“plus ça change, plus c’est la même chose” (the more it changes, the more it stays the same).

- Volumes : In 2017, they have started with a bang, rising up 3% NEM wide but up 9% in QLD and NSW, no doubt driven by hot weather, but down 14% in Victoria due to the Portland smelter being largely offline and milder weather.

- Future prices: Increased in most areas other than South Australia and the charts below show how prices, particularly in QLD have moved up even over the past month.

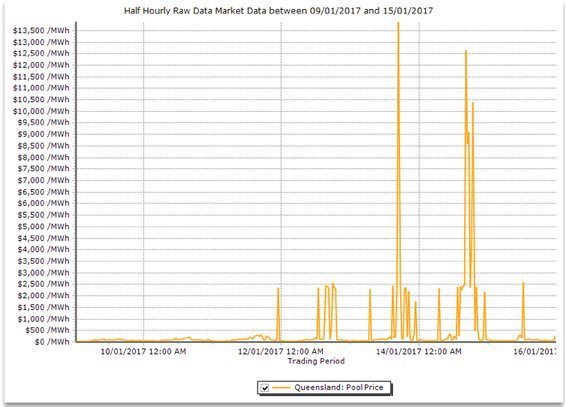

- Spot electricity prices Averaged $447 for the week in QLD with prices over $13000 mark on a couple of occasions. Of course, there is no newspaper article when this happens because, since there is basically only rooftop PV in QLD in the way of renewables, there is no convenient scapegoat. Its QLD that desperately needs new renewables and like South Australia it needs dispatchable renewables. The first reverse auction tender in QLD “should be” for say 200 MW of dispatchable renewables. Get on with guys. See figure 1. We will do more on this later. This year Darling Downs is scheduled to be withdrawn from the QLD market (gas sold to LNG produers). That together with the closure of Hazelwood will see a constant flood of stories this year.

- REC prices in the near term were a touch softer but since there is no trading it’s all a bit theoretical

- Gas prices : Were also very strong averaging over $9 GJ in QLD and South Australia and $7 GJ in NSW. Considering that gas is supposed to be a Winter peaking market these prices show how the need for gas fired peaking generation at a time when gas is short is pushing up electricity prices. The oil price is gradually increasing. LNG prices are linked to oil and gas prices are linked to LNG. Forecasts are for say another 10% increase in oil prices this year in $US and if China slows in H2 of this calendar year the A$ could easily decline again. We see some prospect of ORG in particular writing new contracts to buy gas from say APLNG but it won’t be cheap. ORG is long gas and has no incentive to lower the price. AGL is talking about importing LNG into NSW but that is surely years away. In NSW just getting planning permission for an import termimal could be expected to take a year.

- Utility share prices: The good news, in our opinion, is that bond markets have eased back a bit (interest rates have fallen) as the markets reconsider the “Trump impact”. In this environment utility shares are holding up quite well with most utility shares other than Redflow up on the previous month. We will include “Tilt” from next week.

- Industry news.. This year is going to be all about policy development. Without new investment of some kind electricity prices will continue to stay well above international peers. Of course there will be much more said on this. Frankly the next announcement we look for is that the Portland Smelter is going to close. Recent press commentary, in line with management history, is that the smelter needs to “stand on its own feet” ie if its only viable with a subsidy, that’s not good enough.

- Also in Victoria, we had the Fair Work Commission siding with AGL over the enterprise bargaining agreement at Loy Yang A. Both AGL and the unions are playing for high stakes here. Once Hazelwood closes, a strike at LYA or an outage will really set the cat amongst the pigeons. AGL needs a willing and committed work force. With out that productivity will be poor. On the other hand our believe is that AGL had a case that productivity can be improved at LYA.

Share Prices

Volumes

Base Load Futures

Gas Prices

David Leitch is principal of ITK. He was formerly a Utility Analyst for leading investment banks over the past 30 years. The views expressed are his own. Please note our new section, Energy Markets, which will include analysis from Leitch on the energy markets and broader energy issues. And also note our live generation widget, and the APVI solar contribution.