France has entered into a national debate about its energy transition to meet its long range target to reduce CO2 emissions by 75 per cent by 2050, while maintaining security of supply and the competitiveness of French industry. It is a muddled debate, because the trigger for it is an electoral commitment made by President François Hollande to reduce the nuclear share in the country’s electricity mix from over 70 per cent today to around 50 per cent by 2025, a commitment that few people in France – and maybe not even the president himself – regard as sensible or feasible to carry out to the letter.

There is, however, a real nuclear issue to debate: how far is France content to rest on its laurels of a nuclear industry that has produced some of the cheapest and certainly the most de-carbonised electricity in Europe, rather than to confront the long term cost challenge of replacing current reactors, the systemic risk of operating a nuclear fleet of 58 reactors, and the prospect of one day having to re-carbonise its electricity system if it cannot replace today’s generations of reactors with similar amounts of zero-carbon electricity?

This issue also raises the question of whether a reduction in the nuclear share of its electricity mix might improve France’s relatively poor performance – relative to some of its EU partners – in renewable electricity generation and in energy saving. Able to offer some of the cheapest electricity in Europe, produced by largely amortised reactors, successive French governments have so far been reluctant to negate this cost advantage by loading on to consumers’ bills the same level of renewable subsidies that many neighbouring countries have. Cheap electricity has also reduced incentives for energy saving. Yet, in order to meet its 75 per cent reduction in greenhouse gases, the government has the long term aim of reducing energy consumption by 50 per cent by 2050.

Political context of the 50 per cent commitment

The German decision to phase out nuclear power after Fukushima in 2011 shook the establishment in France, which has in recent years become used to following, however reluctantly, the lead of Germany in many policy areas. Indeed this appears to be happening in nuclear policy too: Hollande’s commitment to reduce the French nuclear share by around 20 percentage points, which he made in 2012 to make a coalition with the Greens possible, matches Germany’s decision to reduce its nuclear share from around 20 per cent to zero.

Many in France doubt the feasibility of this nuclear reduction. In a speech last year concluding the national debate Hollande repeated his commitment, but with the less precise deadline of ‘à l’horizon de 2025’. The new energy law that was to have been passed by the end of 2013 is now scheduled to be presented to parliament in spring 2014 and passed by the end of the year. This lack of precision, in addition to the legislative delay, has given the impression that the president is backpedalling on his commitment under pressure from experts and parliamentarians.

The cost curse

Can France reduce its traditional reliance on nuclear power? A first report by the Parliamentary Office for the Evaluation of Scientific and Technological Choices (OPECST), published in December 2011, warned that France would not have been able to weather the shutting down of its 58 reactors (producing more than two-thirds of its electricity) in the same way that Japan, thanks to imported hydrocarbons, survived the closure over several months of its 55 reactors, cutting the country’s electricity generating capacity by no more than a third.

In a 2013 report the OPECST came out against any idea of going to 50 per cent in the next dozen years, saying that this reduction of 20–25 GW would, if not offset by other generating sources, be the equivalent of wiping out one day’s consumption in every week. Instead, the report suggested a gradual reduction, on a ‘trajectoire raisonnée’, of the nuclear power share down to 50 per cent by 2050 and eventually to 30–40 per cent by 2100. This could be done by installing 2 GW of new capacity for every 3 GW withdrawn.[1]

The OPECST’s prescription for a gradual reduction of capacity coupled with progressive modernisation assumes, however, that new nuclear build is still an economic proposition. The problem is: this is no longer clear.

The nuclear “cost curse” has been dramatically underlined by Électricité de France (EdF)’s new European Pressurized Reactor (EPR) of 1,630 Mw at Flamanville in Normandy. This is now expected to cost more than €8bn, two and a half times the original estimate, and to be completed at the end of 2016, four years later than scheduled.

