Australia has been named as one of eight countries expected to lead a massive boom in energy storage uptake that will see the global market double six times over between 2016 and 2030, to an installed total of 125GW/305 gigawatt-hours in 2030.

In its Energy Storage Forecast, 2017-30, released on Tuesday, Bloomberg New Energy Finance predicts the global energy storage market will follow a “remarkable” growth trajectory similar to that charted by the solar industry between 2000 to 2015.

The report predicts that the global energy storage market will grow to a cumulative 125GW/305GWh by 2030, attracting $US103 billion in investment over this period, as behind the meter storage becomes “ubiquitous” in countries like Australia, and combines with utility-scale storage to play a crucial role in the transition to renewables.

And as we have seen with solar, energy storage market momentum will be driven by falling costs – in the case of lithium-ion battery systems, for example, BNEF is forecasting annual cost reductions of around 10 per cent from now to 2020, and 7 per cent a year by 2030. (Although this will mostly be driven by demand from a booming electric vehicle market, the report says.)

“The industry has just begun,” said BNEF energy storage analyst Yayoi Sekine, lead author of the report, in comments on Tuesday. “With so much investment going into battery technology, falling costs and with significant addition of wind and solar capacity in all markets, energy storage will play a crucial part in the energy transformation.”

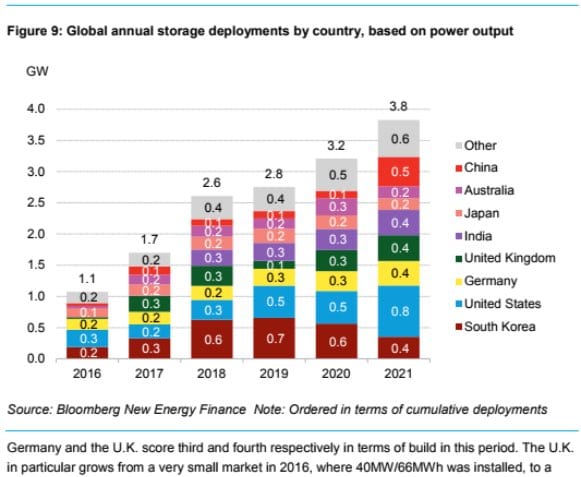

Leading the charge on energy storage, says BNEF, will be a group of eight countries – the US, China, Japan, India, Germany, the UK, South Korea and Australia – which will collectively account for 70 per cent of total installed capacity by 2030.

And while utility-scale storage will be a key part of the growth market – both co-located with renewable energy generation facilities and separately in a grid balancing role – it will be the battery storage systems installed by households and businesses that will really star in future power markets.

“By 2030, we expect 69GW/157GWh to be behind-the-meter, making up more than 50 per cent of total capacity,” the report says – and the chart below shows – as this resource is increasingly used to provide system services, such as peaking capacity, on top of customer applications.

This is a pattern we are already seeing emerge in Australia, as major gen-tailers scramble to work with governments and energy management start-ups to harness – and facilitate – the burgeoning battery storage resource that is being installed on their networks.

And well they should, because according to the report – and as the charts below illustrate – storage installed behind the meter by homes and businesses will make up a whopping 90 per cent of the market in Australia by 2030, the highest proportion of any country in the BNEF forecast.

“We forecast significant growth in behind-the-meter PV and storage uptake as costs continue to slide,” the report says.

“In the long-term, distributed energy will become ubiquitous, and the ongoing uptake is projected to keep grid-supplied electricity demand relatively flat throughout this period.”

This is a major shift from today, the report adds, where BTM is the smaller of the two segments: “This is driven by retail tariff offset economics, demand charges and aggregation opportunities.”

The report also points to the known unknowns of the Australian renewable energy market, and how these could affect the outlook for battery storage – particularly at the utility scale.

For instance, mandating energy storage to be built alongside new renewables capacity – an idea that was broached in the Finkel Review – could undermine the economics of renewables, the report says; “especially if many issues could be resolved by aggregating behind-the-meter capacity instead.”

Likewise, the recent government policy emphasis on “synchronous generation” to meet minimum inertia and system strength requirements” could lead to more renewables curtailment, while also entrenching a role for baseload fossil-fuel generation and adding to development costs of wind and solar, it says.

“More importantly, the emphasis on synchronous power reduces the attractiveness of batteries in comparison to gas generators, pumped hydro and synchronous condensers,” the report says.