Scrapping or diluting Australia’s Renewable Energy Target would deliver a multi-billion dollar windfall win to existing fossil fuelled power generators, while increasing electricity prices for consumers, a new analysis has found.

The study, by energy market advisory group Intelligent Energy Systems (IES), comes to the not-so surprising conclusion that existing non-renewable generators would be windfall winners from LRET removal or dilution, the modelling revealing a potential benefit of up to $4.6 billion in 2023 or $12.8 billion on an NPV basis.

Less predictable, however, is the study’s finding that electricity consumers – households and businesses – would foot the bill.

“The simple view is that reducing or diluting LRET will deliver overall cost reductions that should eventually flow through to benefit customers,” says the IES report, released on Thursday.

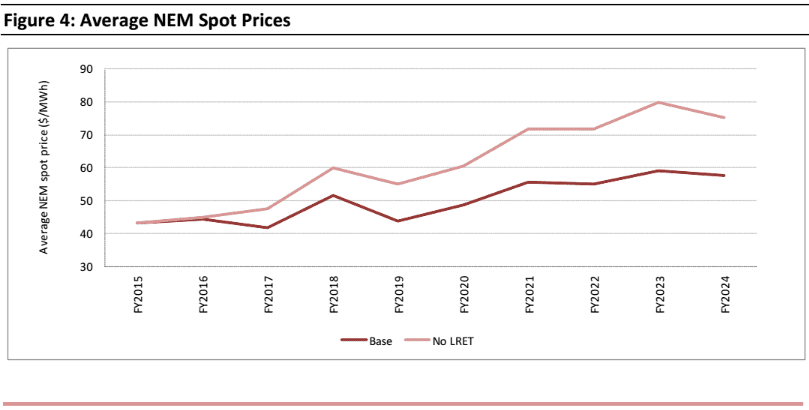

And, as the table below illustrates, IES modelling does forecast a short-term cost reduction in the no LRET scenario. But his does not last, the report notes, with “the benefit… eroded by increasing spot prices over the medium to long-term.”

Under a no LRET scenario – one of the potential outcomes of the Abbott government’s current review of the scheme – the IES modelling predicts that the average household could pay an extra $250 a year for their electricity by 2023, as average NEM spot prices chart an upward trajectory from around 2016 onwards.

“Under current policy settings it is existing thermal generators, not customers, who are effectively underwriting the LRET,” says the report’s author, Hugh Bannister. “We can fiddle with our assumptions and scenarios but I will stick my neck out and assert that this is a robust conclusion from any serious modelling. We will see what ACIL Allen comes up with as the official modellers, assuming that they will produce a winners and losers analysis.”

The rest of the findings, says the report, are “as per expectations:” new wind new-entry is not economic without LRET policy support and the renewable generation that would have occurred in if the LRET was left in place is instead largely picked up by the existing coal and gas-fired generators. Altogether, new renewable generators would lose out $4.7 billion (NPV) across the 10 year period, according to IES modelling assumptions and results.

Exisiting renewables generators would also “take an immediate and substantial hit” if the LRET was removed altogether. With LGC prices pushed down to $0/certificate, these generators would be left with a loss of expected income from LGCs of up to $725m in 2014-15, says the report, adding that “presumably some form of compensation package would be put in place to keep them whole (or retain some lower LRET target), given that they invested in good faith.”

And while the existing non-renewable generators would be the big winners from a no LRET scenario, the IES points to the broader question of what sort of financing would be on offer for new coal fired plant with economic lifetimes of 30 years. “Investment is a long term business,” it notes.

Finally, the report suggests that in an “idealised” world, a carbon tax would be the government’s instrument of choice to raise revenue, “at the same time nudging the economy toward less carbon intensity in the process. With this instrument in place, other policy measures such as the RET and Direct Action could then be gradually phased out or not renewed.”