Flamanville looks like becoming the cost benchmark for EPRs, or at least for any early EPRs. This is confirmed by EdF’s 2013 contract to build two 1,600 Mw EPR reactors at Hinkley Point in the UK, for £7bn each (at 2012 prices).[2] Again, these EPRs will be the first of their kind in the UK, indeed the first reactors of any kind to be built in the UK for a quarter of a century. The cost is very high considering what the UK government has agreed to in order to give EdF financial certainty. While EdF and its partners will take the construction risk of sticking to budget and schedule, the UK Treasury is to underwrite the debt they incur for the project of up to 65 per cent of total costs prior to operation. Moreover, EdF will get a guaranteed price of £92.5 per Mwh, almost double the UK wholesale price, under a 35-year contract that will begin from the date of commissioning, expected to be 2023. An important caveat is that this UK state aid requires approval from the European Commission if the deal is to go ahead.

Such overt state aid is apparently what is needed for new nuclear build in a market such as the UK that is considerably more liberalised than the French market. As EdF becomes more exposed to competition, however, at least from foreign if not domestic competition, the UK contract may be an indication of the future extra state support that the French utility will need to build more reactors in France.

Cost inflation in new nuclear build is not confined to France or to French-built reactors, but has been evident for some decades in other industrialised countries such as the US and Germany. According to a UK study,[3] as early as the 1960s construction costs began to increase as regulators ordered design changes which added cost and prolonged construction times. These lengthened further as the result of new safety measures. On average, US nuclear plants took 5 years to build before the 1979 Three Mile Island accident, and 12 years after it.

The degree to which France was part of this cost inflation was surprising. Indeed as François Lévêque, an expert on nuclear economics at the École des Mines, has pointed out, there was every reason to expect French reactor construction costs to fall: ‘The French nuclear programme offered the best possible conditions for powerful learning effects. The power stations were built by a single operator, EdF, which was able to appropriate all the experience accumulated with each new project. The plants were built in a steady stream over a short period of time. In the space of just 13 years, from late 1971 to the end of 1984, work started on construction of the first 55 reactors.’[4]

Yet, as Lévêque points out, there were other factors. France made step changes in capacity – from 900 Mw to 1,300 Mw to 1,450 Mw – which did involve changes in technology. It went to some expense to ‘frenchify’ the basic American design of Westinghouse, and further expense to source components and machinery in France. The move to larger units means fewer units, and therefore shorter production runs in order to ‘learn by doing’. The first reactors of the third generation – the EPRs – were probably bound to have teething problems.

France’s nuclear bill has recently been calculated by the government auditor, the Cour des Comptes.[5] The construction cost of reactors between 1969 and 2004 was, at 2010 prices, €72.9 bn or €83.2 bn with engineering and labour costs added in. Costs have continued to rise, per unit of capacity. While the construction cost per Mw installed was €1.37m (including engineering costs) for Civaux commissioned as late as 2002, the comparable cost for Flamanville will be above €4m per Mw. Another historic cost has been the €55bn (at 2010 prices) spent on research between 1967 and 2010.

EdF has estimated the cost of keeping the existing fleet going for the period of 2011 to 2025 at €55bn. This includes the cost of upgrading safety after Fukushima, as well as that of replacing large components such as steam generators, upgrading fire safety equipment, enlarging fuel storage pools and measures to deal with any recurrence of the extreme heat conditions experienced in the 2003 heatwave, such as the replacement of chiller units. This adds up to €3.6bn in annual maintenance costs, more than double the average annual cost of €1.5bn in the 2008–2010 period which was itself considerably higher than in the early 2000s.

End-of-life cost estimates have also risen. By the end of 2012 EdF had set aside €20.9bn for decommissioning in a fund that is paid for out of current electricity sales. In common with virtually every country except Finland, France has not yet embarked on burying its residual nuclear waste. But the cost of deep geological storage in France was estimated by ANDRA, the agency responsible for dealing with such waste, at €20bn in 2005, and at €35bn in 2010.

