As those following this year’s climate Conference of Parties in Lima would know only too well, climate finance is a cornerstone of the international architecture necessary to address the climate challenge.

According to International Energy Agency estimates, about $44 trillion will need to be invested in low-carbon projects like wind farms, solar panels, nuclear power, carbon capture, and smart buildings by 2050 if we hope to limit global warming to 2°C and avoid the worst effects of climate change.

But while UNFCC members quibble over who should contribute what, some banks and governments have been getting on with the job by issuing green bonds.

Green bonds, or climate bonds, are fixed-income investments designed to finance environmentally friendly projects. First issued in 2007 by the European Investment Bank, followed a year later by the World Bank, they are today issued by state and local governments and by big companies. They have even bloomed in the harsh investment climate of Australia.

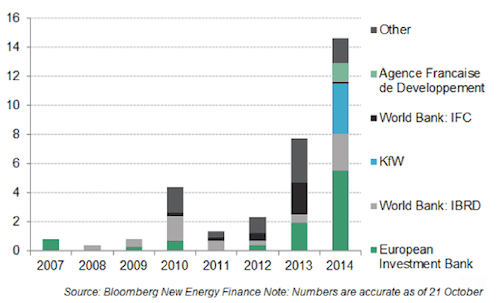

And now, the market is booming. The graph bellow by Bloomberg New Energy Finance says more than $14 billion of sovereign and supranational green bonds – that’s excluding the private sector – were issued in 2014 by the end of October, almost doubling 2013’s $7.7 billion.

When you include the private sector, London-based Climate Bonds Initiative – a nonprofit that also tracks the market – makes it that a total of $34 billion in green bonds issued so far this year, compared with about $11 billion worth in 2013.

This is more than double the total amount that had been issued by June 2014, and puts the market well on track to meet BNEF’s prediction that it will surpass $40 billion for the full year, as more companies issue the debt to finance clean energy projects.

What the chart above also shows, is that in the government sector, Europe is clearly leading the way. Australia has some catching up to do – although with the launch of the “Kangaroo” bonds market this year, local Climate Bonds Initiative analyst Sean Kidney has predicted a domestic market of at least $1 billion by the end of this year.

Globally, meanwhile, some experts are predicting $100 billion of green bonds will be sold in 2015.