The South Australia government has decided to take on the monopoly electricity network operator in the state as it continues its campaign against the market dominance of the powerful energy oligopoly, and their ability to pass on huge price increases to consumers that are often blamed on wind and solar.

Network costs in South Australia – like most of the country – account for more than half the average household bill. Consumers were hoping to get some relief after the Australian Energy Regulator knocked back some of the planned spending by SA Power Networks, but its ruling is now being challenged in court.

Energy minister Tom Koutsantonis says he will send a senior public servant to appear before the Australian Competition Tribunal this week, accusing SAPN of “cherry picking” individual spending decisions from the AER in the hope of boosting its overall spending allowance.

It’s a crucial intervention by the state government, and comes amid huge public controversy over its ambitious renewable energy plans, and the already high penetration of wind and solar that could reach 50 per cent by the end of the year.

Recent high wholesale electricity prices have been blamed by many in the Coalition, and the Murdoch media, on the state’s reliance on renewables, even though most independent analysts and market regulators blame soaring gas prices, grid constraints, and other factors.

South Australia has long had the highest electricity prices in the country, a point underlined by federal energy minister Josh Frydenberg last week, who also pointed out that the recent spikes in wholesale prices used to be a regular event even before the build out of large wind farms and rooftop solar.

History will show that South Australia is taking the right course, with most analysis suggesting the world’s energy systems are now in a dramatic shift away from centralised, dirty, fossil fuel generation, and to a new smart decentralised grid where much of the power comes from local wind and solar, backed up by storage and smart software.

Right now though, the state government is under pressure and keen to relieve the bill shock on consumers. Hence its focus on network costs, which account for 51 per cent of the average household bill in South Australia, according to the Australian Energy Market Commission.

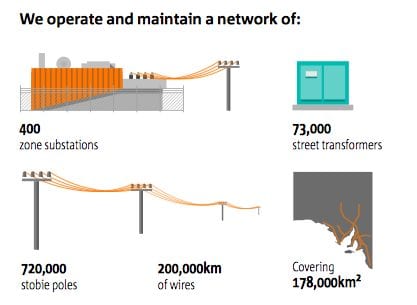

These network costs have risen dramatically in recent years, but regulators are now trying to bring the spending on poles and wires under control. But to some extent it is handicapped by the system.

The spending decision by networks across Australia have turned into a game in recent years. Typically, the network makes an outrageous request which is knocked back by the AER. Then a revised proposal is made which usually results in a compromise position from the regulator.

It used be a joke that the networks would then take the regulator “out the back” and settle the score, but now they are turning to the courts, taking their cue from the NSW government owned networks, which is seeking to lease its networks and is fighting any cuts in spending that could lower the value of the assets. The legal bill is huge.

SAPN asked to spend $4.75 billion from 2016-2020, but the AER in its preliminary ruling decided it should only be allowed to spend $3.2 billion, which could have cut household and small business electricity bills by 10 per cent.

SAPN returned with an offer of $4.55 billion, and AER came back with a final determination of $3.84 billion. But SAPN is not happy, and has taken the issue to court. Koutsantonis says if the appeal is successful it will add 15 per cent to average bills.

Grid costs have been ignored by the recent debate over renewables in South Australia, a fact we highlighted in our assessment of a Today Tonight report, which blamed wind and solar for soaring electricity prices, but which neglected to note that one of its “complainants” had decided not to connect to the grid because “there is a huge annual cost even before you flick on the light switch.”

Indeed, the AEMC assessment of South Australia consumer prices says that green energy costs comprise less than four per cent of consumer bills and are falling, and over the short term are having a dampening effect on wholesale prices.

The South Australia government has attacked the power of the energy oligopoly, which it blames for forcing up wholesale electricity prices and retail costs. The problem in South Australia is the lack of competition, a factor not helped by its reliance on just two interconnectors to Victoria. It wants a new one into NSW.

Its attack on the network operator means all three major components of the electricity bill are now under scrutiny – wholesale prices from generation, retail margins, and network costs.

The issue is further highlighted by revelations that the then state Liberal government, in the late 1990s, had abandoned plans to build an an interconnector to NSW in order to inflate the sales price of the state network operator when it was privatised.

“The deliberate move to restrict competition in the energy market and limit interconnection to other states has resulted in volatile electricity prices for South Australian consumers,” Koutsantonis says,

“There is a reason why the Australian Energy Regulator determined that SAPN could not introduce these extraordinary increases in charges, and that is because there has been no compelling evidence put forward to justify them.

“I have instructed a representative from the Department of State Development to make the case on behalf of South Australian households and businesses that SAPN is able to meet its service delivery obligations with the revenue allowance that the AER has determined.”

He said the lack of competition can be directly attributed to the failure to build an extra interconnector to NSW. “It is one thing to privatise state-owned assets in order to create increased competition and efficiency, but it is another thing entirely to limit competition in order to inflate the sales price and create private-sector monopolies.

“By putting their profits from the sale of our power assets ahead of cost-of-living for South Australians, we now have a situation where limited interconnection is leading to higher electricity prices.

“We are seeing the results of that terrible decision today and now need to do what we can, with limited levers available to us, to stabilise energy prices in South Australia.”