France’s options

Useful though it may have been as a democratic exercise, the 2013 national debate managed to come to absolutely no conclusion about the eventual future of the French nuclear fleet. The final official document summing up the debate said: ‘all participants agree on the need – in order to prepare for future decisions – to define a strategy for the evolution of the nuclear fleet [parc nucléaire], whatever the choice of evolution beyond 2025 (renewal, continuation, reduction or phase-out)’.[6]

So what are the choices France is faced with? The first is how and when the existing fleet be should be replaced. This is not a question that France needs, or is inclined, to answer soon. The oldest reactors in the current fleet are not yet 40 years old, and there is every prospect of prolonging their life to 50 or maybe 60 years, as in the USA. But replacement, if and when it comes, will be difficult. Because so many reactors were built in one decade (1978–88), their replacement would need to be almost as rapid. The EPRs may be bigger, but they also take longer to build. EdF has had a plan to build a second EPR at Penly, but this appears to be suspended until Flamanville is completed. The cost of EPRs is, as we have seen, beginning to appear prohibitive.

Nor does EdF appear to be putting anything like enough money aside to provide for one-for-one replacement of today’s reactors. The amount that the company is putting aside for depreciation runs at over €1bn a year (€1.35bn in 2010, according to the Cour des Comptes). But at this rate it would take EdF eight years to pay for another Flamanville out of its own retained earnings. Moreover, EdF would like to lengthen its depreciation schedule so that it can reduce the amount it has to set aside each year. It has already done this once. In 2003 it changed its accounting schedule for depreciation from 30 to 40 years, in anticipation of the decision which the ASN, the nuclear safety authority, made in 2005 to extend, in principle, the life of reactors from 30 to 40 years. In 2015, the ASN is due to make its next 10-yearly review of nuclear safety and possible extension of reactor life-cycles. In anticipation of a further extension, in principle, to 50 or even 60 years, EdF is pressing also to be able to spread depreciation over 50 or even 60 years, so that it has more money available to spend on immediate repairs, maintenance and replacement of components.

So one-for-one replacement of today’s reactors looks most unlikely, at least from today’s perspective. The picture could change if, at the time when a replacement decision would have to be made, energy prices in general, and electricity prices in particular, were much higher than today’s levels.

The second question is if and how France should reduce its nuclear share to 50 per cent. Common sense would indicate that such a reduction would leave France less of a hostage to any future problems in the nuclear sector, and might actually enhance energy security. But closing Fessenheim, the oldest 900 Mw reactor in France, as Hollande has promised to do, will certainly not, by itself, reduce the nuclear share to 50 per cent by 2025.

In theory, the proportion of nuclear generation should automatically decline as the share of renewables grows. France has an EU-agreed target to raise the renewable share of its total energy consumption to 23 per cent by 2020. But the renewable share of electricity, produced and consumed, is still very small. Of electricity production in 2012, hydroelectricity accounted for 11 per cent, but this share has only grown very slowly. All other renewables amounted to another 5 per cent. As one international expert disparagingly puts it, ‘at their present rate of growth, it would take renewables 178 years to replace French nuclear power’.

The nuclear share might also automatically shrink if nuclear power output remained constant, while total electricity consumption expanded. But most forecasts predict flat electricity demand or at best a 1 per cent annual increase. If, contrary to these forecasts, electricity demand were to fall, then the nuclear share could actually increase.

Marriage of nuclear and renewables

In any case, France seems to have little choice but to pursue some sort of marriage between nuclear and renewables, however difficult that may appear to be. If, in designing a country’s ideal electricity mix, one had to choose an ideal source of back-up electricity for intermittent renewables, you would not choose nuclear power. The simplest and most economical way to run nuclear reactors is at stable levels close to full capacity to provide baseload electricity.

But France is where it is as a result of a big nuclear programme, conceived long before climate change was deemed a problem or renewables a solution. The country is therefore fated to try to integrate nuclear and renewable power.

An extensive study by the Nuclear Energy Agency of the Organisation for Economic Cooperation and Development (OECD) shows that today’s nuclear power plants will suffer less than gas or coal plants by integrating them with renewables.[7] This is because existing nuclear plants, especially those which have fully amortised their capital costs, will find it easier to cover their relatively low variable costs (chiefly fuel) despite lower revenue from electricity sales.

