Global investment bank UBS says solar is likely to account for 10 per cent of global electricity capacity by 2020, as production costs continue to fall, and demand soars in the world’s major economies and in other markets.

In the latest bullish solar analysis released by a major investment bank – see Alliance Bernstein says solar’s dramatic cost fall may herald energy price deflation and Citigroup says age of renewables has begun – UBS says that solar’s dramatic growth is assured because it is no longer dependent on a single, subsidised market.

“China, the USA & Japan presently take the largest share of solar capacity growth,” it writes in a report. (See table below for how the solar industry is supported in those markets – in the US with a tax credit and in Japan and China with feed-in-tariffs).

“For each of these countries it’s important to understand the regulatory and other drivers of growth in order to have some reasonable perspective on how much future growth exists. “

“However, the most fundamental point is that solar growth is now coming from different regions in the world. As such its future is more assured than when all of the growth was driven by feed-in tariffs in Europe in general and Germany in particular.”

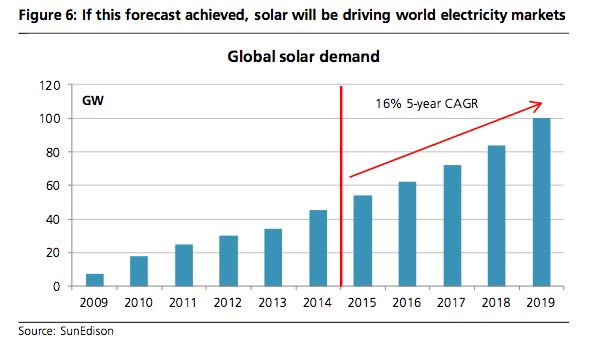

UBS notes that US solar group SunEdison predicts that solar can maintain a 16 per cent compound annual growth rate over the next five years. That will take annual installations to around 100GW by 2019. That’s as much as had been installed cumulatively across the world up to the end of 2012, and as much new generation (all fuels included) that is installed each year in China.

UBS notes that solar has several key advantages over other technologies:

– It has few economies of scale. Which means it can be produced for around the same cost whether it is powering a torch or being used to construct a 100MW utility scale plant.

– That means that it doesn’t need a market any bigger than the individual household to be cost competitive (It cites Australia as a key example of this, where the market for homes accounts for 95 per cent of the market, as opposed to around 60 per cent globally).

– In turn this means that the economy of scale is driven more by the number of installations than the size of the individual installation. This means that solar can be built at the point of consumption and can arbitrage the grid system by avoiding the grid cost, which represents about 50% of the cost of buying electricity from the grid.

– It also means that this is a market that traditional utilities cannot control, which is possibly why it is viewed as such a threat.

– UBS says that the experience in Europe shows that solar production is reasonably predictable and reliable.