The vulnerability of Australia’s ageing and increasingly intermittent coal fleet was highlighted again on Thursday, when a unit of the newly purchased Loy Yang B brown coal generator in the Latrobe Valley failed in the midst of another heatwave, sending prices soaring.

The sudden outage of the Loy Yang B unit is the 13th failure of a major coal unit this summer.

Most have occurred with little impact (apart from offering the Tesla big battery an opportunity to show its wares), this unexpected failure came just minutes after the Australian Energy Market Operator warned it may call on some of its 2000MW of emergency supplies to ensure supply as the heatwave swept across south-east Australia.

The 1100MW Loy Yang B, which generates close to 20 per cent of Victoria’s energy needs, is owned by Alinta Energy, which bought it from Engie just last year for $1.1 billion – a sale that was only finalised on Monday this week.

It is also one of the youngest plants in Australia’s coal power fleet, and is expected to run for another 20 years after AGL Energy’s Liddell plant closes.

Just this week, Alinta told The Australian that it planned to use its expanded coal power capacity to aggressively drive down power prices on the NEM.

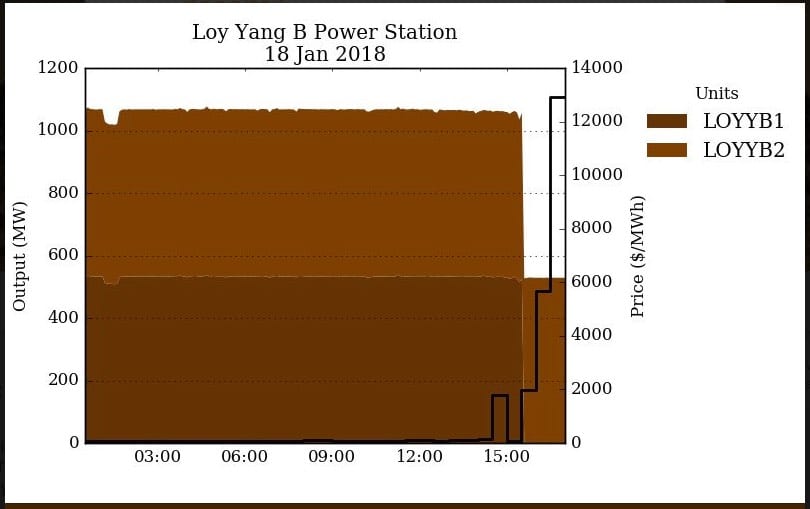

But Thursday’s unexplained outage of Loy Yang B caused the near instant loss of 530MW of capacity, and sent prices soaring in Victoria (to more than $12,900MWh) and South Australia, to a peak of $14,200/MWh.

Analysts at the Energy Transition Hub in Melbourne estimate this added $160 million to the cost of wholesale electricity. Prices jumped to a lesser extent in NSW, Queensland, and Tasmania.

The failure will be if particular concern to AEMO, which has already warned on repeated occasions that the biggest danger to grid supplies is the unexpected failure of a large fossil fuel generator, now a regular occurrence in extreme heat.

It comes as a heatwave is expected to grip South Australia, Victoria, Tasmania and parts of NSW over the coming four days, and amid forecasts for increasing temperatures in future years.

Wind and solar may vary their output according to weather conditions and the time of day, but these shifts are largely predictable.

It is the intermittency of the big coal generators, and their sudden and unexpected outages, that causes the biggest headaches for market operators, along with events such as storm damage and bushfires.

The Bureau of Meteorology has warned of very hot and dry conditions across the country for Friday and over the weekend, particularly in New South Wales, where a severe, five-day heatwave is forecast.

Meanwhile, the latest report from the Climate Council has declared 2017 the the third hottest year ever recorded, and the hottest year without an El Niño event.

So what happened on Thursday? As temperatures soared in the late afternoon, AEMO issued several “lack of reserve” notices and also warned it may call on its Reliability and Emergency Reserve Trader (RERT) facility – a “strategic reserve” of generation and demand response used as a back-up mechanism.

