Australia’s booming rooftop solar market has hit a potential speed hump, with a sudden drop in the price of small scale renewable energy certificates, pushing up the cost of solar by around 10 per cent for households and small business and catching many installers unawares.

After several years of relative market stability, STC prices dipped by one-third on Wednesday, falling from around $40 to as low as $26, and triggering panic among PV installers who have sold systems to customers on the assumption they would get a $40 (per kW) rebate.

The sudden fall in prices comes down to the failure of market forecasters and regulators to adequately factor in the extent of rooftop solar’s second coming in Australia, which has seen record amounts of solar PV installed on homes and businesses since late last year, in step with soaring power prices.

“The fall in prices has happened because the supply of STCs is substantially outstripping power retailers’ obligations for this year as set by the Clean Energy Regulator,” said Green Energy Markets analyst Tristan Edis on Wednesday.

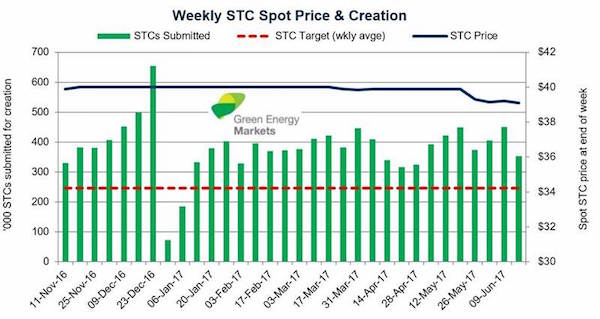

This is illustrated in the chart above, supplied by Green Energy Markets, which shows the extent to which supply since January this year (shown in the green bars) has significantly exceeded retailer requirements (shown by the red dotted line).

“It’s true that prices for STCs had held up until just recently, in spite of the fact that the oversupply trend was clear some time ago,” Edis said.

“The reasons behind this are a little complex and to do with the fact that the regulator front-loads their STC surrender requirements (35 per cent of the liability is required for the first quarterly surrender) as well as constraints around liquidity (some retailers had plenty of STCs but weren’t necessarily making these available to retailers who didn’t have enough).

“These mean that while the market was clearly going to have an oversupply of STCs overall for 2017, we’ve only managed to reach the point where there was plenty of STCs to go round for every retailer after we got past the last quarterly surrender period in July.

“This has then allowed the price to drop very quickly,” Edis said.

As noted above, one of the main effects of this price drop will be to increase the cost of a rooftop solar system by around 10 per cent, which itself could work to dampen demand.

According to Edis, a drop in the STC price from $40 to $33 equates to a reduction in the rebate the installer can pass onto the customer of about $135 per kilowatt across Sydney, Brisbane Perth and Adelaide and $116 per kilowatt in Victoria and Tassie.

“It shouldn’t kill sales,” Edis said. “But a 10 per cent price increase is still significant in anyone’s books.”

Of greater concern, however, is the potential impact on Australia’s solar installers – already feeling the pinch of wafer-thin profit margins ranging from around 17 per cent to 26 per cent.

As Geoff Bragg, from the Solar Energy Industries Association in Australia, told RenewEconomy in November last year: “Any Aussie installer marking up less will be heading for closure in my opinion.”

Many have in recent years – and the STC price drop could see many more follow.

“This will make many (solar installers) close their door today, with quotes signed and jobs to install in coming weeks worth millions of dollars,” one industry player told RenewEconomy in an email on Thursday.

“If this collapse was to occur in the sugar or fuel industry it would be all over the front page of every paper in the country.

“I have been in the industry for 10 years and never seen a swing like this in a so called commodity price.

Surely this must be raised in parliament today. It seems as if they want the industry to fail.”

Edis agrees that the fall in prices will probably result in a lot of “unhappy customers”, namely solar installers caught unaware that the STC market had been “massively oversupplied” for quite a long time.

“A lot of solar installers have forgotten, or weren’t around, when this happened last time,” Edis told RenewEconomy. “They didn’t know that you can have this volatility in prices.”

“There’s an element to which the more sophisticated players would’ve seen this coming,” he added. “It’s dropped more than probably what we would have though, but we knew it was coming.”

And the lower prices could hang around for a while, according to Green Energy Markets, which currently projects that there will be many million STCs created excess to the Regulator’s requirements for this year, if we maintain year to date levels of STC creation.

“The best guide we have is the forward market where buyers agree to pay a price for an STC a few months into the future. This indicates prices in quarter 4 compliance period for 2017 (which is actually Nov 2017 to Feb 2018) of $30.50 at present,” Edis says.

However, Green Energy Markets notes that the design of the STC scheme means that adjustment of the target next year should ideally lead to a recovery in prices.

“The STC scheme is supposed to self-adjusting each year,” Edis explains.

“This year we’ve all underestimated how many STCs will be created, however in setting next year’s target the regulator needs to base this on a forecast of what is expected to be installed next year assuming an STC price of $40 plus they need to increase it by the amount of the oversupply in STCs this year.”

“If all goes well this means the surplus should get whittled away significantly over 2018 and prices should recover”.

However Edis also noted a word of caution, “A few years ago the large oversupply persisted over several years, as we kept underestimating solar uptake and the regulator target was well below supply. This meant STC prices were noticeable less than $40 for an extended period of time.”

(Please note: This article has been amended from the original because of an error in quotes attributed to Tristan Edis which reflected observations that were made 2 months ago not last Wednesday. The article has been updated to reflect latest information and market prices).