Coming events may cast their shadows before them, but when it comes to hydrogen, and now ammonia, the future remains difficult to predict. And there are a lot of red herrings.

There is enough political support from Japan and Australia to get an export hydrogen industry started in Australia, but projects such as those in Gladstone in Queensland won’t be fully or even largely green at the outset.

There is little or no possibility of a difference-making domestic market in the foreseeable future. The first market for the ammonia will probably be to replace some coal in coal generation.

The hope is that developing supply first and using it for coal replacement will allow enough time for the demand technology, eg ammonia fuelled turbines and hydrogen for steel, to prove its technical and ultimately commercial viability.

Green ammonia is much cheaper to transport than hydrogen and per gigajoule costs only about 10% more to manufacture.

Many countries/regions in the world, including in Asia, will be able to manufacture their own hydrogen or ammonia at broadly comparable costs to Australia. That said, some Australia regions such as Gladstone and north west WA have enough wind and solar which may achieve a 60-70% electrolyser capacity factor if built at sufficient scale.

Essentially, the intermittency of wind and solar adds probably 50% to the cost of green ammonia or hydrogen at many locations – but not the best ones due to lower capacity utilization at the electrolyser.

This can be overcome by oversizing the electrolyser and storing excess hydrogen but at a cost. So a combined wind and solar portfolio is your best bet, unless you have access to cheap hydro.

Felicity Underhill from Origin Energy made the excellent point that given hydrogen comes in many colours, and a certification scheme is essential.

If you want green hydrogen it needs to be certified as such. That’s something the Federal Government could immediately assist with. (The Smart Energy Council has been working on such a scheme).

Australia enjoys a strong trading relationship with Japan that may be enough to support an export industry against competing and even Japanese locations.

I remain strongly of the view that offshore wind can be a major energy source in Japan.

Even by 2030, and assuming the large scale ammonia fuelled power turbines exist with ammonia at US$20/gj means that electricity is around US$200MWh give or take.

You still won’t be building a competitive energy intensive economy on those numbers and by 2030 there is every chance that offshore wind in Japan will be around say US$60/MWh.

Any economist would make the point that rather than the Japanese and Australian Government’s using their cronies to pick technology winners, putting a carbon price in place as Europe has done is clearly and obviously superior policy.

By all means give green hydrogen and green ammonia a helping hand but equally a carbon price would make green hydrogen a market based choice that much earlier.

Origin and Stanwell are in two separate hydrogen consortia

I was fortunate enough to attend a recent Quest Hydrogen conference and listen to both Origin’s Felicity Underhill and Stanwell’s Steve Quilter present on two separate but equally sized hydrogen production for export proposals.

Both consortia aim to develop and initial 36 ktp hydrogen production plant, both want to triple size a couple of years later, both consortia aim to do the production in the Gladstone region.

In addition, the strategy of both seems similar. The idea is to team up with an energy importing Asian partner, Kawasaki in Japan for Origin and Iwatani in Japan for Stanwell.

Queensland has long established and strong coal and gas trading relationships with both countries.

Both the buying and the producing country will subsidise the business. That’s not a given but it’s the impression I was left with.

Both projects are based around the export market because, in the near term, there is unlikely to be a domestic green hydrogen market.

And the only reason there is an international one is because of the decarbonization policies of some Asian countries. I guess that Japan, and South Korea for that matter, can bury marginal amounts of very high price energy without materially altering the average cost of energy to their customers.

In both cases the consortia members seem to believe that the potential market is big enough to cover the risk. A number of different rationalisations were offered including an analogy that hydrogen is to renewable energy as aluminium is to coal.

In my opinion, Underhill went a bit overboard talking about hydrogen refuelling being set up for cars in Australia.

That may be the case but anyone who thinks hydrogen is going to outcompete batteries in the light vehicle market hasn’t looked out the window much and needs to revisit both the physics and economics spread sheets.

And I say this to note how much nonsense there still is in the longer term outlook for hydrogen. VW has recently joined a list of global car manufacturers to specifically state there is no case for hydrogen in cars.

