Are Australia’s coal and gas generators fit for purpose to power Australia through next summer’s heatwaves? The evidence of last summer suggests they cannot be relied upon, with a new report showing how coal plants melted in the heat in Queensland on a day of record demand.

The Australian Energy Regulator has documented yet another occasion when fossil fuel generators failed to perform in the midst of a heatwave, raising questions about the ability of the country’s ageing coal fleet to meet demand in future heatwaves.

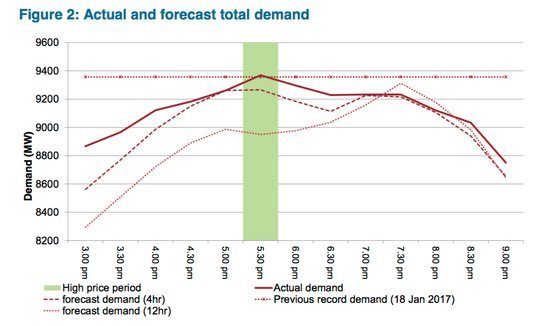

A new report from the AER looks at the soaring electricity prices on February 12, 2017, when high temperatures across the state caused record demand despite the day being a Sunday, when most business and much manufacturing was closed.

The principal reason, the AER notes, was the sudden withdrawal of more than 790MW of coal and gas capacity – all due to technical faults related to the heat.

The plants’ absence nearly created a shortfall of supply, with emergency back-up called on as the 5-minute price soared to more than $13,000/MWh on 11 occasions between 4.35pm and 7.05pm, to meet surging demand that tipped at a record 9,369MW.

The AER report on the events of February 12 is the latest of a string of reports noting how coal and gas plants have failed, or lost capacity due to problems in the heat.

Just a few days earlier, on February 10 in NSW, the loss of 1,000MW of coal capacity and the sudden failure of another 1,200MW of gas generation nearly tipped the state into widespread blackouts.

Just four days before that, on February 6, a total of 3,000MW of coal and gas capacity was lost in NSW and Queensland, mostly due to heat related faults. And on March 3, the sudden failure of the two major gas generators almost caused another system black in South Australia.

On these occasions, authorities said that renewable energy was to thank for keeping the lights on. Other analysis has pointed out that rooftop solar has saved significant amounts in wholesale electricity costs, with one report putting the savings in NSW during the heatwave at nearly $1 billion.

That’s ironic, because much of the mainstream media attention around the risk of blackouts and soaring prices has centred around the role of wind and solar – but it is the performance of the coal and gas generators that is making grid operators nervous.

Queensland is a case in point. It does not, as yet, have any large-scale wind energy apart from an old 12MW wind farm; and has only one large-scale solar plant, a recently built 20MW facility at Barcaldine. Much more – some 2,000MW – is in the pipeline, but for the moment the grid relies on its coal and gas plants for supply, and its high levels of rooftop solar.

On that Sunday, high demand was expected because of the heatwave, which had affected South Australia and NSW on previous days. It reached 37.6°C in Brisbane, up from 37°C the previous day. This was almost 8°C above the February average maximum, and maximum temperature records were broken in several parts of the state.

On that Sunday, high demand was expected because of the heatwave, which had affected South Australia and NSW on previous days. It reached 37.6°C in Brisbane, up from 37°C the previous day. This was almost 8°C above the February average maximum, and maximum temperature records were broken in several parts of the state.

Still, because it was a Sunday, high prices were not expected four hours out, even though demand forecasts had been lifted significantly. But in the end they jumped higher – demand hit record levels, but the killer punch was the failure of units and reduced output from six different coal and gas generators.

“The actual spot price was much higher than the four-hour ahead expectation because a significant volume of low-price local Queensland supply became unavailable,” the AER notes.

It catalogues the incidents above.

The unexpected withdrawal caused the Australian Energy Market Operator to declare an actual lack of reserve (LOR) 2 condition, one step short of load shedding. All it needed was for one more thing to go wrong, and power to homes and businesses would have been lost.

The situation was made worse because of constraints on the network imposed by the market operator that reduced the flows from NSW from a potential 600MW to just 40MW. Constraints have been imposed by AEMO at various points in case of a failure at the Kogan Creek coal-fired power station.

The events of the past summer has caused one of the biggest network owners to complain about the reliability of fossil fuel generation. Spark Infrastructure, which owns networks in Victoria and South Australia, said gas generators were proving unable to deliver reliable power at times of peak demand.

It also accused them of charging excessive prices for both their retail operations and their generation. This follows questions about the reliability of fossil fuel generators and their ability to deliver the grid security they are paid handsomely to do.

AEMO has admitted that some legacy coal and gas generators have no performance standards, and it may not even know what their control settings are. A point underlined by Tom Butler, in his piece today, which analyses numerous issues with governor controls and other issues, and by other submissions which point to system weakness from fossil fuel generation.

The AER has been chronicling all sorts of occasions when coal and gas generation has been lost due to the heat. Apart from the events on February 6, February 10, February 12 and March 3, mentioned above, more capacity was lost in January, mostly the result of “heat” issues that forced coal and gas generators across the state to lower capacity.

On Friday, January 13, for instance, between 600MW and 670MW of coal and gas capacity suddenly became “unavailable” due to “plant limitations, some of which related to the high temperature.”