Today’s Graph of the Day focuses on the building sector, and the high emissions that come from old and inefficient buildings. According to the City of Melbourne, some 53 per cent of its emissions comes from “sick” and inefficient office buildings.

Upgrading the huge stock of old and inefficient buildings is seen as one of the biggest global challenges. The City of Melbourne was the first in Australia to offer Environmental Upgrade Agreements (EUAs), which allows investments to be repaid through rates agreements.

Today’s Graph of the Day is prompted by today’s announcement that bankmecu, Australia’s first customer-owned bank, will provide finance for up to 20 years to companies signing EUAs. Most financiers to date have offered only 10-year terms.

Scott Bocskay, the CEO of the Sustainable Melbourne Fund, said the deal should help create a more energy efficient and healthier city. “With a price on carbon, soaring energy prices and growth in the sustainable investment market, the economic and environmental fundamentals are all in alignment – now is the time to fix poor performing buildings,” he said.

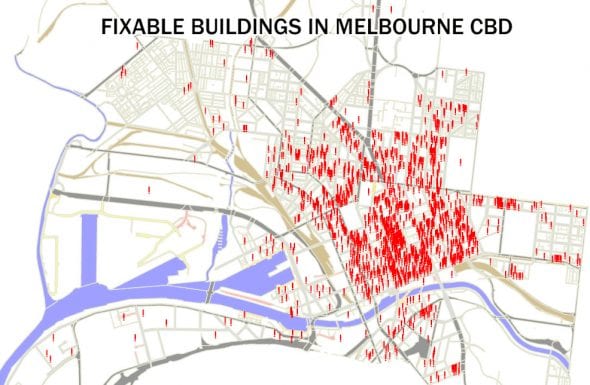

The first graph illustrates the number of buildings in the Melbourne CBD that are considered suitable for upgrades. Melbourne was the first Australian city to establish the EUA model in 2011. Four New South Wales councils now also offer EUAs: Sydney, Lake Macquarie, North Sydney and Parramatta.

EUAs are often used to upgrade poor performing water and energy systems. “Melbourne’s workers perform better in clean, safe working environments. Tenants need dramatically lower energy bills. Property owners want a better building at lower cost.”

The graph below illustrates those benefits. It’s a win, win, win,” said Bocskay.