“You won’t see any hydrogen usage in cars,” said Volkswagen chief executive Herbert Diess, speaking to the Financial Times last week, adding that the idea of a big market for hydrogen fuel cell vehicles is “very optimistic.”

It’s well accepted that if you start with 100 watts of renewable energy about 80 watts ends up as usable battery power in an electric car, but only about 38 watts in a hydrogen car. See this article in the Conversation but that’s only the start of hydrogens problems in cars.

Hydrogen refuelling stations also have many issues. You can read the discussion here but a quote that illustrates part of the discussion

“A mid-size filling station on any major freeway easily sells 26 tons of gasoline each day. This fuel can be delivered by one 40-ton gasoline truck.

Because of a potentially superior tank-to-wheel efficiency of fuel cell vehicles, we assume that hydrogen-fuelled vehicles need only 70% of the energy consumed by gasoline or Diesel vehicles to travel the same distance.

Still, it would take 15 trucks to deliver compressed hydrogen (200 bar) energy to the station for the same daily amount of transport services, i.e. to provide fuel for the same number of passenger or cargo miles per day”.

In our view it’s clear that the role for hydrogen in a decarbonized economy is for industrial heat, potentially steel and cement making, and potentially to have some role in power generation.

Finally there seems to be a potential role for ammonia as a long distance shipping fuel despite the weight and NOX penalties compared to pure hydrogen.

Asia, particularly Japan, has bet on hydrogen

It’s now clear the hydrogen investment in Australia is inevitable. There is going to be significant investment and sooner rather than later.

All problems relating to economics, technical issues, transport are going to more or less be assumed away by the buyer and the seller and passed on to their respective Goverments.

Buyers will offer long term contracts for the plant output. Asian importers, Japan and South Korea are first in line.

The subsided price under those contracts, let’s guess A$4.50/KG (A$27/GJ), still won’t be quite high enough to give a return to the producers so the Australian and Queensland taxpayer will come to the rescue.

The hydrogen will initially be introduced into the domestic gas infrastructure and potentially even into some coal generation plants. This, to be clear, is a complete dead end.

There is no suggestion, as yet, that ammonia or hydrogen can completely replace coal for boiler heating, and for domestic gas there is a clear limit to the amount of hydrogen that can be introduced without causing embrittlement, never mind the cost issues.

However, using hydrogen and or ammonia in this way will enable the hydrogen manufacturing to get started and also allow the Japanese Government to say its reducing emissions.

If you are an optimist you hope or believe that once the initial hydrogen work is proved up new markets will also appear.

Specifically, for instance, purpose built ammonia burning turbines from the likes of Mitsubishi.

At the same time on the production side of thing electrolysers and process development will move down the cost curve.

However, as we will come to, the issue in green hydrogen production is more than just the cost of the renewable energy or the cost of the electrolyser, it’s also about the capacity utilization of the electrolyser.

Stanwell’s proposed 10 MW electrolyser

Ever since, and probably long before, the advent of Amazon, making a profit, or even creating a positive operating cash flow, has become less relevant. These days it’s all about how big and how good the business will be in 10 or 20 years.

Platform businesses, the successful ones, have shown that over and over.

Nevertheless.

We can start with the costs publicly presented in Stanwell’s pre feasibility study for a 10 MW/ 1632 Tonnes per year system as outlined in November 2020.

The two things about the capital costs that immediately catch the eye are the size of the contingency allowance, reflecting the uncertainty of new technology, and even excluding the contingency, the fact that the electrolyser is well under half the total capital cost.

If we assume it was just $60 million, recovering the capital costs over 20 years would require about $1.8/kg, and then something like another $2.5/kg for the electricity costs. And as it’s grid delivered electricity in Qld it’s only a little bit green.

