AGL Energy said on Thursday that it had effectively bought the 2,000W Liddell coal-fired power station in the Hunter Valley for zero dollars.

The give-away by the NSW government – which completed the sale on Wednesday – was revealed by a triumphant AGL Energy while announcing its annual results.

Liddell, which was commissioned in the early 1970s and is located adjacent to a lake of the same name near Muswellbrook – is being purchased as part of the 4,600MW Macquarie Generation portfolio – the last major business to be sold by NSW – for a total of $1.55 billion.

Liddell, which was commissioned in the early 1970s and is located adjacent to a lake of the same name near Muswellbrook – is being purchased as part of the 4,600MW Macquarie Generation portfolio – the last major business to be sold by NSW – for a total of $1.55 billion.

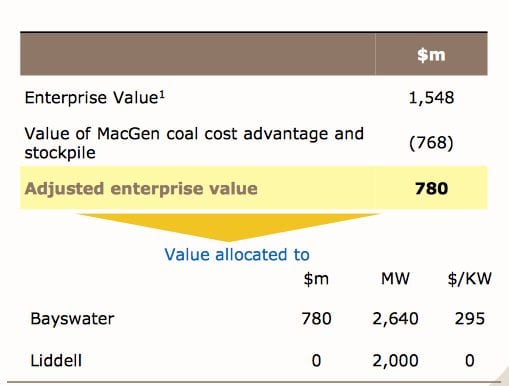

AGL Energy considers this to be a bargain basement price. Just the value of the generators’ long term contracts for cheap coal supplies is worth $768 million, because it will deliver it a huge cost advantage over its competitors.

This means that the value of the larger, newer and lower cost 2,600MW Bayswater power station is valued at $780 million, or around 295/kW – which is cheaper than most recent transactions.

This delivers a valuation of Liddell at effectively zero, as this table (below) included in AGL’s investor presentation illustrates. “We see it as a free option”, the presentation states. AGL intends to close the coal generator – mostly likely in 2017 – when it assumes that its largest customer, the Tomago aluminium smelter, also closes.

However, it is possible that Liddell will keep going until the end of its “technical” life in 2022. This says AGL, will provide substantial upside, which will be further enhanced if the renewable energy target is reduced or scrapped. It could, however, close in 2015 if Tomago closes early. When it does close, it will also mean the end of the country’s first solar booster project.

“We think the deal makes a lot of sense to us, and makes compelling value to our shareholders,” AGL Energy managing director Michael Fraser said in a presentation.

Analysts also said it underlines the decline in the value of fossil fuel generators. “These are stranded assets in the making,” said Tim Buckley, from the Institute of Energy Economics and Financial Analysis.

“The NSW government are effectively selling it to avoid liability associated with the cost of remediation when they close it. This deal flags that the environment is going to get worse for fossil fuel generators. No new coal-fired generation will ever be built in this county. It is a dying industry.”

AGL Energy CFO Brett Redman acknowledge that risk of stranded assets. He said AGL’s strategy was to effectively “harvest” an asset it had got for free. “We are not stranding any capital,” he said.

However, the purchase of MacGen has already been boosted by the scrapping of the carbon price, and AGL says MacGen has a significant advantage over its rival because of its long term contracts – which delivers a tonne of coal at an average cost of $35/tonne out to 2025. This is 35-45 per cent lower than its other coal rivals.

AGL says profits from MacGen will be even bigger if the renewable energy target is scrapped or wound back significantly. It is already factoring in that the current 41,000GWh target will not be met.

The other big advantage that AGL’s new coal fired power stations have – also enhanced by the removal of the carbon price – is over gas fired generation.

This graph (below) highlights the extent to which coal will be cheaper than gas, and why more coal will be burned that gas in coming years.

Already, AGL’s Torens Island gas generator near Adelaide – the largest genrator in South Australia and the biggest gas plant in the contry, is running at a capacity factor of just 14 per cent. Other utilities have already closed or written down the value of their gas-fired generators, or converted them to peaking plants rather than base load.