A massive solar project in Villanueva Mexico and the upward momentum of US market darling Tesla have been singled out as highlights of a somewhat “tepid” year so far in clean energy investment, according to the latest quarterly report from Bloomberg New Energy Finance.

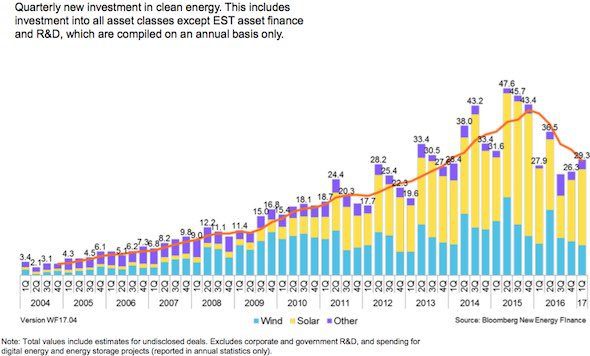

BNEF said on Wednesday that global clean energy investment had totalled $US53.6 billion in the first quarter of 2017, charting a 17 per cent fall from Q1 2016, but down only 7 per cent on the final quarter of 2016.

As with the figures for the full year of 2016, BNEF said the lower investment numbers for Q1 2017 did not reflect a slowdown in the global roll-out of renewables, but rather the falling cost of developing wind and solar generation.

“This trend means that year-by-year it’s possible to finance equivalent amounts of capacity in these technologies for fewer dollars,” said BNEF chief executive Jon Moore.

Strong points for the year so far included the $US1.4 billion of public market share issues by EV and battery storage company Tesla, which as we reported here on Tuesday pushed the company past General Motors to become the most valuable car maker in the US. It also pushed public markets investment in clean energy up by 215 per cent year-on-year to $2.1 billion, said BNEF.

Another major strong point for Q1 was the estimated $US650 million financing by Enel of its Villanueva photovoltaic complex in Mexico which, at 754MW, BNEF says is “arguably the biggest solar project to reach this stage anywhere in the world so far.”

Investment in small-scale solar (<1MW), was the second-largest category of investment, and was one of few categories to chart a rise, with a Q1 tally of $US10.7 billion, up 8 per cent on the same quarter a year earlier.

On the weaker side of the equation, BNEF cites the 60 per cent year-on-year fall in offshore wind financings, to $4.6 billion from a bumper $11.5 billion in first quarter 2016.

Lower investment in the two juggernaut markets, the US and China, is also linked to the slower start to 2017: $US9.4 billion was invested in Q1 in the US, down 24 per cent; in and China $17.2 billion was invested, down 11 per cent.

“It was a relatively quiet first quarter for global investment, but it’s too early to assume that 2017 as a whole will be lower than last year,” said BNEF analyst Abraham Louw.

“(We) are currently expecting both wind and solar to see similar – or higher – numbers of megawatts added this year than last.”

By investment type, the largest category was asset finance of utility-scale renewable energy project, at a total of $US39 billion in the first quarter, down 28 per cent from Q1 2016.

Among the biggest projects financed were the 497MW Hohe See offshore wind farm in German waters, at $1.9 billion, and China’s CPI Binhai H2 offshore wind array, at 400MW and $911 million.

In onshore wind, the biggest deal was for the Texoma wind portfolio in the US, at 500MW. In geothermal the top transaction was the Supreme Energy Muara Laboh plant, at 80MW and $590 million.