There are no prizes for predicting that there will be more batteries in Australia’s electricity grid next year: the trick is predicting how much.

Longer term, the predictions are bullish – up to 80GWh from the likes of Bloomberg New Energy Finance, and a more modest 20GWh from the latest AEMO document, the Integrated S

What happens in the short term, in calendar 2018, is less clear, as battery storage balances on the pivot point of whether it is actually economic or not, and whether the anticipated cost reductions that would tip that scale arrive in time.

Ray Wills, the WA energy expert who doubles as a “futurist” with the Future Smart consultancy, and heads Sun Brilliance, a company planning to build WA’s biggest solar farm, has stuck his neck out:

He predicts an additional 800MWh of utility scale batteries installed or in construction by this time next year, and almost as much battery installed behind the meter by the end of 2018.

Certainly there is interest. Tesla already has a 129MWh battery storage up and running, Victoria still plans another 100MWh of storage, Wattle Point and Lakeland should be completed, Lincoln Gap and Whyalla should have moved close to construction, and numerous other projects such as Kennedy and other solar projects moving towards storage.

At the distributed level, Wills is confident that the payback for solar and batteries combined will mean new installs will start to outstrip solar-only installations over the course of 2018 – and into 2019 no-one will install solar without a battery.

That’s quite a prediction. Already, we have seen rooftop solar at its highest level ever – tipping more than 1GW in 2017 – and installers report interest is continuing to boom.

Another 1GW is expected to follow in 2018 – and why not, considering the huge cost of grid power that shows no sign of any imminent or meaningful fall.

Wills remainds us that regardless of the technology – be it a TV set, car, mobile phone, change always comes faster than expected.

“So you can assume batteries will be faster. Continuous falls in battery cost reductions are consistently demonstrated and a high probability to continue.

Most importantly in this trend is an artefact of battery capacity – storage will be bigger than production source: eg in homes average rooftop solar in Australia is 5kW, battery pack size will be 15kWh plus.

The key trend will be even more Integration and digitisation – bringing all the separate pieces of solar and efficient appliances and lighting and storage together with smart energy management utilising AI and machine learning.

Certainly, this accords with two major new reports that have been delivered this week – AEMO’s look at the future grid and how rooftop solar and storage can be harnessed for the benefit of the grid, and the NSW taskforce looking into energy security in the coal state.

“Novel applications of solar will start to emerge as we look for a generation 2 (and 3) to replace generation 1 solar modules,” Wills says.

“The availability of Tesla’s solar tiles for roofs is the harbinger of the various announcements we should expect in 2018 – including more road surface trials and see through solar glass products to the 3d printing of solar product …. And perhaps some decent amount of solar glass on cars.

Speaking of vehicles, Wills notes that we’ve already moved from a headline a year to a headline a day in the car industry.

“Beyond the basics of all vehicles going electric, there are so many elements changing in the car industry – part of global mega trends in mobility and connectivity and autonomy and the internet of things.

“The key change with the new trends is that we have moved on from predicting what might happen in the future to measuring it, seeing it happen. The only question is just how fast the growth trend is – fast or very fast?

“Also, as we plan cities, millennials are behaving differently – more likely to live in apartments and ride transit, and so will reside in places with restricted parking.

“And they are comfortable with sharing apps like Uber and Airbnb – and so will be just as comfortable with car sharing as they move from being young, dependant consumers to self-funded consumers.

(They may well be, but when confronted with the idea of autonomous and shared vehicles, Trump’s America responded to our story with outrage fury – the general view from there was: “I’ve got a truck, and I’ve got a gun, and you can go to hell”).

But Wills says, the urbanites do appear to be listening to the smart city logic – and the data are solidly supporting the conclusion that the knowledge economy thrives in liveable, walkable, sustainable cities.

