There has been a growing tsunami of climate commitment announcements combined with fossil fuel exclusion policies by globally significant financial institutions during December 2020, building on the pledges two months earlier by the leaders of China, Japan and South Korea committing to net zero emissions targets.

On top of that, three leading corporate announcements show the building momentum towards a decarbonisation-driven technology disruption. Nippon Steel and POSCO – respectively the largest steel manufacturers in Japan and South Korea – both committed to net zero emissions by 2050 targets over the last ten days.

And Australia’s Lendlease has released a roadmap detailing how it will deliver on its commitment to “Absolute Zero Carbon by 2040”.

To IEEFA, Lendlease’s announcement could be a signal of profound global significance. Firstly, like a growing number of global corporate majors, Lendlease is committing to zero emissions, including indirect (scope 3) emissions sourced from activities across its value chain.

Secondly, Lendlease has acknowledged that ‘net zero emissions by 2050’ is not sufficient to hold global temperature rises to 1.5°C, suggesting action needs to be much faster, particularly in the developed world.

Thirdly, Lendlease will not hide behind the carbon offsets ‘figleaf’. Lendlease mandates that all of its supply chain contracts will include a requirement for Absolute Zero by 2040, including its steel – leveraging the growing power of the now global Responsible Steel standard development and certification body.

We exit 2020 with a growing list of the world’s largest steel manufacturers having now committed to net zero emission by 2050 targets.

Nippon Steel and POSCO add global significance to the earlier leadership shown by ArcelorMittal (world #1), Germany’s ThyssenKrupp, Austria’s Voestalpine and Sweden’s SSAB/LKAB/Vattenfall consortium pursing HYBRIT.

All of these steel manufacturers reference two technological paths to the one goal of zero emissions, that being:

- the avoidance of CO2 through the use of green hydrogen, and the storage or use of CO2 produced in steelmaking (carbon capture, usage & storage, or CCUS).

Both are being piloted, and neither have been implemented at scale and commercially proven as yet. 2020 has seen a global tsunami of announcements for the development of green hydrogen pilot projects.

One of the largest and boldest recent announcements came from Fortescue Metals Group, one of the world’s largest iron ore mining firms, who announced a 235 gigawatt of renewables plus green hydrogen ambition in November 2020.

IEEFA has long documented our scepticism that CCUS will prove viable, particularly as a saving angel for aging coal-fired power plants, but the H2H Saltend trials in the North Sea could prove the long elusive breakthrough at scale.

We note the growing strength of the European Union’s emission trading scheme provides a critical pre-requisite to CCUS, namely a price on carbon (EU emission allowances are currently trading above €30/t).

Last week Nippon Steel President Eiji Hashimoto set a goal to reach net-zero emissions by 2050 as a core pillar of its strategy, aligning with Prime Minister Yoshihide Suga’s pledge to achieve carbon neutrality across the country.

Japan’s largest steel manufacturer said it will work with its rival JFE Steel to replace coking coal with hydrogen as a reducing agent.

It will start using an electric arc furnace (EAF) in a steel mill in Hyogo Prefecture in 2022/23 as a first step to wider use. Nippon Steel also said it will also look into CCUS technologies to ensure it meets its environmental target.

This past week also saw POSCO pledge to achieve carbon neutrality by 2050. POSCO is South Korea’s largest steel manufacturing firm leveraging innovative technologies such as CCUS and hydrogen-based steelmaking.

Like an ever lengthening list of financial institutions across banking (Shinhan Financial, KB Financial, Woori Bank, Korea Development Bank), insurance (Samsung Life Insurance, Samsung Fire & Marine Insurance) and asset management, POSCO’s ambition to support the Korean government’s policy of achieving “2050 carbon neutrality” demonstrates its determination to play a leading role in implementing Korea’s “Green New Deal”.

POSCO signed up to the TCFD (Task Force on Climate-related Financial Disclosures) in March 2020 and committed to reduce CO2 emissions by 20% by 2030 and 50% by 2040, and has now added the new target to attain net zero emissions by 2050. POSCO’s CEO Jeong-Woo Choi stressed that industry partnership is a key tool.

