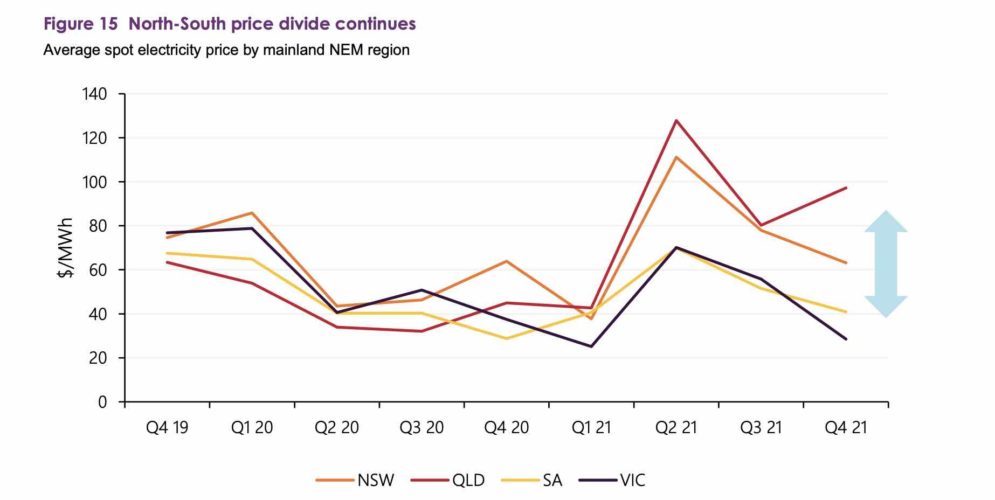

Australia’s electricity markets are now experiencing a significant north-south divide, where state grids in the north more dependent on black coal and gas are suffering significantly higher wholesale prices than those in the south with great shares of renewables.

The north-south divide has been identified by the Australian Energy Market Operator in its quarterly market reports, known as Quarterly Energy Dynamics, as well as some analysts.

The latest QED, which covers the December quarter, notes an even sharper price difference between the northern states (Queensland and NSW), and the southern states of Victoria, South Australia and Tasmania.

It notes that wholesale prices in the north are nearly double that of the south.

“The gap between higher average electricity prices in the mainland NEM’s northern regions (Queensland and New South Wales) and those in the southern regions remained pronounced at $45/MWh for the quarter, having first opened up in Q2 this year,” it notes in its report.

And it has no doubt on the cause.

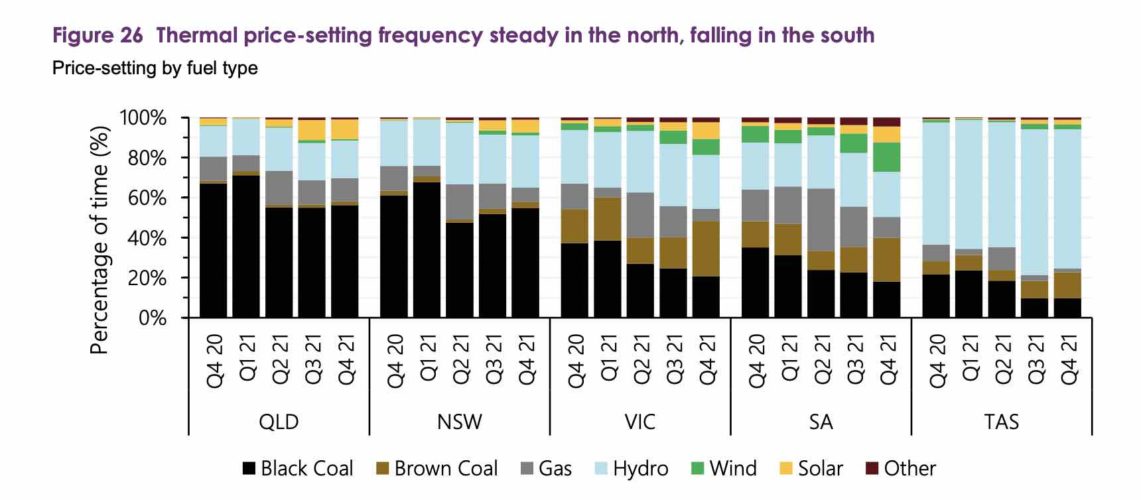

“Black coal and gas offers set prices at higher average levels in Q4 (Figure 27), and their significant role in price-setting frequency in the northern NEM regions goes towards explaining the regional price differentials observed in the quarter,” it writes.

