Australian electricity retailers continue to sit on their hands, refusing to sign power purchase agreements for new large scale renewable energy projects, but some 3,800MW of capacity will need to be committed within the next 12 months if a shortfall in the renewable energy target is to be avoided.

That is the assessment of energy markets trading and research firm Green Energy Markets, which said no new contracts had been written for new renewable capacity, but much was needed by the end of 2016.

It noted that only those projects directly sponsored by the ACT government’s auction program (where certificates are voluntary surrendered), or small solar projects (Degrussa, Uterne) co-funded by government agencies such as ARENA and the CEFC are going ahead.

It noted that only those projects directly sponsored by the ACT government’s auction program (where certificates are voluntary surrendered), or small solar projects (Degrussa, Uterne) co-funded by government agencies such as ARENA and the CEFC are going ahead.

There have still been no new commitments to other large scale projects, despite the bipartisan agreement to cut the RET to 33,000GWh from 41,000GWh, and promises by environment minister Greg Hunt that there would be no change to the policy, and the retailers should end their “capital strike.”

The price of renewable energy certificates (LGCs) has now soared to a record high of $68.50/MWh, more than the “penalty price of $65/MWh ($93.50 after tax impact).

Given that the ACT government has written contracts for $81.50/MWh (fixed for 20 years), this price for LGCs should be more than enough to get new wind farms going. But still there are no contracts or finance.

But at least some of the retailers appear happy to play a game of bluff. AGL has said it does not currently see sufficient market and policy incentives for it to write off-take contracts or develop new solar and wind plants, and analysts say its coal fired generators would benefit from a shortfall.

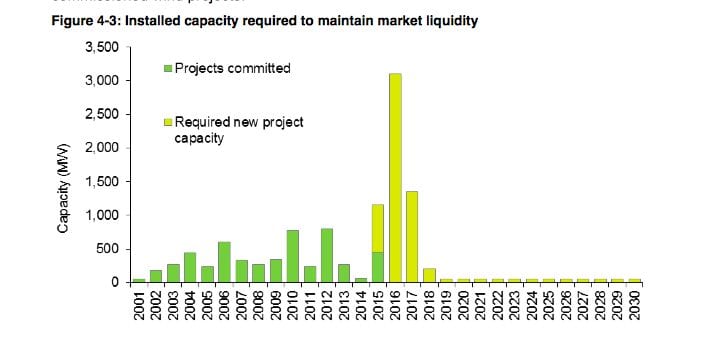

Green Energy Markets says that to maintain a “minimum” 5 million LGC surplus, some 3,800 MW of new projects need to be committed by the end of 2016. A total of 5,450 will be needed by 2020 to meet the new target.

Green Energy Markets says that to maintain a “minimum” 5 million LGC surplus, some 3,800 MW of new projects need to be committed by the end of 2016. A total of 5,450 will be needed by 2020 to meet the new target.

If there are no new projects, then the surplus of LGC’s drops from more than 18 million now to around 3.3 million in 2017.

“This level of surplus LGCs is not expected to provide sufficient liquidity to enable the efficient operation of the market,” its says. “As a result new projects will need to be committed and start generating LGCs well before the end of 2017.”

If there is a shortfall, obligated retailers will have to pay a penalty price of $93/MWh (after tax considerations). The recipient of this money is the federal government, although retailers will attempt to pass these costs to consumers.

Green Energy Markets noted that wind farms that were fully operational on 1 January 2013 had achieved an average capacity factor so far in 2015 of 32.1 per cent, slightly higher than the 31 per cent achieved in 2014. Tasmania had the best capacity factor.

Most forecasts suggest that large scale solar – particularly in Queensland where electricity prices are higher at the wholesale level – could account for half or more of new renewable energy capacity.