That facility may be invoked later on Friday, AEMO said on Friday morning, saying the standby was needed due to soaring temperatures and the threat of bushfires. It intended to conduct an auction for such capacity to be provided on Friday afternoon.

“We have been planning for conditions like today, with a focus on ensuring an operating buffer to manage unforeseen incidents across the power system,” CEO Audrey Zibelman said in a statement.

“We now have a range of dispatchable resources that can be used to strategically support the market as required, including battery storage, diesel generation and demand resources,” said Ms Zibelman.

(UPDATE: AEMO announced later Friday that it had activated some of its RERT contracts to keep the system stable).

The trip at Loy Yang B was noted by Energy Transition hub analyst Simon Holmes a Court, who tweeted shortly after about its impact on supply, prices and network frequency.

BREAKING (literally): loy yang b (coal), recently sold for $1.3bn, tripped at ~4.30pm:

• instantly removed 528MW of power

• ⬆️ price 15,000% to $13,000/MWh+

• dragged frequency ⬇️ to 49.70Hz, below ‘excursion band’

• pushed VIC into ‘lack of reserve level 2’#coalfail pic.twitter.com/zmRvrDRHyk— simon holmes à court (@simonahac) January 18, 2018

It is not clear if the Tesla big battery, which has responded in record time to previous outages at Loy Yang A and Eraring earlier this summer, jumped into the frequency and ancillary services market, as it has done on several occasions this year.

But it does appear it cashed in on the energy market, where it can get paid, injecting 30MW into the grid for over an hour as prices soared.

This is in contrast to an event earlier this week when Neoen, the operator of what is known as the Hornsdale Power Reserve, charged the Tesla battery when wholesale prices in South Australia plunged to minus $1,000/MWh – meaning that it effectively got paid that sum to charge up so it has the opportunity to sell when prices jumped later in the day.

Interestingly, it appears that the diesel generators installed in case of a shortfall have yet to be used.

The repeated failures of more than at more than half a dozen major coal units this summer – following numerous outages and capacity losses in last summer’s heatwaves – is causing concerns that the federal government’s proposed National Energy Guarantee will lock in payments to coal generators – in the name of a “reliability” obligation” – for a service they are unable to provide.

The Australia Institute, which has documented the coal outages this year and produced a report on the intermittency of coal generators, argues that there should be a reliability obligation for coal and gas plants.

The report found that over the month of February in 2017, 14 per cent (3600MW) of coal and gas electricity generation capacity across the NEM failed during critical peak demand periods in three states as a result of faults, largely related to the heat.

It concluded that electricity retailers should be required to provide “heat safe” firming power to backup gas and coal plants, such as dispatchable solar thermal with storage or additional PV to reduce peak demand on hot days. This could be buttressed by with battery storage to dispatch into the evenings, the TAI said.

But energy minister Josh Frydenberg seemed to suggest that it was all the fault of renewables. In a Tweet, Frydenberg noted the soaring prices in South Australia, claiming that only the NEG and Snowy 2.0 could address the price issues.

SA electricity prices went over $11,000MWh at 4pm & $14,000MWh at 5pm today. A reminder why SA needs the NEG & Snowy. pic.twitter.com/U2i9gToztY

— Josh Frydenberg (@JoshFrydenberg) January 18, 2018

There was no mention of the prices in Victoria, no mention of the coal plant trip that caused the price spikes, and analysts say it is absurd to suggest that Snowy 2.0 could do anything from South Australia because no link has been proposed.

See our separate story on the response to Frydenberg’s tweet.

Analysts at IBISWorld noted that electricity spot market in Victoria averaged $905/MWh over the day on Thursday, the highest for January since 2010.

It noted that the failure of two generating units at the Loy Yang and Yallourn power stations failed November 2017 had forced Victoria to import large amounts of energy and rely on expensive gas-fired power.

“This factor has contributed to recent spikes in the electricity spot market,” it said.

*RenewEconomy editor Giles Parkinson contributed to this story