Australia’s biggest energy retailer Origin Energy believes it is sitting pretty for the challenges of what it expects to be a “volatile and messy” green energy transition, with what it describes as its “unique” portfolio of coal, gas, big battery and virtual power plant assets.

The company held a detailed investor briefing on Wednesday, the first since it announced its controversial deal with the NSW government to extend the life of the country’s biggest coal generator, the 2.88 GW Eraring facility in NSW, and the first since the collapse of the $20 billion bid for the company led by Brookfield late last year.

Origin is convinced that its portfolio is the best placed to weather the volatility and pace of the energy transition, as it juggles its grid-scale assets and seeks to unlock the trust, and the distributed assets such as solar, batteries and EVs, of its large retail base.

“We believe that decarbonisation will be good for the environment, but also good for shareholders and customers,” CEO Frank Calabria said. “A lot of opportunities are going to emerge from the energy transition.”

Origin insists that its corporate plan is consistent with a 1.5°C world, despite the agreement to extend the life of Eraring, its large gas portfolio of more than 3 GW of capacity – and its decision to limit new renewable capacity to around 4 GW to 5 GW out to 2030 – around one third of that planned by the spurned bidder Brookfield.

The Eraring deal remains the most controversial aspect of Origin’s plan.

The deal struck with a NSW government worried about high wholesale electricity prices heading into the next election requires the facility to run at just a quarter of its rated capacity – around the same as that of a solar farm.

The terms of the are highly favourable to Origin – it requires NSW taxpayers to underwrite any operating losses from the switch of Eraring from “baseload” to mostly-off, and for Origin energy to share just a fraction of any profits it might make from the two year extension.

Origin is expected to “cycle” its four remaining units to fit a volatile market, noting that there is little opportunity to make any money in the middle of the day – largely due to the growth rooftop solar. It says it expects its units will be able to run as low as 180 MW – a quarter of their rated capacity – when operating.

But the extension of Eraring is a short-term bandaid driven mostly by political considerations, and Calabria says Origin’s future lies with developing and optimising the rest of its portfolio.

He says the company’s gas assets – the biggest in the country – will be key to help batteries, both grid scale and household, “firm up” the enormous growth of renewables over the next 15 years. Batteries will focus on short duration events, while gas will be deployed for longer duration events.

Calabria emphasised that South Australia, with more than 70 per cent wind and solar share in the last 12 months, had more than 250 events in the last 12 months which required at least eight hours storage. It remains to be seen if that continues as more bulk renewables are added to the grid.

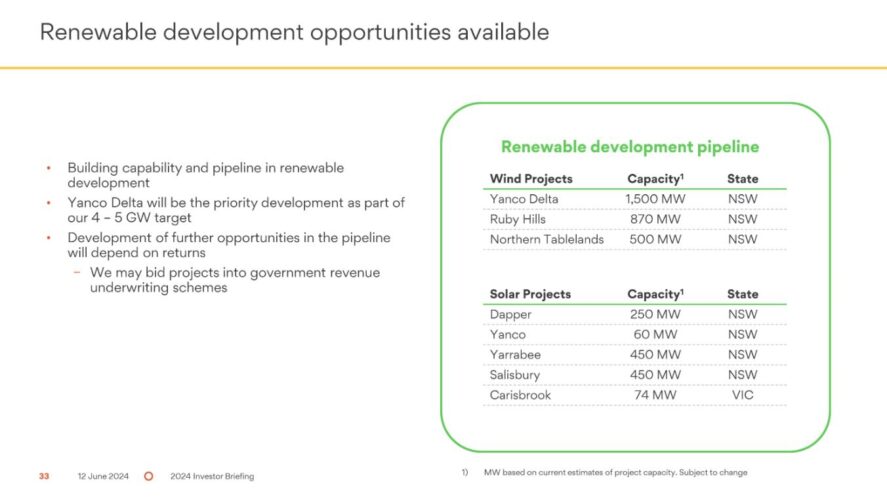

Origin’s own renewable energy plans are limited. Its priority focus is on the newly purchased 1.5 GW Yanco Delta wind project and handful of other wind and solar projects – and its target of 4 GW to 5 GW pales in comparison to Brookfield’s stated ambition to build up to 14 GW of new capacity over the next decade.

It is also just a fraction of Calabria’s prediction that Australia will need 34 GW of new wind and solar to meet the 2030 target of 82 per cent renewables, and another 33 GW to meet the significant electrification of business, transport and homes out to 2040.

But Origin favours a “capital light” approach, meaning that it is interested in early development projects but will look to sell projects to other asset owners looking for a stable return and to keep them off its own balance sheet. Origin is happy enough to have a contract for low cost wind and solar to feed into its trading and retail books.

