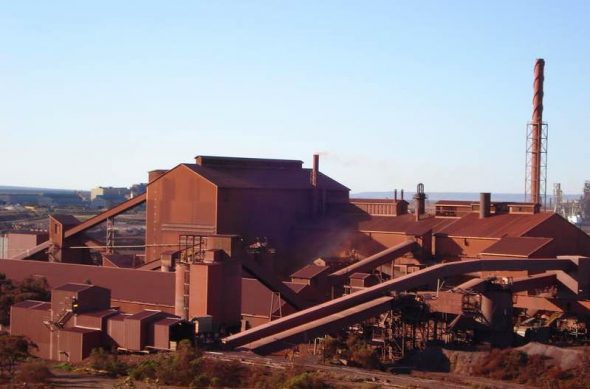

The new owners of the Whyalla Steelworks in South Australia have made good on their commitment to green energy, announcing the purchase of a majority stake in the Ross-Garnaut chaired Zen Energy, an Adelaide company specialising in solar and battery storage.

The deal was announced less than a month after UK billionaire Sanjeev Gupta’s GFG Alliance completed the acquisition of Whyalla, saying it was investment in renewable energy that would make the bankrupt steel-making operation viable again.

RenewEconomy understands that Zen had been in discussions with GFG in the lead-up to the purchase, mostly about the various renewable energy options for the new owner of Australia’s largest integrated steel and mining business, including wind, solar, co-generation and pumped hydro.

Those talks have now resulted in GFG taking a majority stake in Zen and building a strategic alliance led by SIMEC Energy, GFG’s energy unit. The new venture will be called SIMEC Zen.

The alliance has the potential to reshape the debate about renewable energy and its benefits for big business in Australia. Whyalla is not the first major industrial user to turn to renewables to reduce the cost of energy from Australia’s dysfunctional, fossil fuel-dominated grid, and it won’t be the last.

Asked on ABC Radio on Thursday morning if the partnership was based on a “belief” that renewables could power industry, Garnaut responded: “It is not a belief, it is the economic reality.”

Gupta said on Wednesday the high cost of energy is “debilitating for the economy and a crying shame for a country so rich in resources”, and a step change was needed in the power industry to reduce the cost of dispatchable power.

“Our main focus, as in the UK, will be renewable energy,” he said, adding that the company believed renewable energy would be the basis for a low-carbon industrial future

The commitment by one of the country’s biggest energy users – following the investment in solar by Queensland zinc refiner Sun Metals and telecoms giant Telstra – comes as federal politics attempts to do a u-turn and focus on ageing coal plants rather than new renewables.

Former prime minister Tony Abbott threatened to cross the floor of parliament to vote against the future and any policy that looked to address climate change, however modestly, or encourage new renewable energy.

“You can’t run a steel mill on renewables,” Abbott has said. Yes you can, says Gupta, and he intends to show how, using the combination of wind, solar, pumped hydro, battery storage and co-generation for most of its needs.

The announcement also comes days after Zen made a formal application to the Australian Energy Regulator for a licence to retail electricity to customers using solar and storage and demand management technologies.

Zen has made no secret of its plans to launch a renewable-based retailer, and to service the industrial sector, and it also has plans for large-scale solar plants and large-scale battery storage arrays, despite missing out on a South Australia government tender that was won by Tesla and French company Neoen.

“GFG Alliance has now taken a major step towards realising its Australian energy ambitions,” it said in a statement. “The opportunity to invest in large-scale power projects to meet its own industrial requirements and support the domestic economy was a key driver for GFG’s strategic entry into Australia.”

The venture will also focus on providing “cheaper, more reliable and environmentally sustainable energy” for SIMEC’s mining operations in South Australia and Liberty OneSteel’s operations in South Australia, Victoria, New South Wales, Queensland, and Western Australia.

SIMEC ZEN Energy will also project-manage the development of SIMEC Energy Australia’s new large-scale energy projects, including solar PV, battery storage and pumped hydro facilities.

Garnaut, one of the architects of Labor’s now defunct carbon price, which Abbott repealed after warning that a carbon price would turn Whyalla into a ghost town, said Zen had spent years looking to introduce new solutions to Australia’s energy problems of weak competition, high costs, low reliability and unnecessary pollution.

“We’re happy for the skeptics to watch what we do, and learn what is possible,” Garnaut said in a report on ABC TV.

“We have been looking for the right capital investor and strategic partner to help realise our plans, and have found the perfect match in Sanjeev and the SIMEC Energy team,” he said in an earlier statement.

“Their understanding of the energy dilemma this country faces, which is making much of our industry uncommercial and environmentally unsustainable, means we see the market need and opportunity in the same way.

“We are excited about the future, as this will yield benefits for Australian jobs, investors, communities and the environment.”