New report from HSBC says conventional generators will be the biggest losers from the upcoming energy storage boom, as both consumers and grid operators look to battery and other storage technologies.

Conventional electricity generators have already received a battering from the revolution inspired by rooftop solar. Most fossil fuel generators – particularly those in Europe and Australia, are struggling to make a profit.

But things are likely to get worse. The influx of battery storage is destined to further reduce demand from conventional generators.

A major new analysis from global investment bank HSBC – Energy Storage, Power to the People – says the boom days for the fossil fuel generation are over. “There is no prospect of any return to anywhere near the level of profitability seen in the latter part of the last decade in generation,” it writes.

The HSBC analysis looks at a range of storage technologies and how that will impact the conventional energy systems. Its major conclusion is that affordable battery storage will increase distributed generation – solar panels on household and business rooftops – and further reduce demand from the grid.

On top of that, grid operators are also likely to use large-scale battery storage to balance demand and supply and for smart grid enhancements. That’s more bad news for conventional power generators. Once again, it says, the revolution will be led by Germany, notwithstanding the major initiatives in California and China.

“The German energy transition encourages the retail customer to become a ‘pro-sumer’,” the HSBC analysis notes. And it says that domestic storage of solar-generated power is set to take off.

“We believe that in markets such as Germany, households who are in ideological agreement with the drive towards renewables, who wish to be more in control of their own power supply and consumption (ie less of a “consumer” and more of a “pro-sumer”), and who are aware that the financial commitment is long at 20 years, will be prepared to embrace the battery storage principle.”

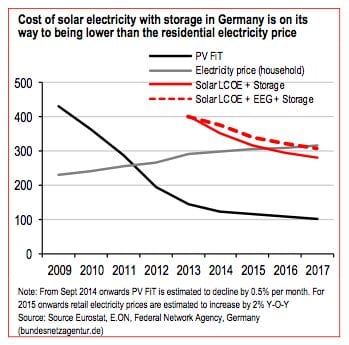

And, as this graph shows, the combined cost of solar and storage is on the way to being lower than the residential price. Welcome to “storage parity”.

But this is just the start, large-scale energy storage is on the horizon and conventional generation is at a disadvantage: the major utilities could lose out unless they leverage their client base and their level of integration by becoming full-service providers.

HSBC looks at the experience of RWE and E.ON, the two largest generation companies in Germany, which in the past 12 months have committed to joining, rather than fighting, the energy revolution in the country.

At least, that’s what they say, but the reality is that they have no choice. Unlike Australia, the German government shows no interest in slowing down its so-called “energiewende”. Sure, some of the market structures and incentives have been tinkered with, but the ambition remains the same, and there will be no bailout or handouts via “capacity” markets.

This is how the German grid operator sees the deployment of energy technologies over the next two decades. The amount of wind and solar will more than double out to 2035 – and nuclear will disappear, and production from black coal and lignite (brown coal) will fall dramatically.

HSBC notes that the German public will drive the growth of battery-based storage of solar, showing the way as the global solar market gains critical mass – just as it did with rooftop solar.

“The German government is, more than any other, promoting a localised system within which households (or collectives) actually own the generation.

“Given that (i) the unit size of 30% (and rising to 50% by 2025, we estimate) of German generation capacity is less than 10MW, the process of re-localisation of power production appears unstoppable.”

“Initially we expect that this will be small-scale in the form of household-based battery storage of solar-generated power, and, further ahead, large-scale conversion of hydro-power to green gas for storage in the gas network.”

Little wonder then, that RWE and E.ON have become heavily involved in distributed energy, regional smart grids, and focusing on energy efficiency and battery and other storage solutions.

They now offer storage devices to end-user household customers with solar, they are looking at compressed air energy storage, and RWE recently installed a CAES pilot plant, storing wind energy, with a capacity of 360MWh in Saxony.

According to RWE, the unit will be able to provide substitute capacity at short notice and replace up to 50 wind turbines of the type used in the region for up to four hours.

E.ON, meanwhile, has snapped up an energy services company, is investing in solar PV battery storage systems for homes, has a power-to-gas pilot unit at Falkenhagen, with 2MW capacity, that can produce 360M3 of hydrogen per hour (from wind energy).

It is also investing in a range of other battery storage technologies, including a modular 5MW “ multi-technology” medium voltage battery storage plant, is investing in 10 start-ups in EU and US. looking to “identify promising business models early in the process”, and is even invested in a ”smart energy real estate” concept development in Sweden.

The clear winners in this transition will be the storage developers themselves. The major question is which one.

HSBC looks at a couple, but Saft stands out simply because of the diversity of its projects.

Saft is leading a consortium to build a 9 MWp solar PV power plant incorporating a megawatt-scale Li-ion energy storage system on Réunion island, and in June it signed a contract with EDF to supply an initial energy storage system using a container of lithium-ion batteries to be installed on EDF R&D’s experimental “Concept Grid” in the south of Paris.

It has also delivered a 20 MW lithium‐ion Energy Storage System for E.ON on Pellworm Island, off the North Sea coast of Germany, and it was awarded a multi-million dollar contract by Kauai Island Utility Co-operative (KIUC) to provide a Li-ion Battery Energy Storage System (BESS) consisting of 8 containers (20MW) to stabilise the Kauai island electrical grid. Saft’s BESS will be deployed for use as part of a new 12 MW solar energy park under construction in Anahola.