However, justifying the huge initial outlay of capital involved in the building of new reactors is a very different matter. As the study points out, ‘in the long run, high-fixed cost technologies will be affected disproportionately by the increased difficulties in financing further investments in volatile low-price environments’.

France is Europe’s top electricity exporter, with net exports of 44 Twh of power in 2012 or 15 per cent of its national consumption. It runs a steady electricity trade surplus with all its neighbours, except for Germany which in 2012 was the source of half of France’s total imports of electricity. But France has a problem, born out of its success in electrifying its heating system more than any other country in Europe except for Norway. The result is that one degree drop in temperature creates an extra 2.3 Gw load on the French system. This sensitivity to temperature change is such that France accounts for nearly half of the entire temperature sensitivity of power demand in the whole of the EU, amounting to 5 Gw extra load across the EU for every one degree drop in temperature.

The normal load in France is around 80 Gw, but the record was 102 Gw in the very cold spell of February 2012. For about 10 days in that month, France had to draw on imports from virtually all its neighbours – the UK, Belgium and Spain, as well as Germany. ‘These peaks seem to keep increasing’, according to Yannick Jacquemart of the Réseau de Transport Electrique (RTE), the French grid operator.[8] Annual peaks in load have increased by 33 per cent over the decade up to 2012, while total consumption has only risen by 15 per cent. After 2015, EU legislation will force the closure of heavy fuel and coal plants, and as a result, in 2016–17, the reserve margins of supply over demand will be very low. Furthermore, any further electrification of the economy, in heating or transport, will tend to augment peak demand.

For the moment, France is relying on a combination of imports, expensive combustion turbines and demand-side measures to cover the peaks during cold winter evenings for an average of about 200 hours a year. In 2014, however, it plans to set up a capacity market, operating on both the supply and demand side, which would take effect in 2016. The essence of the system is to place the responsibility on each and every supplier to balance supply and demand. It is, therefore, according to Fabien Roques of Compass Lexecon, a specialist on capacity markets,[9] ‘a decentralised approach which puts the cost of balancing precisely on those causing imbalances’.

He contrasts this with the UK plan for a more centralised capacity market which ‘will tend to socialise the cost of security across all market participants’. He concedes that ‘the decentralised approach may provide the authorities with less overall visibility of the capacity market, but making each supplier responsible for balancing is more compatible with current trading arrangements’. This French capacity plan has been welcomed by the country’s trading partners, Germany in particular, and by the European Commission.

Prices, competitiveness and efficiency

Any premature closure of reactors or refusal to prolong their life cycle to 50–60 years would almost certainly lead to an increase in electricity prices, much to the concern of French industry. Thanks to nuclear power, France has relatively low electricity prices. These have made it hard for competitors to enter the French market, and they have also acted as a brake on further improvements to energy efficiency. By virtue of owning all nuclear reactors in France, EdF has been able to dominate the French electricity market long after EU liberalisation policies swept aside its legal monopoly.

The true cost of French nuclear power is not easy to calculate, because it depends on assumptions about discount rates and about the amortisation schedule of the capital costs of the country’s 58 reactors. But EU action has shed some light on nuclear power costs. As a result of pressure from the European Commission to enable some competition in the French market, France passed a law in 2010 establishing the ARENH system. This requires EdF to sell 100 Twh of electricity, or around a quarter of its nuclear output, each year to rival suppliers at a price reflecting the historic investment and current operating cost of its 58 reactors, plus a ‘normal margin’. The price of this ARENH power is currently Euros 42 per Mwh, which for example is below the average spot price in France of Euros 47 per Mwh in 2012. (If the ARENH price were to also reflect the costs of a future generation of reactors, which it is not allowed to do, it would be considerably higher).

