The Australian stock market resembles a carbon bomb waiting to go off, according to the findings of a new report measuring and comparing the level of embedded emissions and revenues derived from fossil fuels in the world’s top financial market indices.

According to the Carbon Scorecard report, published by the S&P Dow Jones Indices this week, the S&P/ASX All Australian 50 has the highest level of embedded emissions in proven and probable fossil fuel reserves and the greatest percentage of revenues derived from coal-based activities.

The findings make the Australian market – one of seven headline global indices in the S&P Global 1200, which captures approximately 70 per cent of global equity market capitalisation – the world’s “most exposed” to potential stranded assets, at a time when the rest of the world is rapidly shifting to a low-carbon economy.

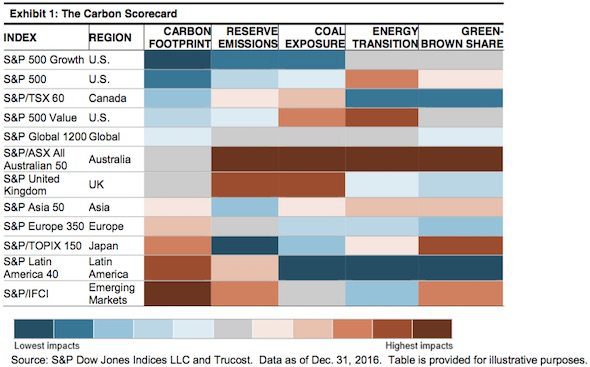

As you can see in the chart below, the report analyses five measures of carbon: carbon footprint, fossil fuel reserve emissions (future emissions), coal revenue exposure (revenue from coal extraction or coal power generation), energy transition (transition to clean energy to gauge the International Energy Agency’s 2°C scenarios) and green-brown revenue share (clean energy activity versus carbon intensive activity).

To find Australia, look for the big block of dark brown…

The only other dark brown patch is attributed to the Emerging Markets index, but that is for its overall carbon footprint. In terms of embedded emissions, coal revenue exposure and the mix of renewables compared to fossil fuels, the emerging markets index is ahead of Australia on every count.