Bloomberg New Energy Finance

Vattenfall, a Sweden-based producer and distributor of electricity and heat, won a tender this week to build two offshore wind farms with a record-breaking bid of EUR 60 ($67.33) per MWh – 20% lower than the previous record set by Dong Energy in July.

The low bid is supported by the location of the wind farms, which are in close proximity to the shore in the Danish North Sea, leading to lower costs for foundations and transportation. “With our bid for DNS [Danish Near Shore Wind], we have demonstrated that we are able to reduce the costs of offshore wind faster than had been expected, only a few years ago,” said Gunnar Groebler, head of Vattenfall Wind.

This tender may not be the final word, however. Vattenfall still needs final approval from the Danish government, which is considering an end to support for near-shore wind farms.

If approval is forthcoming, Vattenfall will initiate final preparations for the wind farms, including procurement, services, optimisation and final design, with the aim to start construction in 2019 and to begin producing power in 2020, according to the company.

The projects are expected to have a total capacity of 350MW and will provide sustainable energy for 375,000 households once complete, according to a company statement. Bloomberg New Energy Finance’s latest outlook on the wind sector can be read here.

In other news in the region, Innogy, the renewables, grid and retail business being split out of German utility RWE, will announce plans for an initial public offering to raise about EUR 2bn ($2.2bn), according to people familiar with the matter.

The Essen-based company is expected to publish its intention to float a 10% stake in the company through an IPO and it is also considering a secondary share offering, the people said.

German power companies have begun separating conventional plants from their green-energy initiatives in reaction to the government’s shift toward wind and solar generation. The policy has hurt profitability at traditional utilities and driven down wholesale energy prices. EON, for example, spun off and bundled its renewable, energy network, and customer solutions business, from the rest of the company in January this year.

Meanwhile, a group of 44 countries in Europe committed to participate in a global carbon market for airlines starting in 2021.

The European Union, its 28 member states, and 16 other nations adopted a political declaration on emissions ahead of a United Nations’ aviation body meeting next month. The International Civil Aviation Organization plans to agree on how airlines are charged for carbon emissions after 2020. According to the European Union, direct emissions from aviation account for roughly 3% of the bloc’s total greenhouse gases, with a large majority arising from international flights.

Over in the Western Hemisphere, the US recorded a 43% surge in solar installations in the second quarter. This was due to a wave of utility-scale projects taking advantage of an extension to the federal Investment Tax Credit. The ITC was scheduled to expire in December last year, but was unexpectedly extended by Congress at the end of 2015

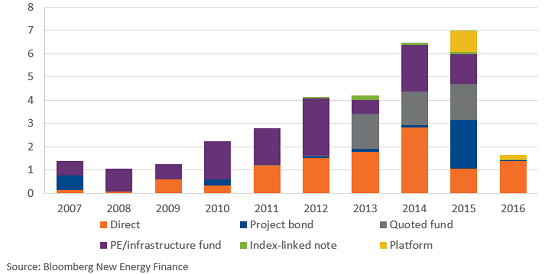

Note: The data used in the graph above was produced in May 2016.

Source: Bloomberg New Energy Finance. Reproduced with permission.