When radio shock jock Alan Jones got the cost of wind energy so horribly wrong in front of a million or so viewers on ABC TV last month, he did more than misplace a decimal point. He repeated an often-made misunderstanding about the costs of energy, and why renewables are already better value than fossil fuels.

Jones, appearing on ABC TV’s Q&A program, claimed that wind energy cost $1,500 a kWh, as opposed to coal which he put at $75/kWh. He had his numbers terribly confused, mixing up kilowatt-hours with megawatt-hours, repeating an error first made in The Australian that lifted the cost of wind energy tenfold.

Jones admitted his error, but he remained unbowed on his view of wind energy and renewables in general. Like the Coalition government, its advisors, and other opponents of renewable energy, including elements of the Murdoch media, Jones is convinced that renewable energy will cause overall consumer costs to soar. But he is wrong about that too.

Citigroup has published a detailed analysis of the costs of various energy sources, and it concludes that if all the costs of generation are included (known as the levellised cost of energy), then renewables turn out to be cheaper than fossil fuels and a “benefit rather than a cost to society.”

That gap, and that benefit, will widen significantly in coming years, particularly in the time-frames that the world needs to act on climate change and transition the global energy systems from coal and gas to clean energy sources such as wind and solar.

Capital costs are often cited by the promoters of fossil fuels as evidence that coal and gas are, and will, remain cheaper than renewable energy sources such as wind and gas.

But this focuses on the short-term only – a trap repeated by opponents of climate action and clean energy, who focus on the upfront costs of policies. This was the same argument used by the Abbott government when trying (and succeeding) in cutting the renewable energy target.

It is the same argument used by Abbott in panning Labor’s 50 per cent renewable energy target, when it plucked an $85 billion cost out of the air, and in responding to critics of its weak emissions reduction target of 26 per cent cuts by 2030 (when it plucked a figure of $600 billion for robust action).

As the Guardian has reported, the Abbott government’s own modelling shows little difference between ambitious and weak targets. That’s because the benefits of action over time usually offset the initial cost.

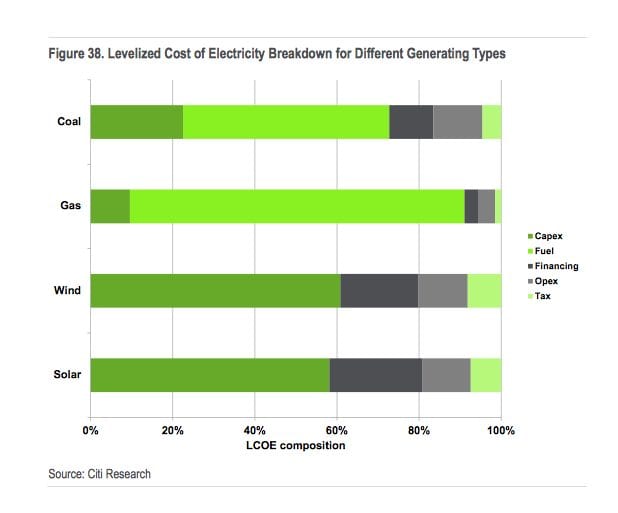

The same can be said of the cost of energy. In its publication, Energy Darwinism II, Why a Low Carbon Future Doesn’t Have to Cost the Earth, Citigroup used this graph below to illustrate how the upfront capital cost of wind and solar technology are much higher than that of coal and gas, for instance.

Indeed, the capital cost of wind and solar – for the equipment, account for around 60 per cent of their total costs. Half of the remainder comes in financing, and this is falling rapidly as new vehicles such as YieldCos bring down the cost of debt and equity.

On other hand, fuel costs can account for 80 per cent of the cost of gas-fired generation, and more than half the cost of coal. And gas costs vary dramatically, from $US3 a unit in the US, to $US8 a unit in Europe (and now in Australia), to up to $US15 a unit in importing countries such as Japan.

Citigroup says it is “dangerous” to rely on assumptions of capital expenditure when the pace of change in an industry is so rapid, and the rate of evolution so fast. “Examining capex on a standalone basis runs the risk of overstating the cost of renewables, and understating the total cost of conventional generation technologies,” Citigroup noted.

So, how do these technologies compare on an LCOE basis?

This next graph shows the lowest cost wind (in the best regions) is already beating coal and gas. Solar in the sunniest regions will do so by 2020. And the cost of solar and wind will continue to fall, with solar eventually beating wind. Even these estimates rely on relatively conservative estimates of the cost falls in solar. Citigroup estimates a “learning rate” of 19 per cent – meaning that solar costs will fall that much with each doubling in capacity (a variation of Moore’s Law). This translates into cost falls of 2 per cent a year.

Even these estimates rely on relatively conservative estimates of the cost falls in solar. Citigroup estimates a “learning rate” of 19 per cent – meaning that solar costs will fall that much with each doubling in capacity (a variation of Moore’s Law). This translates into cost falls of 2 per cent a year.

But as real-life experience shows, cost falls are happening faster than that. Last week, one of the big solar module manufacturers, Trina Solar, said costs had fallen 19 per cent in the past year, and would continue to fall by at least 5 per cent to 6 per cent a year in coming years as efficiencies were improved, manufacturing and labour costs fell.

Even with that quibble, Citigroup says that there is a financial advantage in installing renewable energy.

“We should think of installing renewable energy as a benefit rather than a cost to society,” it writes.

“This is one of the key benefits of examining total spend on an LCOE basis, as it demonstrates well the shifting relative economics of different generation technologies. Most important is this point that as renewables become ‘cheaper’ than conventional, there is effectively a net saving to using them.”

So, why does this matter?

Well, Citigroup says that between 2014-2040, the world is likely to invest some $US190 trillion into energy – whether it takes action on climate change or not.

The difference between taking no action and Citi’s own “action” scenario results in little difference in costs, in fact it would result in a saving of $1.8 trillion, as we reported last week. But the even greater savings comes in avoided damage to the economy in environmental impact. Those costs, if the world persisted with a business-a-usual rate, could be as high as $72 trillion.

In the “Citi ‘Action” scenario, the analysts have assumed that the fossil fuel share across the globe declines from currently over 64 per cent to 28 per cent by 2040, whilst solar PV and onshore wind energy could make up to 22 per cent per cent of the electricity mix, and 40 per cent including all renewables (including hydro and others).

“There is a limited difference ($US1.8 trillion) in the total bill to 2040 between our ‘Action’ and ‘Inaction’ scenarios,” Citigroup writes. “However, we demonstrate the higher earlier spend on renewables and energy efficiency in the action scenario, which leads to fuel savings later.

“Comparing the in-year differential cost between ‘Action’ and ‘Inaction ‘shows that there is a net cost per annum of following a low-carbon path until 2025, after which we move into net savings via lower fuel usage.

“At its worst, this net cost is only around 0.1% of global GDP; in a cumulative sense there is a net cost out to 2035, beyond which there is a net saving; at its worst this cumulative net cost is still only around 1% of current GDP. In the context of the potential liabilities, these seem like relatively small figures.

“In a positive sense, a more diverse energy mix could make future energy shocks less severe, as could the non-fuel nature of renewables.

“The greater upfront investment in energy could also help to boost growth and act as a partial offset to the effects of secular stagnation being witnessed currently. Lower long-term energy costs as a percentage of GDP could ultimately serve as a significant boost to GDP, especially compared to the potential lost GDP from inaction.”