Origin Energy, Australia’s largest utility, has reported a sharp slump in earnings from its core energy markets business – putting the blame mostly on Australia’s warmest ever winter, and the growing impact of rooftop solar PV.

Origin Energy’s half yearly accounts show that its underlying earnings from the energy division fell by a massive 23 per cent to $505 million. It blames lower sales volumes (electricity demand was down 12 per cent in its core mass market) on the warm winter, high solar PV usage, and the impact of more energy-efficient appliances and prior customer losses.

Origin’s energy results are an interesting insight into the state of the Australian electricity market, because it highlights the major trends – growing impact of solar PV and the “pro-sumer” market, more energy efficient prices, and the rising cost of gas.

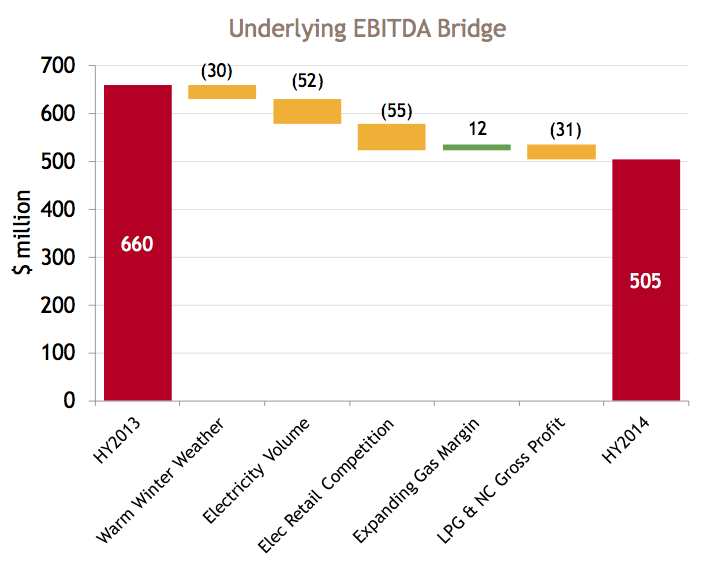

The company quantifies the impacts with this graph below. The warm winter is pinged for $30 million of losses, lower volumes to solar PV and energy efficiency is $52 million, the impact of prior discounts is $55 million. Gas margins is the only bright spot for the company, and caused a small rise in earnings.

Ironically, Origin Energy’s earnings were also clipped by $13 million because of lower sales of rooftop solar PV systems following further reductions in state and federal government subsidies for the residential market. Origin Energy used to be one of the top two sellers of solar PV in the country.

Indeed, Origin Energy’s gas division the one high point of the result, lifting profits by 7 per cent thanks to a rise in gas prices. Origin Energy, of course, is heavily geared to the gas industry as it works to complete the $24 billion LNG export terminal in Queensland, which will start delivering profits in 2016 and is expected to contribute to a sharp jump in gas prices.

King said that gas generation was likely to be forced out of the market due to moderating demand, and the requirement to install more renewables. “Something has to give,” he said. Gas generation was costing $80-$100/MWh, and was being substituted by wind generation, which he said was costing more than $100/MWh. He wants the RET review to look at this issue.

Consumption from the mass market sector, essentially households, fell 12 per cent from 10.3TWh to 9.1TWh. Even the commercial and industrial market consumption fell 6 per cent to 10.4TWh.

Origin Energy says the key driver of its future earnings will be the impact on volumes – both from energy efficiency and solar PV, and its ability to lift margins.

Interestingly, it says the gradual uptake of more efficient energy appliances is continuing to reduce the rate of household energy consumption. However, this impact on electricity demand, is expected to moderate and be largely offset by the rate of household growth, which adds additional demand for energy.

This graph below shows the forecast moderation in electricity consumption. It assumes (inset) another sharp fall in solar PV installations, and then flat-lining in that sector.

Origin Energy did not quantify the fall in rooftop PV installations, although it said it had fallen significantly since the removal of the “very high” subsidies.