Australian households are almost single-handedly pushing the country towards a clean energy future, spending billions on generating their own electricity and accounting for nearly two thirds of total investment in renewables in Australia in 2013, and virtually all of it in 2014.

New global data released by the Pew Charitable Trusts, a US-based NGO, and compiled by Bloomberg New Energy Finance, shows that there was $4.4 billion of clean energy investment in Australia in 2013.

Two thirds of this, or around $2.8 billion, came from the solar sector as households, and a few businesses, installed nearly 1 gigawatt of rooftop solar PV – mostly as a hedge against soaring electricity prices.

Around $1.4 billion was invested in the wind sector, most of this on the 420MW, $1 billion Macarthur wind farm in Victoria. But as we reported on Wednesday, the large-scale renewable sector in Australia has come to a virtual standstill – because of the uncertainty over the future of the renewable energy target, with no new commitments made in the first quarter of 2014.

In 2013, only four new large-scale projects were committed, and these only because of incentives provided by the ACT government, the now defunct solar flagships program, and financing from the Clean Energy Finance Corporation, which the Abbott government is trying to dismantle.

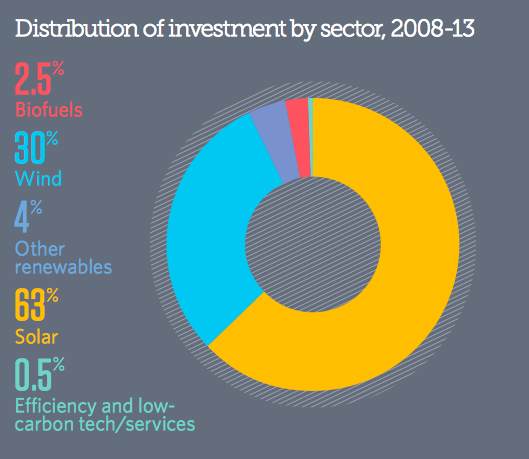

The major role played by household investment in renewables in Australia is not new. As this graphic above shows, solar has accounted for two-thirds of total renewable energy investment in the country from 2007 to 2013. That household investment helped Australia record the third highest growth in renewables investment (32 per cent average annual growth) in the G20 over the last five years.

A lot of this was driven by generous state-based feed in tariffs and other federal incentives, but even though these support mechanisms have been largely wound back, Australian households are still adopting rooftop solar at a rate of more than 13,000 households a month.

Recent data showed that more than 4,000 applications are coming in a month just in the south-east Queensland region managed by Energex. In South Australia and Western Australia, the take-up rate in more than 2,500 a month, in Victoria is has been just below 2,500 a month. We have not had time to crunch the numbers for NSW, the rest of Queensland, Tasmania and the Northern Territory, but these would add several thousand more households.

This creates an interesting problem for the Australian government, which is under pressure from utilities to wind back the remaining incentives for rooftop solar, mostly because rooftop solar has taken away the profits the generators used to make in the afternoon peak. Many generators are making losses, and some have had to close or make major writedowns.

There are also numerous stories of utilities refusing to connect households or businesses wanting to install rooftop solar, or forcing them to downsize their plans. Many are required to install expensive equipment that prevents them from exporting solar energy back to the grid.

This is now becoming a political issue. The Victorian Greens, preparing for a state election later this year, believe rooftop solar may be a “sleeping giant” of Australian politics. The industry believes it had an influence with its “Save Solar” campaign in the recent Senate re-run, which saw a big boost to the Greens vote.

This is now becoming a political issue. The Victorian Greens, preparing for a state election later this year, believe rooftop solar may be a “sleeping giant” of Australian politics. The industry believes it had an influence with its “Save Solar” campaign in the recent Senate re-run, which saw a big boost to the Greens vote.

Both Victoria and NSW are facing critical issues in 2016, when tens of thousands of households will lose their premium tariffs, and will look for other means to maximise the value of their solar output – perhaps looking at battery storage.

The Pew report notes that rooftop solar will remain an attractive option for Australian households in view of high retail electric power prices.

The market for large-scale investments is less clear, Pew notes, because of the change in policies from the Abbott Government. Right now, utilities are not writing any power purchase agreements, in the hope and expectation that the renewable energy target will be diluted, and banks say that the merchant market is too risky.

The only projects likely to get committed this year include two more solar projects from the ACT’s reverse auction scheme, and possibly some wind projects to be allocated in another upcoming auction.

Australia currently has around 3.4GW of solar – almost entirely rooftop, and most of this on households rather than commercial premises – and just over 3GW of wind energy.

This compares to global installed capacity of 735GW (not including large hydro) as at the end of last year (See graph to the right).

This other graph below also adds some global context to Australia’s investment patterns. While many other countries have seen solar dominate investment dollars in the last year, most of them (with the exception of Japan) have been predominantly large-scale or medium scale installations.

Australia still has only one completed, utility-scale ground mounted solar farm, the 10MW installation at Greenough River near Geraldton in Western Australia, although the Nyngan and Broken Hill projects being built under the solar flagships scheme, and the three projects to be constructed in the ACT, will soon add to that.