Solar PV and wind energy will beat both coal and gas on costs – without subsidies – in the major Asia energy markets of China and India by 2020, according to Bloomberg New Energy Finance.

BNEF, in its Markets 2030 report last week, predicts a fundamental shift in Asia’s energy mix as the major economies turn increasingly to renewables and away from fossil fuels.

The attraction of renewables means that it will account for two thirds of total power additions in capacity terms between now and 2030. It predicts more than 800GW of solar PV, more than 500GW of wind energy and around 440GW of hydro.

The implication for Australia – and the developers of large coal mines and the potential investors in huge infrastructure – is that the share of coal will gradually shrink as the significance of local air pollution and climate change, and the competitiveness of renewable technologies, crowd out further investment.

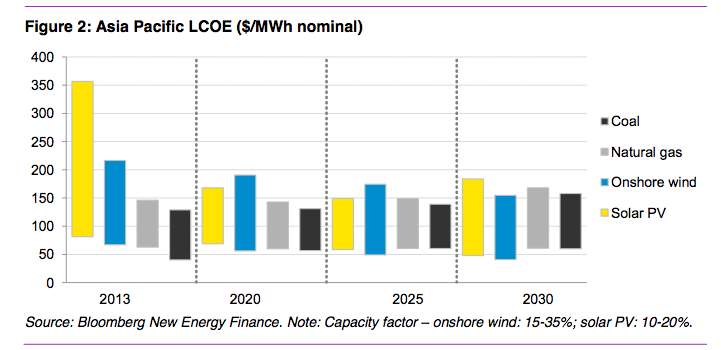

Where once coal was assumed to make up the bulk of new electricity investments – indeed just until a few years ago, it is now very much a minor role, as this graph illustrates.

BNEF says that although Japan and South Korea have several coal plants under construction or planned, this is expected to be a temporary phenomenon on the back of an urgent lack of power supply, high gas prices, no added carbon costs and few immediate cost-effective alternatives.

This is going to translate into a renewable share of electricity production of 45 per cent for India by 2030, 33 per cent in China, 31 per cent for Suuth-East Asia and 26 per cent for Japan.

This comes as the Australian government considered putting the brakes on the deployment of renewables to ensure it does not exceed 20 per cent by 2020, contrary to its stated legislation of at least 20 per cent.

BNEF says if the current policies were left as they were, Australian could reach 36 per cent by 2030, but while other countries are taking advantage of falling costs of renewables to increase ambition, Australia is contemplating erecting policy walls to protect its fossil fuel generators.

Indeed, it is the estimates of technology costs that are most striking, particularly for those lulled into the belief that renewables are “too expensive” – which seems to be the default position of most of the conservative commentariat and policy makers in Australia.

BNEF says solar PV is already competitive with coal if high environmental costs were taken into account, and with gas if it was supplied through LNG – which is the case for many Asian countries.

But there are more significant cost reductions to come for PV in contrast, BNEF says, which will mean it will be a “fully competitive source in only six years (2020) in much of the region”.

As this graph above illustrates, BNEF believes that the LCOE of solar will be as low as $70-112/MWh in much of Asia by 2020. Wind energy, which also has some cost reductions in the pipeline, will be between $56-166/MWh. They will both be even lower in 2030.

BNEF says coal will be at $57-131/MWh and gas at $60-143/MWh. The lower prices only apply to those countries with domestic sources. The high range applies to imported coal and gas.

This has great significance for commodity exporters such as Australia, because it will be hard for their products to be used competitively against local renewable sources. Indeed, BNEF puts the marginal cost of gas generation using LNG at more than $140/MWh. This radically restricts its market attraction.

“The coal LCOE has a very wide range depending on the country’s source of coal and inclusion of environmental costs. Currently, it can be as low as $40/MWh in China and as high as $107/MWh in Japan or even $85-129/MWh in Australia where an on-and-off-again carbon policy has dramatically increased the cost of financing if it is possible to obtain at all.”

“Over time we expect the coal LCOEs for Australia, Japan and China to converge around $133-137/MWh as China is expected to impose similar environmental constraints (eg, high- quality coal, carbon price, scrubbers) as the other two. India and Southeast Asia will remain as low as $60-81/MWh in 2030 unless they take similar environmental measures as China.”

As in Australia, BNEF expects households and businesses will install solar PV on an unsubsidised basis to save money. This will happen as equipment becomes cheaper, and despite expected opposition from utilities and changing rate structures for consumers.

See also: Fossil fuels, electric utilities and petrol cars to be obsolete by 2030.