The federal government’s Safeguard Mechanism scheme covers large industrial facilities with direct emissions of more than 100,000 tonnes of CO2-e per year. Around 203 facilities (excluding electricity) are covered by the scheme, across the mining, energy, manufacturing, and transport sectors.

Together, these facilities are responsible for over one quarter of Australia’s national greenhouse gas (GHG) emissions.

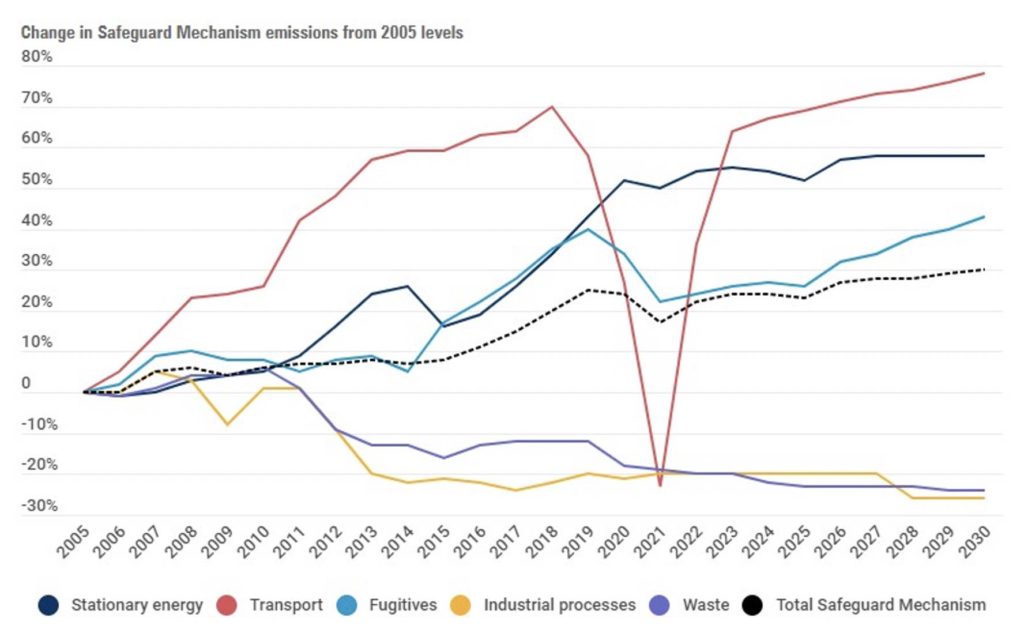

Covered emissions (shown via the black dotted line in Figure 1) were 142 million tonnes in FY20, or 14% above 2005 levels (115 Mt), and are projected to grow to 149 Mt in FY30 (29% above 2005 levels).

From today’s levels (FY20), emissions are projected to grow 13% to 2030, underpinned by emissions growth from Fugitives (LNG, coal mining), Transport (road, domestic aviation, rail, shipping) and Direct Combustion (energy, mining, manufacturing, buildings, agriculture).

In line with current policy, compliance demand from the Safeguard Mechanism is currently negligible, with net demand of just 88,000 ACCUs in FY20 due to the transition of covered entities to Calculated Baselines, determined based on forecast production and emissions intensity.

This creates headroom for covered facilities to increase their emissions without exceeding their baselines.

As shown in Figure 2, the average of total emissions baselines under the Safeguard Mechanism between FY17-20 (the average of the solid red line which depicts the sum of all baselines per year) is 183 million tonnes, against reported emissions of between 131-143 million tonnes between FY17-20 (blue line).

This creates a potential net surplus of 40-52 million tonnes of GHG emissions per annum. Current compliance demand is therefore negligible, primarily attributed to emissions slightly exceeding forecasts.