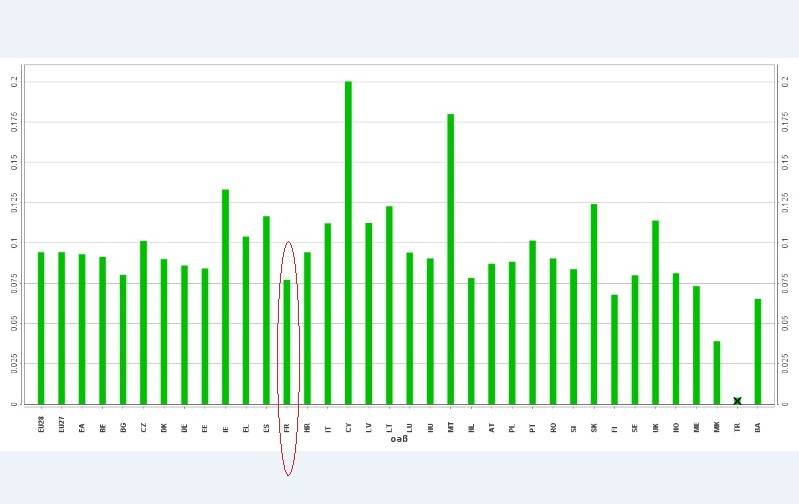

Electricity prices (excluding tax) for industrial consumers (euros per Kwh) Jan–June 2013 (Source: Eurostat)

Note: This table charts the average national prices, excluding taxes, charged to final consumers during the first half of 2013 for medium size industrial companies with an annual consumption of between 500 and 2,000 Mwh. It shows that the average price in France (circled in red), at €0.0771 per Kwh as being nearly the lowest in the EU, thanks largely to France’s past investment in nuclear power. This French price is only slightly lower than the German price, but the competitive concern of French industry is that, while French and German medium size companies pay more or less the same price, electricity-intensive companies in Germany pay a very small proportion of the German renewable energy levy and are exempt from grid access charges. So they end up paying less for their power than their French counterparts.

Source: Eurostat

Conclusion

The nuclear debate in France has been useful in that it has shaken the widespread complacency that France accomplished the necessary transition to carbon-free electricity long ago, and that any further transition should just be more of the same – extending electricity further into the transport and heat sectors.

France faces no urgent decision about the fate of its relatively young reactors. Prolonging the lives of most of these reactors to 50 years or some even to 60 years is the most sensible course of action. Replacement of these reactors is still a distant issue. But the huge cost that is now apparent for the new EPR reactors does make it a big issue, and a bigger one for France than for its customers in Finland and the UK. For these countries are only contemplating buying a few EPRs, France would need several dozen to replace its current generation of reactors one-for-one.

So what needs to be done to reduce the scale of this future transition? First, the government should do what it can to prevent the nuclear share of generation rising further and thus magnifying the challenge of diversifying away from nuclear.

Second, prolongation of the lifetime of current reactors will have some accounting consequences for EdF that will free up extra money that EdF could return to its majority owner, the French state. The government could in turn use this extra money to give French renewables a needed boost. As we have seen, the marriage of nuclear and renewable power is not impossible. France has little to fear from a more ambitious approach to renewables.

Third, French electricity prices need to rise, in order to reflect the future cost of replacing at least some of today’s reactors, to give renewables more of an economic chance in the French market, and to encourage energy efficiency.

Finally, it will be important to spread out over time the future replacement of reactors. It might appear economically rational to try to extend the life of all current reactors to 60 years. This is what EdF is pushing for, in principle. In practice, however, it would make no sense. Having the majority of its reactors that were built over a concentrated 15-year period in the past all come to the end of their life in a 15-year period in the 2030s and the 2040s would present France with an impossible reconstruction challenge. France will not, in the future, be able to rebuild all that it built in 15 years in the past. Better to retire some of today’s reactors at 50 years or less, and so stretch out the task of replacement.

David Buchan is a former journalist with the Economist and the Financial Times. He has been with the OIES since 2007, specialising in European Union energy and climate policy. He is currently researching the subject of energy costs and competitiveness as the key issue that is driving Europe’s energy and climate policies apart.

This is a shortened version of a paper originally published by the Oxford Institute for Energy Studies on 6 January 2014. Reproduced with permission