The biggest threat to Australia’s legacy coal fired generators is not the explosion of wind and solar farms, or even the settings of the country’s emissions policy: Right now, it’s the continued boom in rooftop solar.

That’s the assessment of Bloomberg New Energy Finance, which is expecting a massive surge of “behind the meter” solar PV capacity, referring to the solar that is installed by homes and businesses mostly to supply their own electricity needs.

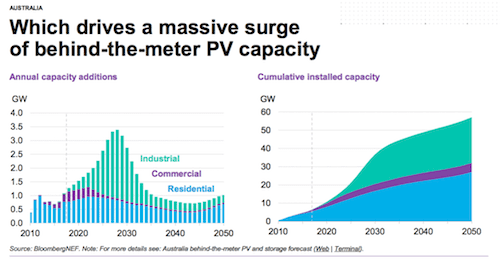

And the big driver of this over the next decade will not just be the household sector that will continue to grow from its current 7GW of capacity across more than 2 million homes, or the “commercial” sector, the smaller business sector that is currently booming and will install nearly as much.

It will also come from big industrial users, who are expected to account for nearly half of the 58GW that will be installed in Australia by 2050, and will be installing more than 2GW a year by the late 2020s (That’s the green shades and lines in the graph above).

“Consumers are going to be the most influential generator in terms of volume”, says Kobad Bhavnagri, the lead analyst from BloombergNEF Australia.

“There will be more capacity behind the meter than the total current capacity in the National Electricity Market (NEM),” he tells RenewEconomy after the presentation of the company’s New Energy Outlook in Sydney on Tuesday.

“It is a massive slab of capacity … and it will be the biggest single contributor to generation.”

Bhavnagri – interviewed before the ACCC recommended that rooftop solar subsidies be abolished by 2021, rather than progressively wound down by 2030 – says the rooftop solar uptake is happening quite separately from the dynamics of the wholesale market, and it will have consequences.

“The most significant is that it will have the biggest impact is pushing coal out of the system,” Bhavnagri says.

“You can forget about the carbon price, you can forget about the NEG (National Energy Guarantee), what will push coal out of system is rooftop solar PV.”

That’s because the “duck curve” created by solar PV will change the dynamic of the system, putting the emphasis on flexible and dispatch able power.

Coal generators simply don’t have that flexibility, and if the solar boom continues as planned, Australia will reach 40 per cent penetration of rooftop solar (as a percentage of total installed capacity) by 2030.

(Maybe this explains the ACCC recommendations to slow down the rollout of rooftop solar and enourage the government instead to provide contacts to new “dispatchable” generators, including coal and gas plants).

Bhavnagri expects rooftop solar owners will install battery storage, adding to the benefits of the system. BloombergNEF expects that rooftop solar capacity to be paired with 58GWh of behind the meter battery storage.

That’s because the falling cost of battery storage means the combination will soon be economic, with the pink lines indicating the spread between different states. In South Australia, for instance, it is already “economic”, which BloombergNEF says is less than a 10 year payback.

What Bhavnagri does want to see is a change in tariff design, towards a “genuine’ time of use metering system, for electricity and solar exports, that will encourage households “to give system what it needs and therefore will lower costs for everyone.”

This and the growth of rooftop solar will encourage users to shift their load to the middle of the day – be it industrial processes, electric vehicle charging or air conditioning.

“Actually we want the load shape to change. That will help renewables generally,” Bhavnagri says.

“By the mid 2020s it’s going to have as good a payback period as solar PV only. Therefore we expect to have material uptake from early to mid 2020s.”