The Queensland Labor government has ruled out a repeat of its intervention in the power market, despite the state now boasting the most expensive grid in the country and electricity prices soaring to unprecedented levels.

Queensland’s wholesale power prices have average a record $350/MWh in the month of May, and in months before that have been been the most expensive in the country, almost double that of states such as South Australia and Victoria that enjoy more renewables.

The reason is simple: Queensland is more dependent on coal power than any other state, and its grid is being hit by the surging cost of coal and unreliable generators. And the market sees little relief in the future because of its dependence on fossil fuels.

In the past three weeks, Queensland’s “baseload” futures for fiscal year 2023 have leaped from $151/MWh to $227/MWh. This time last year that contract was at $44/MWh, analysts say.

Traders and retailers say the market is broken, and have been urging the state to repeat its successful intervention in the market in 2017, when the Palaszczuk government directed state owned generators such as Stanwell and CS Energy to change their bidding practices.

See: Queensland drops bidding directions, says wind and solar less than $50/MWh

The directive was dropped in 2019, around the time that the newly created CleanCo started operation.

But now the state has the most expensive power, prompting many in the market to call for a repeat. Queensland is the only mainland state in the National Electricity Market where the networks and generators are state owned, and it is more dependent on coal than any other state.

“It seriously calmed the market last time,” said one energy retailing executive of the bidding directions. “I don’t understand why they are not repeating it.”

Adrian Merrick, the CEO of Energy Locals, says the state government has the ability “to be heroes” to alleviate the cost of living pinch, and not just for the state itself.

“We firmly believe that if the Queensland government were to force generators to run as required and bid fairly, there would be quick and positive impacts on the NSW wholesale market, followed by the Victorian one,” he said.

“No other State government has the level of control over the wholesale power market that Queensland. It would a shame if they waste this opportunity to make a rapid, positive impact to customers in homes and businesses in both Queensland and beyond.”

The issue about “run as required” is an important one.

Queensland has been hit by planned and unplanned coal outages, but the cost of coal generation has soared, and generators are more interested in playing with financial instruments, known as caps and swaps, than actually generating power. Which is one of the many complex reasons for the prices to be so high.

Will the government act? No.

“The department continues to put downward pressure on electricity prices,” a spokesperson said in response to a query from RenewEconomy.

“Last week it was announced that Queenslanders will receive a $175 cost of living rebate to take into account rising wholesale electricity prices driven by a combination of global factors, including rising gas prices driven by Russia’s war against Ukraine.

“Looking forward, increasing supply from generators returning from maintenance, the upgraded Queensland-NSW Interconnector coming online, as well as a pipeline of new generation and battery investments will help ease peak pricing.”

The problem is that the state’s energy regulator today announced retail price hikes of nearly 10 per cent, which will swallow up most, if not all, of the cost of living rebate, and big consumers won’t be protected, and will pass on the increased costs down the line.

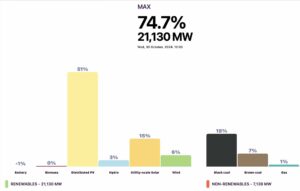

Queensland has a renewable energy target of 50 per cent by 2030, which it announced five years ago, but it still has the lowest renewables share in the country of less than 20 per cent, and many question if it will reach that target.

The department spokesman says the government is working on a new “energy plan” to consider the longer term needs of the energy system to meet the renewable energy target and continue to put downward pressure on wholesale electricity prices. The Plan is due for release later this year.

Note: This story has been updated to make clear that CleanCo was not subject to the 2017 bidding directive as it had not yet begun operations.