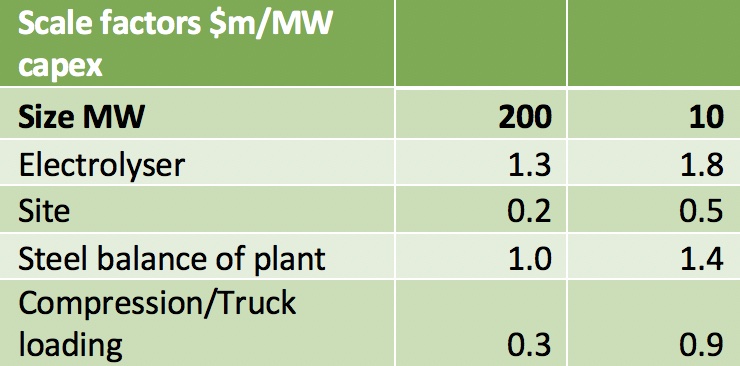

There clearly are lower capital costs in using a 200 MW electrolyser, but how much lower?

Purely for my own amusement, and with no pretense at accuracy, I adopted the following:

Figure 3 Source ITK

And then we can use those factors to look at two plants. The first requires a 500 MW electrolyser because it’s assumed to run only on wind, there is no hydrogen buffering and no spilled wind. It’s certain that a real plant would do better on this as discussed below.

The second one is based on using grid electricity and hence has a capacity factor of well over 90%.

The green project also requires a $900 million wind farm. I have no clue about the non power opex but I’ve used $0.4 /kg. If we assume a grid electricity price of A$40/MWh then I get the following table:

The number are just analyst estimates based on even less information than usual. In the end hydrogen investment is highly speculative. It hasn’t been done yet.

Personally, if I was a fund manager looking at Origin it would be exciting, but I might decide to wait until I was sure it worked, was on time and on budget before putting my investment dollars in.

On time, working and on budget have not historically always been the adjectives used to describe Origin’s projects.

Let’s turn to ammonia.

Ammonia may be the best way to export hydrogen

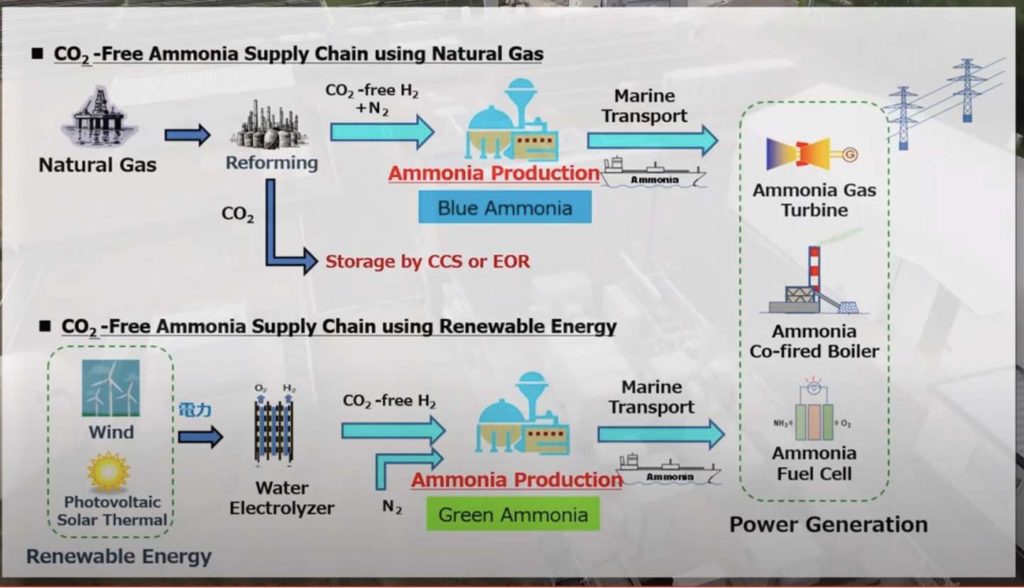

Transport and distribution of hydrogen has long been seen as a major problem. However, it turns out that at least for power generation ammonia may be an alternative.

One plan is to manufacture ammonia rather than hydrogen and then use the ammonia to be injected directly into coal burners, and potentially having ammonia fuelled “gas” turbines.

Ammonia’s great advantage over pure hydrogen is its much, much lower transport cost. Still there are added manufacturing costs and, as the video and referenced article below discuss, you have to manage Nitrous Oxide [NOX] production

A discussion of the progress in Japan for using Ammonia to replace at least 20% of the coal in a coal generator can be found here (ammonia energy org) and there is a 2018 youtube video worth watching from which I have extracted the following image.

