West Australian energy minister Mike Nahan has conceded the state’s electricity market faces radical change, with rooftop solar to become ubiquitous on homes and businesses within a matter of years.

In questions following an eagerly awaited speech in Perth on Tuesday, outlining the first of his government’s major energy market reforms, Nahan said solar, battery storage and off-grid installations would have a big impact on the market.

In questions following an eagerly awaited speech in Perth on Tuesday, outlining the first of his government’s major energy market reforms, Nahan said solar, battery storage and off-grid installations would have a big impact on the market.

The West Australian energy market is currently a basket case. Last year, it required more than than $620 million to bridge the difference between the cost of generation and delivery of its ageing coal and gas infrastructure, and the price it charges to consumers.

That is a massive subsidy in a small market, and clearly unsustainable. It has largely been brought about by an absurd subsidy to fossil fuel generators – the so called “capacity payments” – that has seen many gas and diesel plants built at public expense and never even switched on.

The market review completed for the government says the excess capacity is just not needed. It wants the capacity mechanism removed, but the free-loading fossil fuel generators are threatening to sue for compensation.

The review itself paid little attention to solar, but Nahan clearly is, and so are WA consumers. In response to questions from a packed luncheon at a Perth hotel on Tuesday, Nahan said rooftop solar would be built on nearly every home and business in the state as consumers took matters into their own hands.

This is clearly his acceptance of an estimate by the state’s Independent Market Operator, which predicted last year that more than two-thirds of houses and 90 per cent of businesses could be generating much of their own energy by 2023. A proposition that is even more likely now that the WA government has pledged to remove the fossil fuel subsidies that plague the state.

Energy storage is also coming down the cost curve, something that Nahan appears to agree with. Asked if customers would be “allowed” to go off-grid, Nahan – who has previously hinted that all users might be hit with a service charge, on-grid or not – said yes.

He even pointed to the old UK comedy series, The Good Life about a couple trying to become totally “self-sufficient” in their home in Surbiton. At least now, Nahan quipped, the technology meant that households – and presumably businesses – could do it properly.

Still, he did not answer questions on whether the state would impose a special charge on solar households, as he flagged earlier this week, as part of its attempts to claw back the cost of retail subsidy. Nahan may accept that solar is inevitable, but it is no sure thing he will make its entry any easier.

Indeed, Western Australia – thanks to its soaring costs and excellent solar resources – could be exhibit A, along with Hawaii, on how or how not to manage the transition from centralised fossil fuel generation, to a renewables-based distributed future.

The solar question is critical for the state, which has one of the highest generation and delivery costs in the world, and some of the best solar resources. Successive state governments have refused to pass on the full cost of the generation, fearing political fallout.

But they now recognise that the retail subsidy is not sustainable – and when the prices do reflect the cost of delivery, then the attraction of solar and battery storage, which is falling rapidly down the cost curve, will be even more apparent to consumers.

Nahan wants the capacity market subsidy removed, and his first initiative from the energy review is to announce that the retail market – currently a monopoly held by Synergy – will be opened up for competition.

But that retail competition will not likely happen for another four years – the time it will take to remove the subsidy. By then, retail prices will be in the high 30c/kWh (even ignoring future cost rises), from the current level of around 26c/kWh, making solar and storage highly competitive.

As a side note, South Australia is often criticised by anti-renewable types for having the highest residential costs in the country, something they say is because the state has the highest penetration of renewables – it sources 40 per cent of its needs from wind and solar.

But this is not true. South Australia’s electricity costs – and emissions – have come down since the introduction of renewables.

Its customer costs are not hidden by massive cross-subsidies, as is the case in WA and Queensland (where the cost is also $600 million a year). Indeed, the WA review said generation costs in that state (85 per cent coal and gas) were 80 per cent higher than in South Australia. Yes, 80 per cent.

Here’s the quote:

“Wholesale energy costs (that comprise energy and capacity costs in the SWIS, but just energy costs in other systems) are substantially higher in the SWIS (the WA grid) than any other distribution area and about 80 per cent higher than the next highest distribution area in South Australia (SAPN).”

