This is the first of a series of articles on my recent SIREN-Powerbalance modelling of the renewable electricity (RE) transition for WA’s South West Integrated System grid (SWIS), using the Australian Energy Market Operator’s August 2018 cost figures.

The first important finding is that 75% renewable electricity (RE) will cost no more than the existing coal and gas-dominant mix, with negligible cost increase moving to 85% RE (Table 1 below, more details in a following article).

The other significant finding is that a rapid transition to RE would be less risky than trying to prolong the life of coal and gas steam thermal (ST). The AEMO’s planned ‘step change’ modelling of the NEM transition is overdue; it may well conclude that even a 50% renewable target by 2030 should be a minimum target.

The step change modelling explained in this series of articles indicates that the SWIS could and should move to at least 75% RE by 2030.

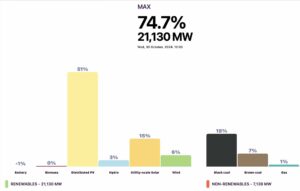

Figure 1.

Figure 1 shows electricity cost for a transition scenario on the SWIS, from 2018 to 100% renewable energy (RE) in steps of 5%. The 4 old Muja CD (1980-84) generators are closed first, and then all remaining ST is shut down for 3 – 6 months over summer when RE generation is highest.

The 300MW Collie coal and the gas steam thermal (GST) units are closed in 4 steps between 50% and 70% RE. Blue Waters 1 & 2, the newest coal generators built in 2009 are closed in the last 2 steps.

There is no steam thermal left at 75% RE and the dispatchable generation role is taken over completely by fast ramping OCGT gas turbines and storage.

The first batteries are installed at 25% RE, Concentrating Solar Thermal – Molten Salt (CST MS) at 40% RE and pumped hydro at 70% RE. While ST could be phased out with only 65% RE, this would increase peak gas use during the transition*.

The big conundrum for the phase-out of coal is the greatly increased ramping due to variability of wind and solar (Table 2).

Fueled steam thermal generators – coal, gas CCGT and gas co-generation – have large boilers up to 10 – 15 stories high. Ramping or cycling entails rapid temperature changes which cause heat stresses in the boiler pipes, increasing cracking, wear and tear and risk of failure. Stopping and starting the plants exacerbates this problem and cold start-ups can take up to a day.

The effects of this are already being felt in WA, as reported by Daniel Mercer in the ‘West Australian, April 2019: “AEMO….. said Synergy faced big increases in costs as its coal plants were increasingly stopped and started to cope with the influx of renewable energy……. (which also) increased the risk of units tripping in the run-up to the evening peak when solar power tapered off”.

Table 1. Modelled increase in frequency and rate of steam thermal ramping during phase-out of coal and gas steam thermal on SWIS

In this scenario, the ST generators can ramp down to 50% capacity and are kept running whether needed or not, (Table 1 column 3) except for periods of 3-6 months during summer when they are shut down.

System ramps in excess of a nominal 33% of capacity, which do not occur at all now, will be happening 165 times in 6 months – i.e. 6 times a week at 65% RE. Hours where ST is kept running when RE is available increase more than three-fold at 40% RE when there is still 1680 MW of ST in service.

Thus up to 10% of ST energy generated is ‘wasted’ i.e. it would not have been needed if the generators could be shut down. This is together with increasing ST maintenance costs accounts for the $5/MWh (0.5c/kWh) increase in energy cost between 35% and 70% RE (Fig. 1)

The increase in ST maintenance costs due to increasing ramping should not be underestimated. Figure 2 below is from a study by NREL of coal units used in cycling (ramping) mode versus traditional ‘base load’ duties.

Capital and maintenance costs begin to rise rapidly from aged 26 years, quadrupling by age 30. I have conservatively factored into this modelling a doubling then trebling of fixed costs for steam thermal.

Figure 2.

Ref: N. Kumar, et al. NREL, April 2012. Power Plant Cycling Costs.

Ramping is no problem with fast ramping open cycle gas turbines (‘aero-derivative OCGT’s). As all who travel in jet aircraft can testify, they are designed to ramp from cold to full power in less than 10 minutes.

Battery storage can deliver full power in milliseconds, pumped hydro in a few minutes and steam turbines heated by molten salt are designed to turn off and ramp up daily.

This modelling replaces steam thermal with OCGT power and these three types of storage. The capacity factor for OCGT increases from a few percent in 2018 to 30% with all ST closed, decreasing to about 5% with 95% RE.

This is well within the capability of the modelled fleet of 30-60 OCGT’s with a total 2600 MW capacity.

This is just one of many possible scenarios. Up to 85% RE can be attained without any PHS or MS storage, much more wind capacity would be required *

In summary, for steam thermal generators on the SWIS during the transition:

ST will have to work increasingly in cycling (ramping) mode during the transition period, making increased maintenance and replacement of parts inevitable. The duration of this period needs to be minimized for reasons of cost and risks to system stability.

Refurbishment is not an option. This proved a $350 million waste of money for Muja AB as the units had to be closed 2 years later regardless. The Muja CD units are 34-39 years old, and to his credit the WA Minister for Energy Bill Johnson has ruled out refurbishing them.

The OCGT’smust be used more to take the ramping pressure off the coal generators

Some curtailment of available wind and solar in order to keep ST running and avoid shut-downs will likely be necessary during the transition despite increased costs.

ST could be shut down for 3 – 6 months over summer during the late to mid transition, as modelled here.*

Points 1 – 5 above indicate that ST generators should be phased out as quickly as possible as soon as enough RE, OCGT and storage capacity can be connected to replace each unit.

The aim should be to attain 75% RE and close all fueled ST generators before 2030.

Flexible dispatchable capacity needs be increased and strengthened to cope with increasing wind and solar generation. In my view:

- The fleet of fast ramping OCGT’s should be renewed , owned and controlled by the State Government to prevent the price gouging that has occurred in the NEM.

- Grid battery storage is needed now, for frequency control and load following.

- Planning for lower cost larger scale CST-molten salt and pumped hydro storage should begin immediately.

*These points will be further explained in future post

** SIREN-Powerbalance is open source renewable energy modelling software developed by Angus King, Len Bunn and the Author. It can be downloaded from https://www.sen.asn.au/modelling_overview

References:

Australian Energy Market Operator (AEMO), August 2018. Integrated System Plan Modelling Assumptions.

Ref: N. Kumar, et al. NREL, April 2012. Power Plant Cycling Costs.