Leading investment bank Citigroup says Australian utilities will be impacted by the ‘energy Darwinism” that is currently sweeping the global electricity industries. And despite the opportunities that the transformation offers, incumbency is not likely to be an advantage and Australian utilities have a high risk that they will come off second best.

The 72-page report, lead authored by Elaine Prior, says change is already underway with grid-scale plant in Australia losing volume to roof-top solar, and the operations of gas and coal-fired generators being wound back.

She notes there are numerous factors playing to the major changes taking place in the industry. But the most important of these will be the extent and speed of technology development and cost reductions for solar, battery or other storage solutions, and other distributed generation / smart / renewable technologies and solutions.

“If costs fall to the extent that these technologies can be competitive, even if network charges are restructured to make renewables more expensive and regulatory support is limited, then the fundamental driver exists for increased adoption,” Prior writes.

“Technology and new product development appears to be progressing rapidly around the world, and may drive substantial change in Australia sooner than many anticipate.

Prior notes that storage options and large scale solar are now being trialed, innovation is increasing in the retail space, and new entrants and new products are challenging the incumbents, who are not commanding strong public trust.

“Big Data will help to create a new and competitive market of services for utilities, where customer service and brand name are key,” it notes. “These are attributes where traditional utilities may lag.”

The Australian analysis suggests that despite the opportunities offered to utiilties, these are outweighed by the risks because many of the opportunities have lower barriers to entry, meaning more new players. “Competition will be stronger and incumbency may be less of an advantage,” the report notes.

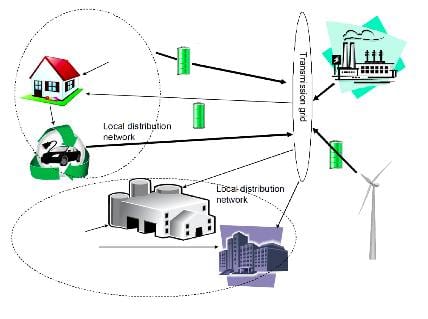

The analysis notes the “Energy Darwinism” report that Citi prepared last year and looked at global trends, as well as the CSIRO Future Grid report released late last year that predicted rapid change in the way the electricity market is structured

Prior sees the key risks to incumbents in Australia include lower demand, the potential for customers to leave the grid, and potential asset writedowns.

Prior sees the key risks to incumbents in Australia include lower demand, the potential for customers to leave the grid, and potential asset writedowns.

“In Australia, we see increasing risks to incumbents including: lower grid volumes affecting generators and networks; reduced utilization and closure of gas plant due to higher gas prices, lower carbon prices and higher solar penetration; and the potential for revised pricing and lower cost storage to encourage households to reduce demand at high priced times of day or to leave the grid.

“Network writedowns are possible, with no indication of whether these might be partly borne by private network operators. Electric vehicles might offset demand shrinkage, but logically would seek low-carbon power. Their batteries might alleviate peak demand pressures, but could reduce revenues from time-of-use pricing and enhance the viability of rooftop solar.”

However, in our view, the most critical determinant of the medium term trajectory will be the extent and speed of technology development and cost reductions for solar, battery or other storage solutions, and other distributed generation / smart / renewable technologies and solutions. If costs fall to the extent that these technologies can be competitive, even if network charges are restructured to make renewables more expensive and regulatory support is limited, then the fundamental driver exists for increased adoption. Technology and new product development appears to be progressing rapidly around the world, and may drive substantial change in Australia sooner than many anticipate.

It notes that the list of opportunities include smart meters, distributed generation, EVs, large scale renewables and energy efficiency.

“Opportunities abound,” Prior writes. “For example: smart meters, smart appliances, communications technology for remote control; distributed generation, including solar; large scale renewables; battery or other storage, both household and grid scale; electric vehicles and support infrastructure; energy efficiency and demand management initiatives.

“However, in some of these areas there will be low barriers to entry, or new players will have expertise, so incumbent utilities may face substantial competition as they navigate new directions. “

To what extent the utilities took up these opportunities depended on the initiative of individual companies.

“We sense that some of the more vociferous industry incumbents would like to see growth of solar and other distributed generation discouraged,” Prior notes, “because it could reduce demand from existing generation plant (most likely higher cost intermediate-load plant), and reduce volumes through network assets. If storage gains traction, baseload could also be threatened.”

She cites two examples, the push by the Electricity Supply Association for higher network charges, and the suggestion from Origin Energy CEO Grant King that the Renewable Energy Target (RET) could be pushed out.

She says this indicate that both organisations may see potential threats to their existing businesses. smart appliances, communications technology for remote control / and demand management.” Indeed, it is borne out by the recent submissions of a range of generators and network operators – both private and publicly owned – that are calling for the RET to be removed.