Share price drivers

In summary, Origin Energy (ORG) has lots of problems, its utility profits are just flat, its balance sheet is stretched and APLNG needs a higher oil price. All that said the worst is probably behind it and in the share price. The most encouraging news in this result was the cost achievements. In our view investors have always appreciated a disciplined approach to cost management. For the first time in years ORG seems to be showing this.

ORG shareholders have numerous concerns, but the principal share price drivers short term are:

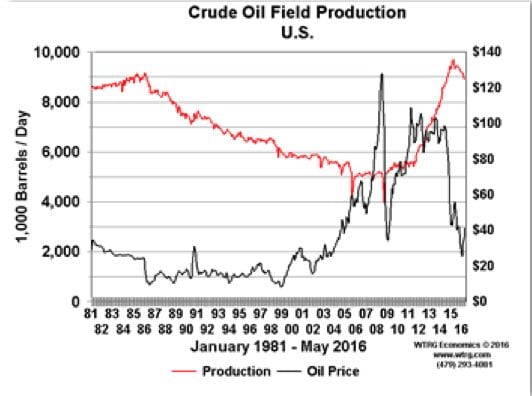

- Oil price. Every A$10 per barrel the oil price is above US$42 per barrel means an extra A$200 m for ORG. ORG explains that it gets cash from APLNG when the Brent Oil price is above US$42 barrel. The $42 figure builds in $1 bn per year debt repayment at APLNG,. Brent is presently at US$45. Consensus is for oil to be a bit over US$50 barrel in 2017 and maybe 10% higher the following year. Still ,those numbers could be wildly wrong. It likely requires US$70 barrel to justify a new offshore oil field development. Capital expenditure for bigger, long lead time projects has been cut very substantially internationally but these days the USA shale oil sector can respond to meaningful change in price within say nine months, and there is still a significant inventory of drilled but not completed shale wells.

- Debt. Tied up with ORG’s APLNG profits is the company’s ability to reduce debt from the year end level of $9 bn (excluding the conceptual share of APLNG’s senior debt). This can only be done from asset sales or improved operating cash flows. Over time as its existing upstream assets excluding APLNG deplete it will need to reinvest. Similarly although it can simply contract to buy the output from say Stockyard Hill in one sense this is just lease financing its development. ORG will need to spend significantly in the utility=energy markets business over time.

- Near term we are also keeping a close eye on the gas profits earned by the energy markets segment. ORG forecasts those to be maintained in FY17, but they dropped sharply in H2 of FY16 and there will be virtually no ramp gas by the end of this calendar year. We expect a physically tight gas market next Winter and even tighter the following year.

- Electricity retail competition in NSW. ORG has 45% of its mass market customers in NSW. FY17 will be the first year where ORG, like every other retailer, will be free to charge what it likes in NSW. Will this lead to an uptick in margins or will competition work? Right now we see margins in Victoria, fully deregulated, as similar or just a touch above the semi regulated NSW market. This makes us think that NSW margins will go up a bit. Still even if they made another $50 per customers that’s just $60m per year.

ORG will be split up, either by the company or by someone else

It’s become very clear that the risk preferences and management skills for an upstream business and a utility business are very different. ORG is clearly two companies under one banner. At the moment ORG guarantees its share of APLNG project debt, so a split can’t be done, but that won’t be a problem in another 12 months. The only question is how it will happen.

A quick glance at the results and outlook

We show a quick figure of the main P&L and some guesstimates about how it may look over the next couple of years. The projections should be treated with a large grain of salt. They don’t have the benefit of peer review, or reasonableness checks and represent a high level sketch rather than the output of a detailed model. Furthermore we have totally ignored the mandatorily redeemable cumulative prefernence shares [MRCPS] as we regard them as largely a cosmetic device to get cash into and out of APLNG in a tax effective manner.

ORG’s peculiar method of accounting for APLNG makes it difficult to appreciate that APLNG is in fact nothing more than an investment for ORG and in our view its easier to understand ORG’s finances by treating APLNG as an investment and simply seeing the cash paid to ORG once the company is running. For FY18 we see as follows:

ORG’s energy markets (utility) results were basically flat on last year. That is actually an improvement on recent years as electricity gross profits have been under pressure for some time. The increase in gas profits was initially due to buying cheap ramp gas (gas produced in advance of LNG production) and then in this half by sales to GLNG at higher oil linked prices.

However, since the oil price is down, the actual sales price to business customers fell and the cost of gas increased. In our opinion, despite increasing volumes sold to GLNG next year the gas gross profit bears watching. The electricity price charged fell mainly due to a fall in network costs in NSW.

Renewable energy and ORG’s position

What ORG says and what it does in regard to renewable energy is a function mainly of necessity. ORG is short thermal generation, so it is in its interest to say that is a good thing and carbon will become more of a problem.

ORG has about 1.5 m REC inventory and for the next couple of years has around 3.8 m production and contracts. The message from the slide in today’s result pack is that the upto 500 MW Stockyard Hill site will fill much of the major gap that develops from around 2020. Of course at 500 MW Stockyard Hill is about $1.2 bn of capital expenditure and that won’t be done on a 5 year PPA.

In 2016 ORG executed 156 MW of solar PPA’s but of course part of that was on the already in production Moree plant so it produces no new renewable energy.

Upstream – at least the $40bn LNG plant works

The upstream results reflect the outcome of a lot of bad news that has driven the shareprice down from $15 to $5. Specifically, ORG ended up contributing more capital to APLNG than originally anticipated, a largish contract to sell gas to QCLNG at an oil linked price has lead to a $63 m ebitda loss in FY16 rather than the profit originally anticipated. The second train will be about 9 months behind when the company said it would. However, if you are an optimist, you might see:

- APLNG has already made substantial cost cuts, with 2000 jobs gone and achieved its cost target six months ahead of schedule;

- The plant goes great

- The upstream fields produce as well as or even better than expected.

- Customers are honoring their contracts;

Our quick look at APLNG’s financials suggests that at an oil price of US$65 boe APLNG could be distributing about A$0.5 bn to ORG after paying down A$1 bn of APLNG’s own $11 bn of project debt.

Oil price upside maybe limited by the ability of USA shale production to respond promptly to a price signal.

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.