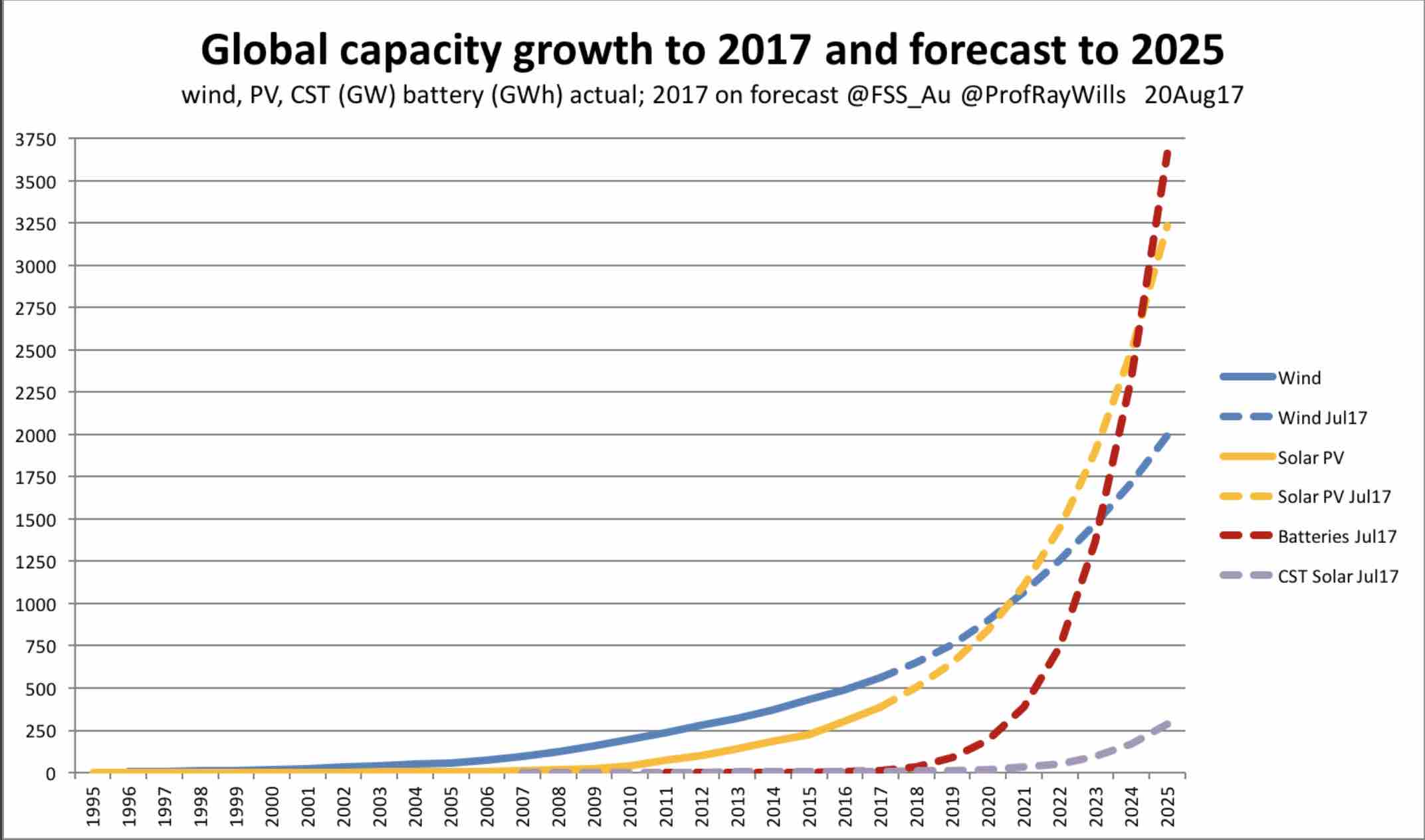

“Globally – the triumph of renewables is almost upon us – but my view is next decade will be bigger and faster than this one.

“In my assessment, there has been no economic logic for “new” coal since 2015, which is why last year I predicted that globally we would see a surge of nations announce closure of old coal plant, and in related moves, even more government commitments to banning diesel engines and improving air quality in cities and nations.

“Now the falling cost of storage could rule out “new” gas by 2018 – but it will take a few years for this to be obvious, and then one or two more for it to properly stick.

“So doing the timeline, it will be blindingly obvious that electrical storage works out cheaper than peakers from 2021, and I predict the world will build no new gas post 2023. (Matched with the earlier prediction of no new combustion engine vehicles post 2025).”

Wills says the other push will be on the Australian front an attempt to value add in the battery space in Australia – with Australia’s dominance in the raw materials of storage, there might finally be an opportunity for Australia to do more than just make big rocks into small rocks.

“The potential to value add downstream of the raw materials for storage products is obvious – but without the right policy climate, may be stifled and missed.”