Additionally, POSCO committed to no new investments that utilise coal.

There is a global trend building.

September 2020 saw the world’s largest steel maker ArcelorMittal announce a group-wide commitment to being carbon neutral by 2050.

ArcelorMittal noted that one project key to this strategy is already being piloted in Hamburg, where by 2023 it will operate Europe’s only direct reduced iron (DRI) EAF facility, testing the ability of green hydrogen to reduce the iron-ore and form DRI, then using that carbon-free DRI in the EAF in the actual steel-making process.

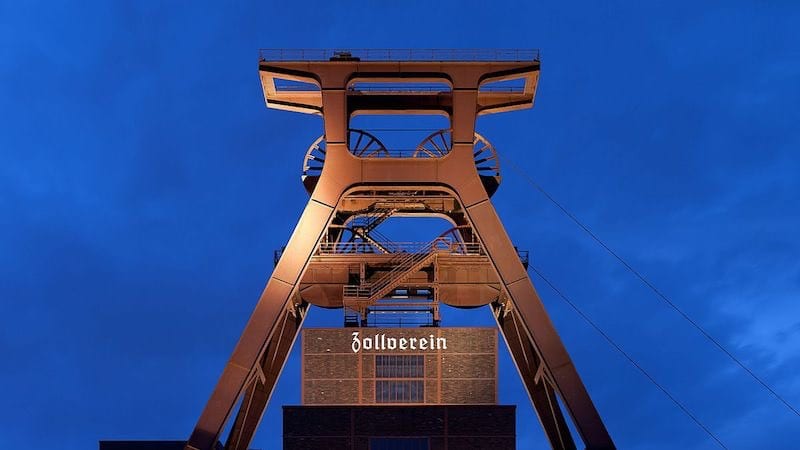

At the start of 2019 Germany’s ThyssenKrupp announced plans to invest €10 billion to make its steel production carbon-neutral by 2050, with an interim target to reduce emissions by 30% by 2030 (relative to a 2018 base). ThyssenKrupp plans to run the entire Duisburg-Hamborn steel mill using hydrogen to replace pulverized coal, thereby reducing steel emissions by 20% by 2022 as its key first step.

In August 2020 ThyssenKrupp announced it will build a 400,000 tonne per annum green hydrogen-based steel plant for commissioning in 2025 as the second step.

Further, Austria’s Voestalpine is working with Siemens, Austrian hydro utility Verbund, the Austrian Power Grid and other partners to build the world’s biggest research plant for producing green hydrogen, located in Linz in a project called H2Future.

And back in 2016, SSAB (Sweden’s leading steel maker), LKAB (Europe’s largest iron ore producer) and Vattenfall (Sweden’s largest utility) joined forces to create HYBRIT – an initiative to replace coking coal, traditionally needed for ore-based steel making, with green hydrogen at Lulea, Sweden.

The result will be the world’s first fossil-free steel-making technology.

In December 2020 LKAB announced plans to invest up to 400 billion kronor (US$46bn) over the next two decades to expand into an emissions-free iron process.

According to the Government’s Office of the Chief Economist, Australia supplies 55% of the world’s seaborne coking coal. Yet should the world’s steel industry deliver on its net zero emission targets, the demand for coking coal could well enter terminal decline over the coming three decades.

The International Energy Agency’s World Energy Outlook 2020 models a halving of coking coal use globally by 2040 under its Sustainable Development Scenario (a 3.5% annual decline each and every year).

A review of the performance of the predominantly coking coal producing Coronado Global Resources share pricing since listing in October 2018 shows a near perfect correlation with Whitehaven Coal (a predominantly thermal coal miner), with both destroying over 70% of shareholder wealth relative to a 10% rally in the Australian stock market overall.

Figure 1: Whitehaven Coal vs Coronado Global Resources Shares Since October 2018

It is time for Australia to start preparing a transition plan for the growing inevitability of a global energy system transition. The momentum is accelerating and the opportunities, and risks, for Australia are enormous.

Tim Buckley is Director Energy Finance Studies Australasia at IEEFA.