There has been a lot of talk – on RenewEconomy and other websites and in the mainstream media – about the big developments in the renewable energy target, and the call by the Clean Energy Council, along with other industry bodies, for a compromise.

There is no certainty that will happen. The CEC has suggested 33,500GWh, but the Abbott government has signalled it has no intention of moving above 32,000GWh. Labor has so far said it sees no reason to offer less than 35,000GWh.

But what will happen if such a target is agreed? So far we’ve had little insight, but these graphs from New Zealand company TrustPower, which built the last major wind farm in Australia, the 270MW Snowtown 2 project, give some insight.

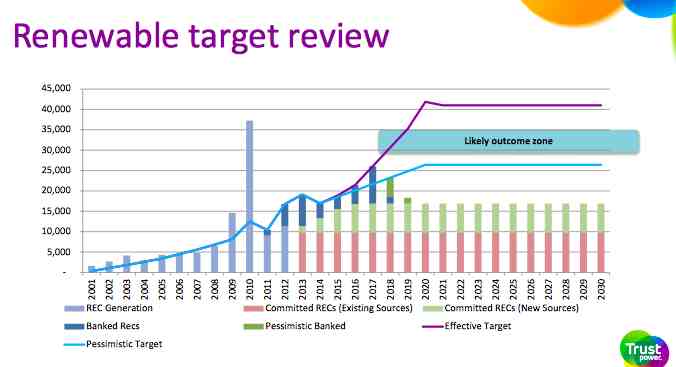

First of all is TrustPower’s appraisal of where the target is at now, given at the annual investor day presentation by its parent company Infratil. The current target is 41,000GWh, but is effectively there in name only, given that the Abbott government refuses to endorse that target. With no policy certainty, not a lot will get built.

The blue line here (pessimistic target), is the so-called “real 20 per cent” adopted by the Warburton Review and by the Abbott government, equivalent to around 26,000GWh. The blue shaded area shows the likely outcome between 30,000GWh and 35,000GWh.

What does this mean? As RenewEconomy reported last week, probably a cut of at least 3,000MW of planned renewable energy installations, a cut of around $6 billion in investment and the loss of several thousand would-be jobs. The solar industry, aggrieved by the compromise proposed by the CEC, fears that it will be the most affected by this reduction because it is further down the cost curve.

This graph from TrustPower gives a detailed breakdown. Note that its estimate suggests that an agreed target of 30,000GWh would result in a halving of new renewables required over the next five years.

This next graph shows just how far Australia has fallen in the eyes of international investors such as TrustPower. Over three years, Australia had been a big improver on investment attractiveness, but in the last year its ranking has plummeted. Only the UK has fared worse.

Still, Trustpower says all is not lost. It has around 2,500MW of wind projects in the pipeline – in Victoria, South Australia and New South Wales – and with some policy certainty is interested in new opportunities in grid connected solar, as well as hydro and other wind projects.