But Calabria said the company is excited about Yanco Delta, which could have a solar farm and battery added to the massive wind component, and which is in the southwest of NSW where a number of other gigawatt scale projects are being put forward.

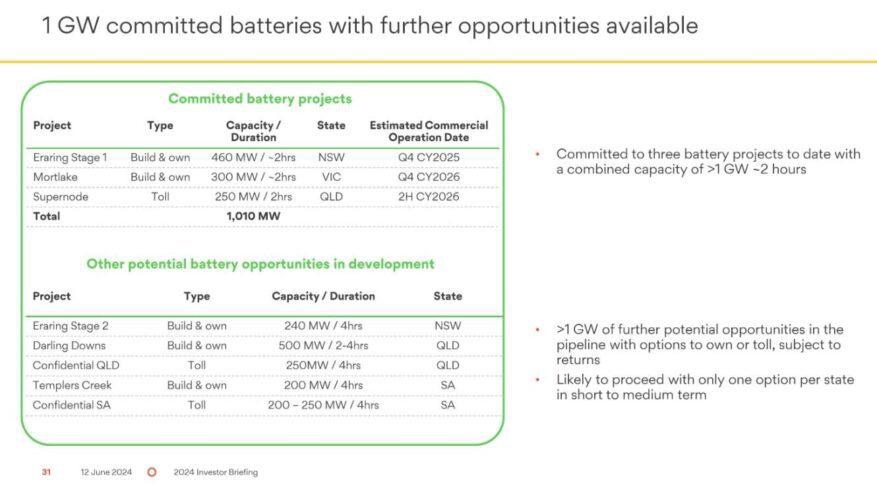

On battery storage, Origin Energy is showing more ambition. Origin has already committed to about 1 GW and about 2 GWh of big batteries that it will own or contract, including a two hour facility at Eraring, and a 300 MW/650 MWh facility next to its Mortlake gas generator in Victoria.

But it may grow that capacity significantly with another 1 GW of mostly four hour batteries (4 GWh), including an Eraring extension. It is part of a plan to have a big battery in every state in the National Electricity Market.

“We think the upside is skewed to volatility and a messy transition,” Origin’s newly appointed chief financial officer Tony Lucas says.

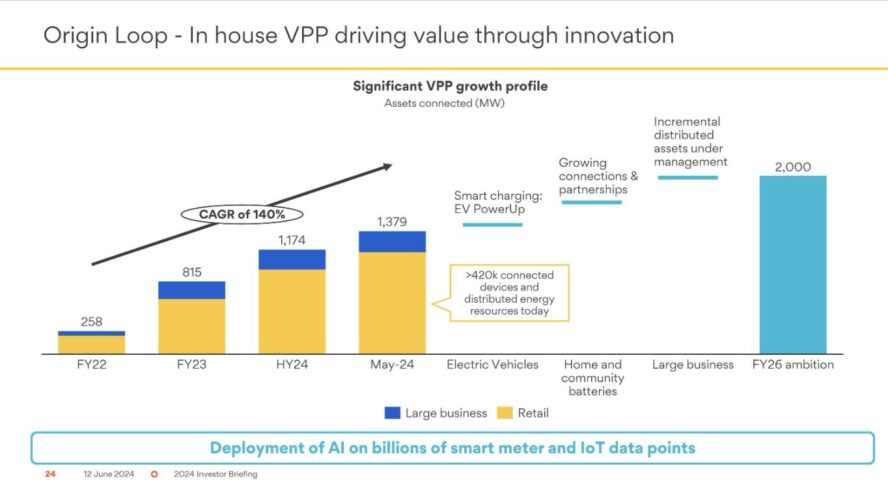

But the company’s greatest growth is coming through virtual power plants (VPP), and it says it has so far gathered 1.4 GW of capacity from its customers in the last few years – a five-fold growth in just two years – and believes that could reach 2 GW by 2026.

These VPPs are designed to “orchestrate” consumer assets, including rooftop solar, household batteries, electric vehicles (at least the EV charging component), and heat pumps, which the company says is showing strong growth.

They are also designed to keep incumbent utilities relevant to the rapidly changing energy transition. This is testimony to the changing dynamics of the grid, and the electricity market in general, and the biggest challenge for the big incumbents is winning the trust and faith of their retail base as they invest in those assets.

Distributed, or consumer energy resources, are predicted to be equally if not more important than large scale assets in a future grid, but how and who gets to control those assets is one of the big conundrums for the industry, as Amber Electric’s Dan Adams describes in the latest episode of the SwitchedOn podcast.

Origin highlighted its EV “power up” tariff that lets customers select how much they want their car to be charged for and by what time, allowing Origin to “optimize” those times that are lowest cost for customers.

It says it will soon launch a “battery maximise” tariff which will allow customers to be able to discharge their battery for a premium feed in tariff, particularly in the evening.