So, here’s the problem. If you’ve ever wondered exactly why the global coal industry has argued so vehemently – first against the science of climate change and secondly against doing anything about it – the International Energy Agency lays it all out in its latest World Energy Outlook.

Basically, the WEO data suggests, there are a trillion reasons for the global coal lobby to resist change. That’s one trillion dollars each and every year – the loss in annual revenue for the coal industry if the world takes serious action to prevent global warming, rather than just continuing on in business-as-usual.

The WEO is considered to be the annual reference point for the global energy industry, and has been since the IEA was first created in the 1970s in response to the global oil crisis. In the last few years, however, the conservative agency has expressed growing alarm about how the world’s energy policies are hurtling the world toward’s catastrophic climate change.

It repeats its warning in the latest outlook, released overnight, saying that even under the “new policies” scenario – where the world responds to the “politics” of climate change, but not the science – the world is heading towards a scenario that locks in average global warming of 3.6C – a level that scientists say would be disastrous. The IEA estimates that in this scenario there is only a 6 per cent chance of keeping temperature rises to an average 2C (the level at which scientists say offer an even bet at limiting the impact of climate change).

Under the “new policies” scenario, the IEA says gas has a “very bright” outlook for the gas industry, particularly countries like Australia, the US and China, which have a lot of it to exploit, although the game plan relies on carbon capture being a serious and cost effective option by the mid 2020s. The future of the coal industry is also bright in this scenario, with its use predicted to rise by 21 per cent by 2035.

But, warns the IEA, the coal industry – and the funds management industry and the banks that finance it – are carrying on as if it’s business as usual, making decisions about hundreds of billions of dollars of investment as if nothing would change, and not even lip service was paid to the climate change problem.

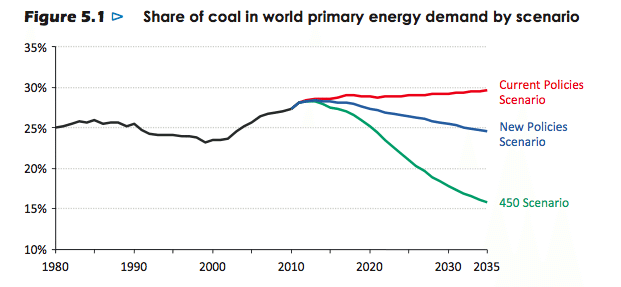

Under the IEA “current policies” scenario – essentially business-as-usual that locks the world into average temperature rises of 6C – coal demand grows by 1.9 per cent per year out to 2035, and coal actually dethrones oil as the leading primary fuel around 2025, settling in at a share of just under 30% of the global energy market by 2035.

“This prospect is the basis on which some industry players are considering their investment plans,” the IEA laments.

Yet, it warns, in its “450 Scenario”, where the world actually does take action and acts accordingly, and which the IEA recommends as the sensible course of action, the coal industry collapses – its shares of the global primary energy mix (which includes all forms of enegy), tumbling to just 16 per cent by 2035, by which time it is overtaken by renewables and gas.

Here’s an interesting table that outlines exactly how the growth profile of the coal industry changes under the different scenarios …

And here (below) is how it translates into financial impact on the coal industry …. note that this is not the coal generators, but demand from coal miners – the Gina Rineharts, Clive Palmers, Nathan Tinklers, and BHP Billitons and Rio Tintos of the world. Note the difference between the current policies, which the IEA says the industry is planning for, and the 450 scenario, where the IEA says we should be aiming. By 2035, it’s a difference of 4.5 billion tonnes of coal a year, three quarters of the lost volume coming from thermal coal for energy.

That translates into $500 billion a year in lost revenues, if you take the IEA thermal coal price forecasts of $110/tonne under its New Policies scenario as the benchmark. But the impact on the coal industry is effectively doubled, because under the current policy scenario under which much of the industry is making its investment, coal prices would be “significantly” higher, the IEA says, because of increased demand.

Under the 450 scenario, coal prices slump in the opposite direction, as rigorous climate policies “lead to a collapse in demand.” That means that the impact on coal mining revenues between the current and the 450 policies is closer to $1 trillion a year.

This situation might be laughable if it were not so serious, and reports such as the IEA will add credence and gravitas to the warnings of the “carbon bubble” that is awaiting the world’s investment community. The good news is that some financiers are starting to wake up to this, even if the miners are not. The IEA notes that financing for some coal projects is becoming more difficult to obtain.

The IEA repeated its own warnings of last year that the world has just about used up its carbon budget, and its energy and infrastructure investments will have exhausted all allowable emissions by 2017 – which means that any new investment has to be met by an asset sacrifice elsewhere if that budget is adhered to.

IEA executive director Maria van der Hoeven said that serious attention to energy efficiency measures could buy the world an extra five years, but these actions would have to be rapid.

The IEA describes energy efficiency as the “hidden fuel”. “You can’t sell it, you can’t buy it or put it in your tank,” van der Hoeven told a press briefing in London. “Efficiency in energy use is just as important to our energy future as unconstrained energy supply.”

She said this five-year period could be valuable if offering the world time to secure a global agreement by 2022 – the current climate change negotiations about to resume in Doha call for an agreement by 2015, with policies to be put into place by 2020. The energy efficiency measures would cost nearly $12 trillion, but would save around $18 trillion in fuel costs. Mostly, you guessed it, from coal. Rinehart and Palmer and their fellow travelers better start digging.