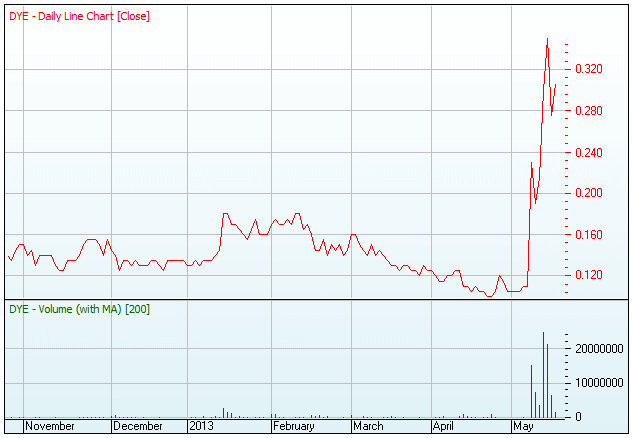

A week can be a long time in the world of clean technology stocks, and so was this past seven days for ASX-listed dye solar cell maker Dyesol. Described in its $2 million Share Purchase Plan this week as “an emerging company in an industry that has gone through enormous turmoil,” Dyesol shares rocketed by 12 cents – or 109 per cent – to 23 cents a share last week after the company announced a ‘game changing’ technical breakthrough: the achievement of a solid-state Dye Solar Cell (DSC) efficiency of 11.3 per cent at full sun – up from 5 per cent in 2010.

In its announcement last Wednesday, Dyesol called the news “a quantum leap,” not least of all because it would make its DSC technology grid competitive – an achievement the company describes as “the ‘holy grail’ for renewable energy technologies.” Dyesol’s shares continued their climb this week, jumping more than 39% on Monday, to close at 30 cents, and then another 23 per cent on Tuesday – the day the Share Purchase Plan was released – to 37 cents. At time of writing, however, the price was back hovering around the 31 cent mark.

This is good news for the company and its investors – not least of all Saudi Arabia’s state-owned Tasnee, which invested $4 million as part of an R&D partnership announced in late February, and has the option to invest up to $20 million more at 18c a share. As the company said this week, it looks like it “has weathered the storm well and looks well positioned to carry its 3rd Generation technology towards successful commercialisation.” But any excitement should, perhaps, be measured against the below chart, which reminds us that Dyesol shares once traded at $1.85 in 2007. As the company’s management has itself advised, “shareholders should remain patient knowing that a vigilant Dyesol has survived, where larger and better-funded companies have failed.”