Nahan also announced that regulation of the market would be handed to the Australian Energy Regulator, which does the same for the main grid on the eastern states, but Nahan ruled out linking the two grids (That would cost a bundle with an interconnector).

He also ruled out splitting or selling Synergy’s generation assets. This is problematic. WA’s energy cost crisis will not go away, because the cost of coal generation is rising, and local coal generators are losing money despite this.

Last year, the review even advocated importing coal from Indonesia as a measure. This is patently ridiculous, and will not be adopted by the government, but it goes to highlight the depth of issue the government faces. It is also facing a potential gas price issue, with reserves in the north-west shelf being massively depleted.

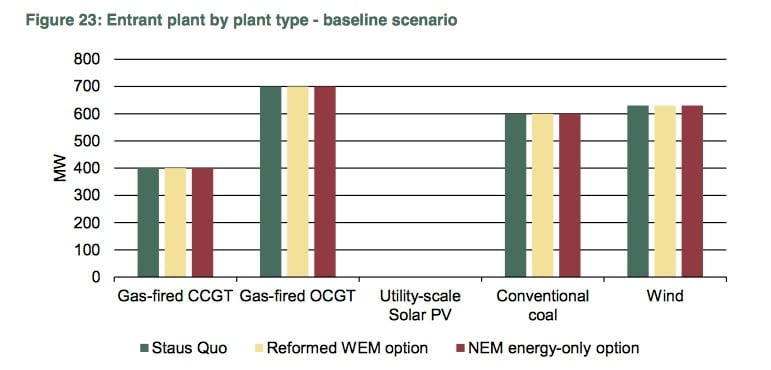

Still, the review is still largely shaped by a conventional view of generation. Modelling done by ACIL Tasman – the same brought in for the Abbott government’s Warburton RET review – did not even include large-scale solar as its base case, as this graph illustrates.

That, again, is bizarre. WA has some of the best solar resources in the world, possibly only bettered by Chile. And if the true cost of generation was reflected in the market, solar may already be competitive. There are numerous large-scale solar projects in the state with planning approval, just waiting for some policy certainty (mostly from the federal government’s renewable policy) before being built.

That, again, is bizarre. WA has some of the best solar resources in the world, possibly only bettered by Chile. And if the true cost of generation was reflected in the market, solar may already be competitive. There are numerous large-scale solar projects in the state with planning approval, just waiting for some policy certainty (mostly from the federal government’s renewable policy) before being built.

Nahan was asked about the impact of renewables on state generation assets, and conceded they will have an impact on the state’s energy asset values – presumably mostly the ageing fleet of coal generators. Nahan plans a major statement on renewables later this year.

The capacity mechanism is the biggest headache, however, and should serve as a warning to those regulators who are being lobbied by fossil fuel generators in the eastern state to introduce the same in the National Electricity Market.

The review said that retaining a capacity mechanism, even when assuming perfect foresight, results in higher costs than an energy-only market (which exists now in the NEM). It said the extra cost of the capacity payments transfers value from consumers to generators.

And how did they get into such a mess? For the same reasons that the those on the other side of the country over-invested in coal and gas plant, and network upgrades – a mixture of hubris, greed and a refusal to recognise the impact of technology changes. In WA, it was the failure to recognise the impact of solar – hopefully something that is now changed.

This graph shows the massive difference between the prediction and the actual result (the black line at the bottom).

As the report notes:

“With rapidly changing economic conditions and the growing up-take of solar power, forecasts have failed to predict historically low levels of electricity demand growth and the extent to which that limited demand growth is met by small-scale solar photovoltaic panel systems.

“As a result, the Reserve Capacity Mechanism has produced a large amount of surplus generation and demand-side management capacity over and above the peak demand for electricity.

“In 2013-14, the amount of surplus capacity amounted to 1,254 MW over and above the Reserve Capacity Requirement (about 20 per cent of total installed capacity), 1,676 MW over and above forecast maximum demand (27 per cent of total installed capacity), and 2,341 MW over and above actual peak demand (38 per cent of total installed capacity) (see Figure 15).

“Generators and providers of demand-side management receive capacity payments for this considerable surplus of capacity, the cost of which is passed through to electricity retailers and customers. In the case of Synergy‟s small use customers, this becomes a significant component of the operating subsidy.”