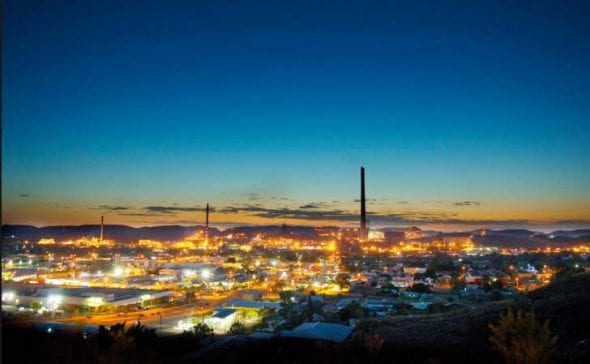

International mining giant Glencore is apparently threatening to close its huge copper operations in Mt Isa – with the loss of at least 2,000 jobs – because of the soaring cost of energy, amongst other things.

According to an article in the Australian Financial Review on Tuesday , Glencore’s copper chief Aristotelis Mistakidis has written a letter to the state and federal governments complaining that the price of power has risen 100 per cent in three years and will continue to escalate.

But it only has itself to blame.

Glencore is the biggest miner of coal in the world following its merger with Xstrata, and the biggest mineral commodities trading business.

Back in 2011, Xstrata had a choice of which energy it should choose for the future supply of Mt Isa – between the Copperstring transmission line from Townsville that would deliver wind, solar, biomass and maybe geothermal, or a gas plant supplied by AGL.

It went for the latter, and it has turned out to be be a mighty stupid decision. Gas prices have soared, as many predicted, and the cost of gas generation has likely more than doubled.

The cost of solar and wind, meanwhile, has halved, as many predicted. Glencore would likely be paying half of what it is now had it chosen the renewable energy option.

And it wasn’t as though it wasn’t warned. As I wrote at the time, Windlab, the developer of the giant Kennedy wind and solar park, and a supporter of the Copperstring project, had advised that wind and solar would reduce the cost of energy significantly, even without the scope of the cost falls that have occurred.

BIS Shrapnel said the Copperstring project was a better and “compelling” bet; Deutsche Bank analysts questioned the choice of gas over renewables, and even the then Queensland Labor government of Anna Bligh agreed, noting that Copperstring was a “once in a generation opportunity”.

But like so much about Australia’s energy policy over the last decade or two, the decision was outsourced to the fossil fuel industry.

The Queensland government allowed Xstrata to make the call, which it did, relying on a report from current ACCC boss Rod Sims, the then head of advisory firm Port Jackson Partners, and it went with a new 242MW gas fired generator, siding with a local monopoly rather than being connected to the national market.

(Interestingly, Sims was quite equivocal but suggested that the consumer might go for the short term savings. i.e. gas. His report is still online, and relied on forecasts from the likes of ACIL Tasman and MMA that gas prices “might” rise to just above $6/GJ by 2026, but would still be below $5/GJ now.

(Interestingly, Sims was quite equivocal but suggested that the consumer might go for the short term savings. i.e. gas. His report is still online, and relied on forecasts from the likes of ACIL Tasman and MMA that gas prices “might” rise to just above $6/GJ by 2026, but would still be below $5/GJ now.

It is not known what Glencore pays AGL for its gas supply, which is transported along the 840km Carpentaria gas line, but the Australian Energy Regulator reports that in March, AGL was quoting industrial customers $20/GJ. (see here, page 84).)

It any case, the decision has proved a disastrous decision on so many fronts. Apart from bringing an end to hopes of opening up a major province of new renewable energy projects, and providing power to numerous other mining projects, the gas plant brought construction group Forge to its knees because of cost over-runs.

Now the gas plant, and the near doubling of gas prices, threatens to end the long history of mining and smelting at Mt Isa, with the possible loss of 2,000 jobs, and likely the economic future of a major regional centre.

If Glencore is really serious about the operations at Mt Isa and reducing energy costs, it would have no hesitation in building a large solar plant to meet at least some of its energy needs. That can be easily incorporated into the gas plant, particularly with the help of storage and smart controls.

Mt Isa has excellent solar resources. It would likely deliver electricity at a cost of $70-$80/MWh, perhaps even less. If it had acted quickly enough, Glencore could have cashed in on the high price of renewable energy certificates.

That would have meant that the cost of electricity would have been free for at least a few years (LGC prices have been trading around $80/MWh).

At the very least, a large portion of its energy costs would be largely hedged for 25 years. It would have guaranteed its earnings and the jobs of 2,000 people, and the future of a major regional city.

South Korea zinc producer Sun Metals is doing just that near Townsville, building a 116MW solar plant so it can control costs and justify the expansion of its zinc refinery. It acted on its own because it was sick of the high prices and market manipulation of the state fossil fuel generators.

Now Telstra is doing the same thing, announcing on Wednesday that it will contract a new 70MW solar farm also in north Queensland to reduce and control its electricity costs.

Monash University, which has tendered for a 40MW wind or solar plant, has followed suit.

Ironically, Glencore already boasts that 19 per cent of its energy needs across the globe is sourced from renewable energy. Now is the time to put a big effort into securing a similar amount in Australia. It is so obvious, it is stunning that these big mining companies have not already jumped to it.

But, as Marc Hudson notes in his fantastic report into the recent history Australia’s energy policy: “Why were we so stupid, so unrelentingly shortsighted?”