DNSPs already have key foundational capability and are best placed to plan, operate and connect to the network, with many networks already implementing a range of flexible services programs. We understand DNSPs will still need to evolve their capability, however, it would be a much simpler and more cost-effective option,” the Queensland DNSPs say.

“[Current] restrictions limit the ability to create genuine competition and value around the use of these assets. To fully leverage end-to-end value opportunities and economies of scale, and to support the ongoing rapid adoption of CER, we encourage DCCEEW to explore how regulatory hurdles can be removed to overcome barriers to genuine competition in the use and operation of assets such as network batteries.”

In amongst the more than 90 submissions to the NEM Review, however, there are plenty arguing that networks should be made to stay in their lane. Among them, Nexa Advisory’s Stephanie Bashir argues that network ownership and operation of batteries will likely stifle competition and innovation in what is a new and evolving market.

Bashir notes that Australian Energy Regulator, back in 2021, expressed concern that allowing DNSPs to actively engage in the community battery market risked pushing out other players. This would not be in the long-term interest of consumers, the AER said, and could mean the full range of benefits from batteries were not realised.

“The ring-fencing guideline protect consumers and ensure that the regulated electricity DNSPs do not exercise their monopoly powers in using revenue earned from electricity customers from regulated services to fund contestable services and increase their profits,” Bashir told Renew Economy.

The NEM Review is being led by Tim Nelson, after he was appointed to the role last November by federal and state energy ministers. It is due to deliver a draft report by the middle of the year, and final recommendations by the end of 2025.

Submissions to the NEM Review were made public this week, here. In a statement on LinkedIn on Tuesday, Nelson thanked stakeholders for “the significant effort put into providing submissions” and released dates for public forums in Sydney, Hobart, Melbourne, Adelaide and Brisbane over coming weeks.

Check Renew Economy’s Green Energy Calendar for the dates and details of the public forums.