“Increases in underlying traded prices for black coal and gas, were likely to have been influences on offer price levels for some of these generators.”

This shouldn’t be a surprise. Rising commodity prices are pushing up the cost of coal and gas generation, but the fact that states more dependent on fossil fuels, are suffering higher prices goes against the narrative pushed out by the fossil fuel industries and their spruikers in the government and conservative media.

Queensland (20 per cent) and NSW (25 per cent) have the lowest share of renewables in Australia’s main grid. Victoria over the last 12 months has achieved a 35 per cent share, while South Australia has a world leading 62.5 per cent share of wind and solar, and Tasmania (mostly hydro) had more than 100 per cent.

But it’s not just the share of renewables that counts, it is the influence of fossil fuel generation on bidding patterns and price setting, as this graph below illustrates.

And the limits on transmission – thanks to the lack of infrastructure investment over the past decade despite the pressing need – means that the ability of lower priced power to flow north to lower prices is limited.

The QED report notes:

“While underlying spot prices fell or were stable in the southern NEM regions, the larger share of thermal generation in Queensland and New South Wales and higher prices being set by black coal and gas, as well as limitations on transfers of lower cost energy from the southern regions each contributed to ongoing north-south price differentials in Q4.”

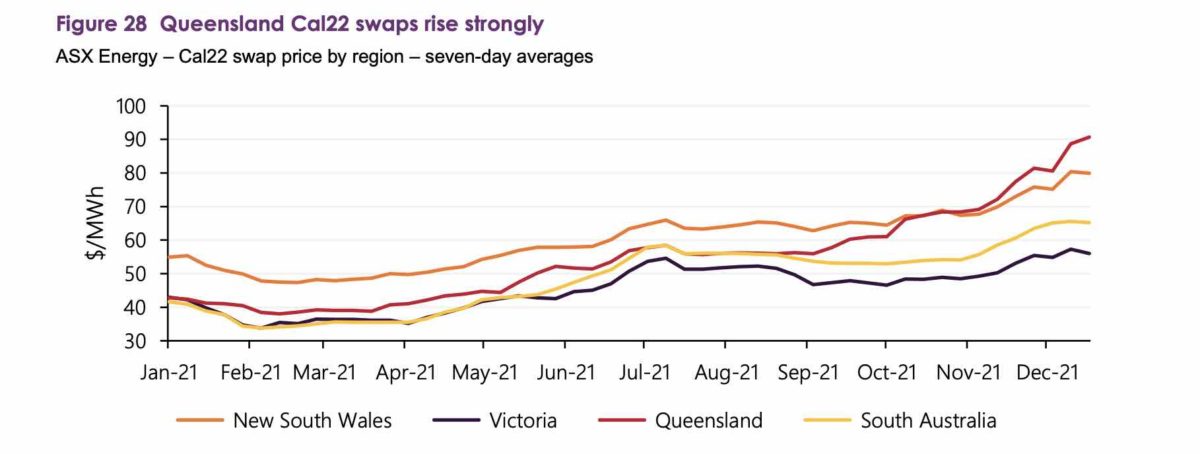

The price difference is also being reflected in the electricity futures market, with calendar 2022 contracts ending the quarter prices from $91/MWh in Queensland and $56/MWh in Victoria.

“The spread between the northern and southern states increased by $13/MWh to $25/MWh on average, with South Australia at $65/MWh while Victoria remained the lowest-priced state at $56/MWh,” it noted.