Baseline scenarios to net-zero in 2050

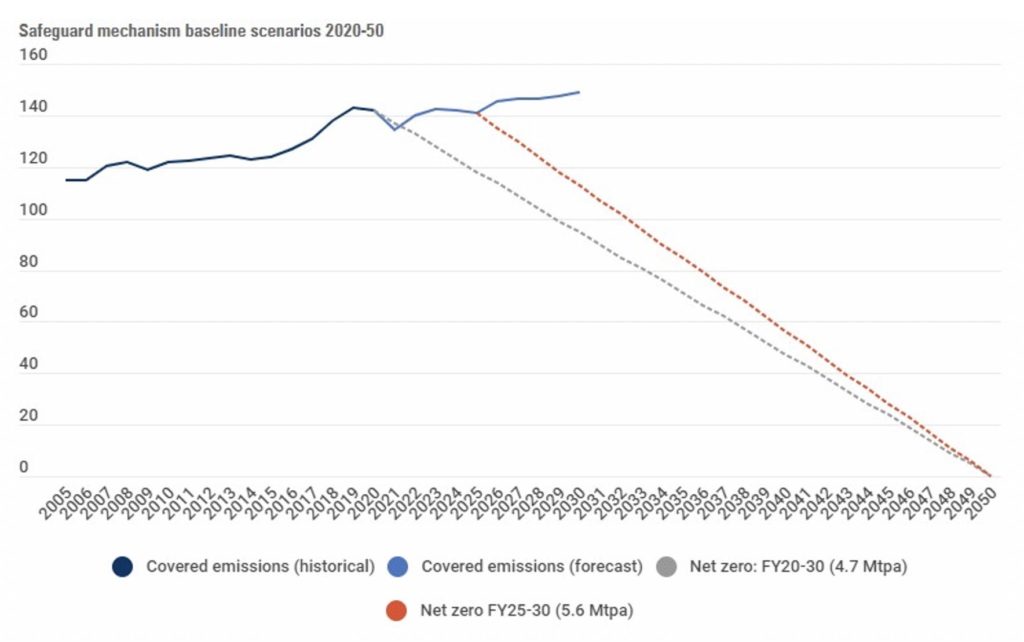

Under our updated net-zero emissions scenarios, high emitting facilities covered by the safeguard mechanism are assumed to be liable to a binding net-zero emissions reduction target, starting from between FY22 and FY25.

This translates into a uniform reduction in absolute emissions consistent with a net-zero target trajectory by 2050, reaching a 2 per cent or 17 per cent reduction on 2005 levels by 2030, respectively.

Analysis takes a regulatory approach, underpinned by federal and state policy, with baselines modelled to decline from reported emissions to reach net zero in 2050, rather than taking a carbon budget approach.

Analysis therefore reflects current political intention, not scientific need. Recent analysis by the Climate Targets Panel (adapted from the Climate Change Authority) indicates that to be consistent with the Paris Agreement goal of limiting global warming to well below 2°C, Australia’s 2030 emissions reduction target must be 50% below 2005 levels, reaching net-zero emissions by 2045.

To be consistent with the Paris Agreement goal of limiting global warming to 1.5°C, Australia’s 2030 emissions reduction target must be 74% below 2005 levels, reaching net-zero emissions reached by 2035.

A ‘net-zero emissions by 2050’ target is therefore not sufficient to align Australia with the Paris Agreement goal of limiting global warming to well below 2°C (nor 1.5°C).

Implications for carbon market demand and prices?

As we noted in our recent Market Outlook, the adoption of a net-zero emissions target will impact carbon market supply and demand from 2021-30, feeding into the price of Australian Carbon Credit Units (ACCUs).

Our recent analysis considered three scenarios for market and price development under net-zero emissions, which we modelled via the assumed adoption of a binding target for industry implemented via the ‘safeguard mechanism’.

Findings indicate that the adoption of a net-zero emissions target will be a supportive long-term factor for ACCU contract prices, with increasing demand for locally sourced offsets from voluntary and compliance market companies creating a sustained uptrend in carbon market prices, particularly over the first half of the decade.

We forecast that the price of long-term ACCU supply contracts could more than double from current levels, growing to a range of $20-45/t in 2030.

Liable entities are assumed to meet their individual emissions reduction tasks via direct GHG emissions abatement activity (calculated on a sector-by-sector basis) or the sourcing of external emissions reductions (in the form of ACCUs), with the relative level of demand for external offsets differing in each scenario based on the prioritisation of internal abatement activity (resulting in a range of forward price outcomes).

Likelihood of changes to the safeguard mechanism

The safeguard mechanism is implemented via legislation, building on the National Greenhouse and Energy Reporting scheme, however, baselines are overseen via regulation (the National Greenhouse and Energy Reporting (Safeguard Mechanism) Rule 2015), providing the Energy Minister of the day with power to update baselines.

This power has historically been used to relax baseline settings, such as in March 2019, which gave facilities the option to use published production variables and industry default emissions intensity values in baseline applications, and in May 2020, to extend the transition of facilities to calculated baseline determinations.

Under a new net-zero environment, there are two plausible outcomes:

- Alignment of the safeguard mechanism with a net-zero trajectory:This may be a linear or non-linear pathway based on consultation between government and industry, complimented by scheme changes such as proposed Safeguard Mechanism Credits (SMCs) for “below-baseline crediting; or

- No change to the safeguard scheme: Resulting in continued growth in voluntary demand from medium-to-high emitting companies.

Whichever path is ultimately taken, modelling indicates that the adoption of a net-zero emissions target will be a supportive factor for carbon market demand and prices.

While our analysis aligns industry emissions with a net-zero goal via the safeguard mechanism (creating increased compliance demand), this resultant demand could also be interpreted to reflect voluntary activity as companies increasingly set net-zero emissions targets in response to external pressure (e.g., from investors and consumers, or the threat of domestic or international regulation such as carbon border tariffs).

As a result, industry is already beginning to take action in anticipation of future government regulation, and external pressure, with the combined effect of this activity already beginning to impact spot prices and forward expectations.

To learn more, view our latest webinar (recording) on the current and forecast shape of the Australian carbon market under net-zero emissions.