AGL Energy has formally announced that it will back down from its proposed demerger, conceding defeat in the face of a concerted campaign led by tech billionaire and now largest shareholder Mike Cannon-Brookes.

The company will also clear out several senior management and board roles, announcing the resignation of both the company’s CEO and board chair, in a major upheaval of one of Australia’s largest energy companies, the country’s biggest coal generator and greenhouse gas emitter.

See also: Cannon-Brookes has achieved a stunning victory at AGL: Now for the hard part

In a statement to the ASX on Monday, AGL Energy says it will withdraw its demerger proposal as it expects to fall short of securing the backing of at least 75 per cent of shareholders necessary to progress the plan.

“Having regard to anticipated voter turnout and stated opposition from a small number of investors including Grok Ventures, AGL Energy believes the Demerger Proposal will not receive sufficient support to meet the 75% approval threshold for a scheme of arrangement,” AGL told shareholders in a statement.

“In these circumstances, the AGL Energy Board considers that it is in the best interests of AGL Energy shareholders to withdraw the Demerger Proposal.”

AGL says it will now seek court approval to stop the demerger.

Last year, AGL announced that it planned to split the company into two – carving out the bulk of the company’s fossil fuel assets into a new entity, Accel Energy while leaving the core AGL brand to focus on electricity retailing, renewable electricity generation and providing carbon neutral services to customers.

Following the demerger’s failure, AGL said it will now instigate a strategic review of the company’s future direction.

The failed demerger will also lead to a major cleaning out of AGL’s senior management, with the company’s CEO Graeme Hunt and board chair Peter Botten both set to go.

Hunt is the second CEO to quit as a result of the problems surrounding the demerger, following the sudden departure of Brett Redman last year.

“Chairman Peter Botten will resign from the Board upon appointment of a replacement independent Chairperson,” AGL’s statement says.

“The Board and Graeme Hunt have agreed that Mr Hunt will step down as Chief Executive Officer and Managing Director.”

“Mr Hunt will continue to act in this role until a new Chief Executive Officer and Managing Director is appointed. The Board will immediately undertake a search process to complete this appointment as soon as possible.”

Two other board members will also vacate their roles, with non-executive director Jacqueline Hey resigning immediately and Diane Smith-Gander set to follow in August.

It is a major win for Cannon-Brookes, who sought to prevent the demerger after an earlier takeover offer was rejected by the AGL board.

Cannon-Brookes has spent $650 million of his own money – through Grok Ventures – while also winning the support of major institutional investors like superannuation fund Hesta to build a blocking stake.

After amassing an 11 per cent personal stake in AGL – making the Atlassian co-founder the single biggest shareholder – Cannon-Brookes had demanded the right to select at least two appointments to the AGL board.

With at least three vacancies set to be opened up following the failed demerger, Cannon-Brookes is likely to get his wish.

In a statement, Cannon-Brookes’ investment vehicle Grok Ventures welcomed the AGL backdown.

“Grok Ventures welcomes the sensible decision by AGL to abandon its value destructive demerger plan and renew its board,” the group said in a statement.

“AGL’s retail and institutional shareholders have sent an emphatic message to the Board and management of AGL that the company needs to be kept together to take advantage of the economic opportunity presented by decarbonisation.

“As we announced on Friday, Grok will be seeking board representation. We want to ensure that AGL has the talent, capital, capability and oversight that is required to embrace the opportunity presented by decarbonisation,” the statement adds.

Wow. A huge day for Australia 💚💛

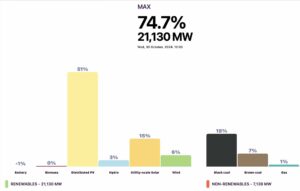

Had to sit down & take it in. This live shot couldn’t be a better metaphor for a better, greener path ahead 🌱

We embrace the opportunities of decarbonisation with Aussie courage, tenacity & creativity.

Lots of work but we CAN do this 👊🏻 pic.twitter.com/mSCQl554C0

— Mike Cannon-Brookes 👨🏼💻🧢🇦🇺 (@mcannonbrookes) May 29, 2022

Outgoing AGL board chair Peter Botten said that the failure of the demerger proposal would now serve as a trigger for a renewal of AGL’s and strategic direction.

“While the Board believed the Demerger Proposal offered the best way forward for AGL Energy and its shareholders, we have made the decision to withdraw it,” Botten told shareholders in a statement to the ASX.

“The Board will now undertake a review of AGL’s strategic direction, change the composition of the Board and management, and determine the best way to deliver long-term shareholder value creation in the context of Australia’s energy transition.”

In the statement, AGL said that it had already spent an estimated $160 million on the preparation of the demerger.

AGL says shareholders will be provided with an update on the strategic review in September, ahead of its 2021-22 financial year results update.

In its statement to the ASX, AGL says it expects the pace of Australia’s energy transition to continue to accelerate, including the exit of coal fired generators.

“Australia is at a pivotal moment in the transition of our energy system and the Board remains strongly committed to decarbonisation,” the statement says.

“AGL has been in ongoing discussions with key stakeholders in this regard and believes that the relevant dates for closure of coal fired power stations will continue to be accelerated.”

See also: Cannon-Brookes has achieved a stunning victory at AGL: Now for the hard part

And: Grok welcomes AGL demerger backdown, warns against asset sale