Australia’s cleantech sector continues to fall further behind the rest of the world, despite the fundamentals of the burgeoning global industry being better than ever, a new report has found.

The report, to be published on Wednesday by research and advisory firm Australian CleanTech, found that while ‘cleantech’ was currently out of favour in Australia’s mainstream political circles, the fundamentals of improving industry efficiency and driving jobs, investment and trade were stronger than ever.

“The opportunities to both increase the efficiency of our existing industries and build a significant export market through building the cleantech sector are massive,” said John O’Brien, managing director of Australian CleanTech. And yet, he adds, “Australia is falling further behind the rest of the world.”

“The opportunities to both increase the efficiency of our existing industries and build a significant export market through building the cleantech sector are massive,” said John O’Brien, managing director of Australian CleanTech. And yet, he adds, “Australia is falling further behind the rest of the world.”

The analysis of comparative policy initiatives in 2013 shows Australia lagging behind its Asian peers in terms of cleantech industry development, despite the fact that in Korea, Japan and China – three nations targeted by Australia with free trade agreements – the focus on cleantech is becoming one of the highest priorities.

“This year we have found that whilst the term ‘cleantech’ has fallen out of favour politically in Australia, both Australian industry and the big Asian markets see it as one of their highest priorities,” O’Brien said.

“We work extensively in China and Korea facilitating bilateral technology and investment transfers and the difference in the growth in those markets compared to Australia is huge. We have some great technologies and expertise and we have the opportunity to take these to the world.”

“This presents a huge opportunity for Australian companies,” says O’Brien, “and, at the same time, will present significant challenges for our politicians.”

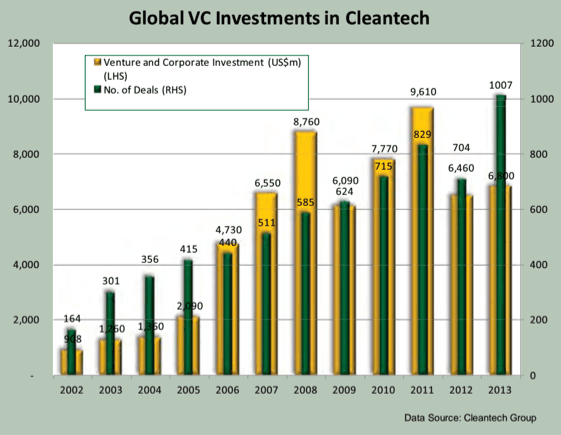

Another key factor identified by the report as hampering the growth of Australia’s cleantech sector is the lack of available venture capital. Averaged out over the last five years, the report finds that a only a quarter (24.7%) of Australia’s total venture capital investment was spent on cleantech companies, with the 2013 figure of $18.3m representing 16.4%.

But despite political ambivalence and a lack of ready finance, the report found that the nearly 1,500 Australasian cleantech companies employ more people than Australia’s declining automotive manufacturing sector, while cleantech employees were found to be five times more productive than those in general manufacturing.

As a sector, cleantech companies had combined revenue of $32.5 billion and employed 58,000 people in 2013 – taking the sector to above 2 per cent of GDP for the first time.

The 1,500 companies were involved in 120 separate capital transactions totaling $4.3 billion, with NSW and Victoria coming in as the most active states, with waste, water, hydro, environmental services, solar and wind sub-sectors all generating more than $1 billion of revenue over 2013.

The report also lists its predictions for the top 10 cleantech trends for 2014 (see table below), including: demand for cleantech in Asia reaching new highs; greater involvement of “high street” banks in funding cleantech; an increasing investor focus on climate liabilities; a challenge to current electricity distribution network business models and; (it goes without saying) ongoing international embarrassment over Australia’s climate and cleantech policies.