The influx of renewable energy sources such as wind and solar into energy markets is forcing coal and gas fired generation out of the market, quicker than most analysts expected.

In a new analysis, the energy market team at UBS note that the pace of closures in the coal and gas sector in Europe is accelerating – even as the growth in renewables steadies and, in some countries, slows.

According to their data, some 70GW of coal and gas-fired generation shut-downs have occurred in the last five years, and the pace is increasing, as this graph below illustrates.

That will not be the end of it. The combination of reduced demand and yet more renewable energy additions over the next two years will force the closure of at least 24GW of thermal capacity (coal and gas), and could lead to another 30GW of closures just to ensure that the remaining coal and gas fired plants can stabilise profits.

That will not be the end of it. The combination of reduced demand and yet more renewable energy additions over the next two years will force the closure of at least 24GW of thermal capacity (coal and gas), and could lead to another 30GW of closures just to ensure that the remaining coal and gas fired plants can stabilise profits.

But UBS says there is a risk that many more plants could close. According to its analysis, nearly half of the remaining 260GW of coal- and gas-fired generation in Europe is cash-flow negative, meaning they do not earn enough money to cover basic costs.

But UBS says there is a risk that many more plants could close. According to its analysis, nearly half of the remaining 260GW of coal- and gas-fired generation in Europe is cash-flow negative, meaning they do not earn enough money to cover basic costs.

As this graph below shows, many of those plants are in Germany, which continues with the highest penetration of renewables, but the UK, France and Spain also have significant capacity at risk.

The question is what to do about it, if anything. It’s a question that is being asked in Australia as well, which already has a surplus of baseload coal-fired generation, and more gas plants than it needs.

That is despite the deployment of large-scale renewables coming to a virtual stop in the last 18 months as the coal-fired generation pressure the government to cut, or even abandon the renewable energy target.

UBS says European policy makers may have to agree to offer a subsidy to the fossil fuel generators, in the form of capacity payments, or similar, to ensure that the generators earn enough money to stay on line.

UBS says the cost of this can be relatively small, and may add only 0.2 per cent to prices, or a total cost of just over €1 billion per annum.

But there is fierce debate across the EU about the need for capacity payments.

The centre-right German government is under intense pressure to introduce capacity payments, but is resisting. Instead, it is considering new carbon bills in an effort to force out brown coal generators instead of less polluting, and more flexible, black coal generators.

The capacity payments system has been mooted in Australia. But capacity markets can have perverse outcomes, as Western Australia has discovered to its considerable cost, spending billions of dollars on plants that are not needed, and in some cases not even switched on.

UBS describes the potential closure of so much at-risk capacity as a potential disaster that could cause the lights to go out. If 125GW did leave the grid, it would leave the system precariously balanced, with not enough capacity to meet peak demand.

In the end, however, there is unlikely to be 125GW of coal and gas-fired generation in the next three years, because the market would quickly rebalance. As more generators exit, the surplus energy diminishes and prices recover.

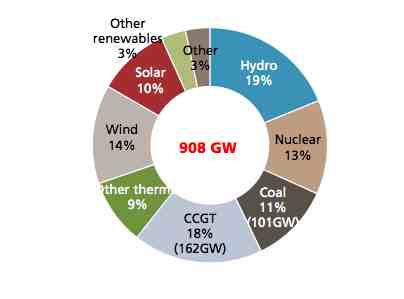

Just to conclude, here is an interesting graph that highlights the different sources of energy – by capacity – in the European market. Coal and gas currently account for just 30 per cent of that capacity.

Below, UBS estimates the output from the various technologies. Black coal will suffer the most significant reduction in production over the next five years.