If you talk to engineers about the challenges of the switch from fossil fuels to renewables, it’s not the wind, solar and storage technologies that keep them awake at night – it’s whether the coal generators still in the system will actually work as they are supposed to do before they close for good.

Policy makers and ministers have a similar problem. Just how far will the fossil fuel industry try to make them bend over the barrel before they are satisfied they are going to get their “just rewards” for their graceless and undignified exit from electricity grids and the transport fuels markets.

The fossil fuel industry threw away what remains of its social licence earlier this year – on a global scale with its rapacious “war profiting” from Russia’s invasion of Ukraine. And it’s not about to apologise. If anything, the bad behaviour is getting worse.

Even the head of the IEA – the fossil fuel lobby created half a century ago after the last major “energy crisis” – declared the profiteering of the global oil and gas giants to be “grotesque”, particularly as they forced millions more into energy poverty and threatened millions more to go without power.

In Australia, it was just as bad – the actions of the fossil fuel suppliers and generators – hiding behind the veil of “economically rational” behaviour and the letter of the law, basically held the country to ransom.

And now they are threatening to do the same all over again, with confirmation that the private suppliers of what is supposed to be an essential service can’t possibly deliver what they say they will do without being entitled to super profits.

The industry is being told by state and federal governments that it will face temporary price caps, to stop the price hikes for commodities whose price of extraction have remained the same.

These price caps, it should be noted, are well above the prices that were operating a year ago, and which were apparently sufficient for them to write long-term contracts and promise investment in new projects.

But apparently it’s now the end of the world as we know it – the lights will surely go out and these shrill refrains are being amplified – like never before – by the Murdoch and Nine media groups and others who should really know better.

It’s all getting a little tiring. AGL used the blackout threat when responding to the suggestion it should get serious about a 1.5°C climate target. That was outrageous enough.

Oil giant Exxon Mobil is now leading a new round of fear mongering in response to the government’s newly announced coal and price caps, and the entire gas industry is falling in behind.

Fortunately, there are some adults in the room. The Victoria state government had to intervene to basically tell its remaining coal generators when to close, and AGL only fast-tracked its planned closures under pressure from shareholders led by the billionaire activist Mike Cannon-Brookes.

Queensland and Western Australia have also read the tea-leaves and given close-by dates to their state-owned coal fleets. The few private operators in those states are expected to follow suit.

On Friday, we were reminded of the mess and the complexity of leveraging coal out of the electricity system.

The owners of the coal generators are angling for more government handouts to subsidise their maintenance costs if they need to stay open longer than their current close by dates.

Why might they need to stay open longer? Because not enough new capacity has been built in time. And who might be at fault for that? Arguably, the same retailing giants that own the coal generators and who have been going as slow as they possibly can in the shift to green energy.

The shrill response to the new price caps – $12/gj for gas and $125/tonne of black coal – is undermined by the fossil fuel industry’s own decisions, the fact that there is no gas shortage in Australia, and that the gas industry was very happy to keep investment (even if everyone else didn’t want them to) at much lower prices.

The coal industry mostly gets its supplies of coal from neighbouring mines, and the costs of extraction has not gone up there. The only coal plant with a major headache is Eraring, which is struggling to get low cost supplies as it negotiates with coal miners that would rather quadruple their price in the export market.

As Oliver Yates, the former head of the Clean Energy Finance Corporation noted on Twitter:

“Just to be clear… no fossil fuel company made their investment decision on the basis that there would be a war with Russia that would drive fossil fuel prices through the roof. All the excess prices they are receiving are windfall unexpected war gains.”

But the sense of entitlement reigns supreme. Most people know that price caps are a second best and messy option, and that a super profits tax – that would funnel returns back to consumers – would be a smarter solution. But as Labor found with its proposed mining tax years ago, it remains politically difficult.

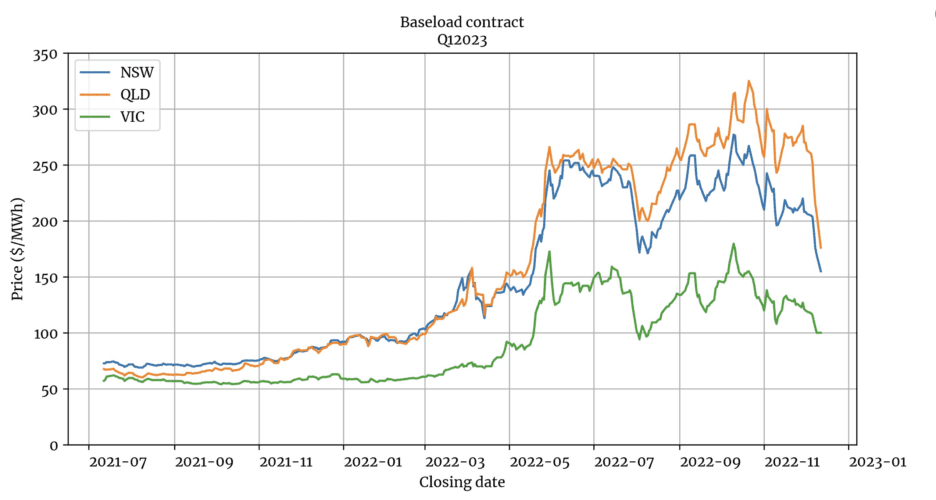

At least there are already some positive outcomes. As energy analyst Dylan McConnell also tweeted, baseload futures on the electricity markets have already plunged spectacularly.

It is one of the features of these markets – it’s all driven by marginal pricing, so what goes up based on the soaring price of a few megawatts of capacity can come down when market forces act in the opposite direction.

That’s what’s really bothering the fossil fuel industry. This policy might actually work. And consumers might actually be better off. Labor’s Chris Bowen can be satisfied by the early results, despite the deafening wails of the fossil fuel industry and its media tarts.