Jera to use 20% ammonia firing at two 1000 MW units of Hekinan power plant

This trial is expected to run for 3-4 years, and if successful to be implemented commercially requiring 0.5-1 mt per year of ammonia (ie a plant 10x-20x larger than the hydrogen plants proposed by Stanwell and Origin at Gladstone).

Later, it is said that up to 40% ammonia might be possible at existing coal power plants. The process “simply” requires replacing some of the burners previously producing heat from burning pulverized coal with burners producing the heat from ammonia combustion.

The heat is used to produce steam through the existing steam turbine. From the coal generator’s point of view the great advantage is the very low capital cost.

But it still at best only reduces coal and carbon emissions in the plant by 40% and it has to be shown, at that scale, that all the NOx emissions can be captured.

Initially, the ammonia will be carbon intensive and then if everyone can agree it could shift to green ammonia.

So just in that one power station is 0.5 m tonnes of green ammonia demand if the Japanese Government wants it to happen.

Mistsubishi developing 100% Ammonia capable gas turbine

Beyond using ammonia to reduce carbon emissions in existing coal plants by say 40% at best, the hope is that ammonia can be used to fuel gas turbines, the equivalent of today’s open cycle gas plants. Mitsubishi is working on such a project.

The 40 MW (still very small by modern open cycle gas turbine standards) is expected to be available around 2025. One idea is/was to develop a turbine that “thermally cracks” ammonia into hydrogen and nitrogen and then combusts the hydrogen.

The thermal cracking might use the waste heat from the turbine, kind of like a combined cycle gas plant uses lower heat exhausted from the turbine to make steam.

According to reports in “powermag” there are still some issues. EG the “combustor” has to be “much” larger because of low combustion speed. And actually the multistage method may be too hard. Here’s a recent news quote:

“Mitsubishi Power has explored lowering the NOx via two-stage combustion, but it said larger gas turbines posed “many technical problems, such as upsizing and complication of the combustor.”

“Development of the 40-MW ammonia-capable gas turbine announced this week, however, suggests Mitsubishi Power is rethinking the multistage ammonia-cracking approach to explore “a method for directly combusting ammonia.”

To address NOx production, which is prompted by oxidation of ammonia’s nitrogen component through its combustion, the company’s commercialized gas turbine system will combine selective catalytic reduction (SCR) with “a newly developed combustor that reduces NOx emissions,” it said”. Source: www.powermag.com

Green ammonia might be US$450/t by 2030

The cost of ammonia is mainly the cost of the renewable energy used to power the electrolyser and the capital cost of the electrolyser itself. Also the electrolyser presently uses “noble metals” such as palladium for catalysts.

It maybe they can be replaced with cheaper catalysts but at a production efficiency cost.

A good study of the costs fully green ammonia which the authors refer to as “islanded green ammonia” was published in the “Energy & Environmental Science” in July 2020. “Techno economic viability of islanded green ammonia” Nayak-Luke and Banares – Alcantara

Islanded means there is no grid supplied power it all comes from wind and solar. The authors studied 534 locations in 70 countries.

The authors minimize the intermittency issue by oversizing the electrolysers and using the surplus hydrogen produced as a buffer and by spilling some wind and or solar.

They find that Cape Grim Australia has the lowest potential cost using 2019 data and by 2030 the 10% best producers might have costs around US350/t

I highly recommend reading the Nayak-Luke article if you are interested in the topic. As well as the results the methodology and the use of a “genetic” algorithm to find the best locations are of great interest.

I reproduce their figure 5 to give an idea of the numbers. The yellow dots are Australia, for readers with good eyes.

The study does not consider locates like say Tasmania or Norway where hydro could make the entire grid green and therefore 100% electrolyser capacity utilization is possible using grid power.

A point to be made is that there are a number of locations in Asia that will be just about as competitive as anything in Australia.

So many numbers, but it comes down to the cost of energy in $/gj

Based on my reading ITK’s projection of 2030 fuel costs at the point of production are:

The figure is taken from the following table.

The ammonia numbers and the hydrogen numbers essentially assume the best locations globally for production. Average costs will be higher.