This week one of the most crucial documents for the near and mid term future of Australia’s electricity industry will be released – possibly even more crucial than the Finkel Review of just a few months ago.

On Monday, the Australian Energy Market Operator was due to deliver a report commissioned by federal energy minister Josh Frydenberg into how much baseload or dispatchable energy is required over the short to medium term.

AEMO this week will also release its regular ESOO report, a summary of the short term “opportunities” for new power generation in various states. The special report for the minister will go into more detail about the need for baseload and dispatchable generation.

Both reports are critically important because they are likely to help frame the debate about the proposed clean energy target that is being considered by the Coalition, and was recommended by the Finkel Review, but also underpin the work of the new Energy Security Board that has been put into place.

The report should be about electrical engineering, but it is likely to become a hot political potato as well. The coal industry, and its supporters, are desperate to argue the point that new coal generation is necessary. Others are equally keen to make the point that it is not needed.

The wind and solar industry are already concerned about some of the developments taking place, both in the management of markets and in policy development – seeing them as overly cautious and imposing penalties on them that are not necessary.

They fear that some of the new thinking in electrical engineering is not being recognised and many of the more crucial decisions are being made by lawyers and economists, not the engineers expert in the field (and there are a range of views among this peer group too).

Some caution is understandable given the blackouts, load shedding and near misses over the last year, and the way that this has been taken up by politicians, ideologues and vested interests alike.

Wind, in particular, has found itself guilty by association for just about every event that has occurred – even though the nature of wind energy (its variability) has not been in question – at least by the people that run and operate the market.

However, AEMO has imposed some overly cautious initiatives in recent months, such as the requirement to have three or four gas generators operating at times of high wind capacity in South Australia, and appears to have imposed strict conditions on new connections, even though these new rules have not yet been ratified.

This has led to wind farm curtailment at times – the most recent last weekend, when the Waterloo wind farm in South Australia was curtailed, and limits placed on the inter-connector to Victoria. One gas generator was instructed to keep on generating, even though it didn’t want to.

The actions means that South Australia was limited by the amount of wind it could export, and was able – for the first time in several months since new gas requirements were put into action – to achieve low prices that used to be common with high wind generation.

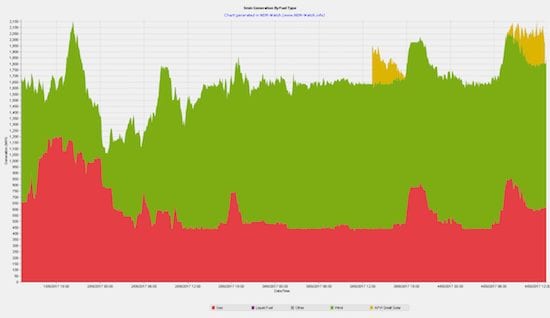

This graph above from WattClarity, who provide the software for our popular NEM-Watch widget, illustrates how the wind blew in South Australia in recent days. For a contemporaneous report on AEMO’s actions on Sunday, read this piece.

The industry hopes that such restrictions will gradually be unwound as AEMO satisfies itself that other measures including the Tesla big battery and the demand response mechanisms perform as expected.

Certainly, this would seem to be preference of CEO Audrey Zibelman, who has said repeatedly, and ever since she took office and oversaw the final report in the System Black in South Australia, that there has to be smarter and quicker alternatives than simply shovelling more fossil fuels into the system.

But this is a complex industry, with nearly opaque markets and impenetrable rules and regulations. And as discussions take place about how much baseload is needed, how much dispatchable generation, and how much inertia and frequency response, the wind and solar industries fear they are being unfairly penalised.

To be sure, the wind and solar industry understand that storage and grid services will need to be provided, and many see great opportunities in this. But they are also keen to ensure that they are not overburdened – and the consumer saddled with extra costs – with un-necessary requirements.

A report from 2014 points to the heart of the issue that will be discussed in impending policy decisions, particularly by the newly-formed Energy Security Board.

The report, presented to an international energy workshop in Beijing by Iain Macgill, from the Centre for Energy and Environmental Markets at UNSW, and co-authored by Jenny Riesz, now at AEMO, looked at the integration of costs of wind energy, but it made a critical point: namely that the integration costs of existing technologies – nuclear and coal as just two examples – are almost always excluded

“Adding wind causes other units to cycle more, increasing their costs,” the presentation says. “But so does nuclear, and coal baseload by the shifting merit order.

“Where is the discussion on the integration costs of these technologies? Which are even more challenging to allocate fairly.

“Wind ‘causes’ cycling costs only because inflexible thermal plant have high costs associated with cycling process; wind itself is highly flexible. You could argue that inflexible existing plant with high cycling costs are responsible for imposing these additional costs on system.”

It noted that over the short term that adding wind (or solar) does not increase the firm capacity requirement, because a system with sufficient firm capacity doesn’t need more when wind or solar is added.

“But we don’t talk about back-up cost of peaking plant when installing baseload to reflect its inherent economic inefficiency in supplying peak demand.”

The report says that increasing levels of wind capacity actually reduce total system costs and on this basis argues that it is “not meaningful” to ascribe cost of ‘back-up’ capacity to wind generation

This is a battle the wind and the solar industry is fighting. Some are aghast at new rules imposed in South Australia by the local regulator ESCOSA, and the apparent push to have them imposed in other states.

Like the CEEM report, many of the submissions to the review questioned why the new connection rules were being imposed on wind and solar, and not to the existing fossil generators, where many of the big problems lie, particularly in their inability to respond quickly to network faults, as identified by Finkel.

Pacific Hydro’s submission to ESCOSA typified those of many:

“There is a clear reluctance to set a technical obligation on synchronous units (gas and diesel generators) to meet the current minimum standard for RoCoF (the rate of change of frequency), a problem that translates as a cost to the entire region through constraints,” it says.

“The majority of the cost for the inability of gas turbines to ride through 1 Hz/s rates of change is being borne by the renewable sector and SA customers in the form of constraints.

“Connecting any generator that cannot operate through higher rate of change is placing the risk and cost of the poor performance on to the rest of the market,” it says.

“The inability of these (gas) units to ride through events is compounded by the “loose” governor settings. Correcting the governor settings on a synchronous unit so that it injects energy to its drive shaft early will aid the frequency response and actually help reduce the RoCoF.”

Yet, no action was taken by ESCOSA to address this issue, and now it seems new rules flagged to the market for the rest of the country appear to be causing wind and solar installations to be stopped in their tracks.

Even the Conergy solar and storage facility in north Queensland, the first such hybrid to be built in Australia, had to go back to the drawing board to review its technical parameters. As a result, its connection has already been delayed by a few months.

There will be much more of this in coming weeks