Last December, the Australian Conservation Foundation reminded us just how much Australians pay for fossil fuel subsidies, with a report estimating a total of $47 billion would be allocated by the federal government to the production and use of fossil fuels over the following four years.

As the report also pointed out, the biggest single drag on taxpayer funds was the Fuel Tax Credit scheme, which would be responsible for $27.9 billion over four years. But a new report, released on Wednesday by the ACF, has found that basic reform to that scheme could save as much as $15 billion over the four year period.

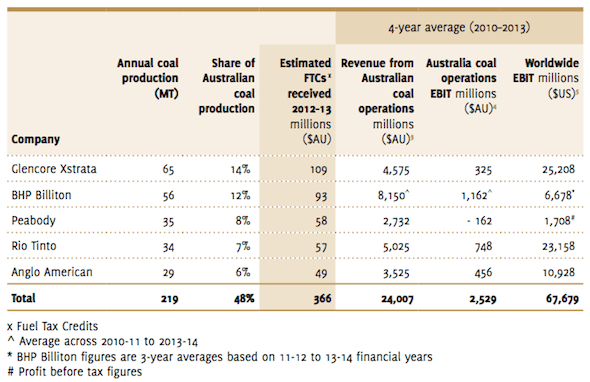

According to the report – and illustrated in chart below – the cost of subsidising the diesel fuel used by just five of the nation’s biggest coal companies – Glencore Xstrata, BHP Billiton, Peabody, Rio Tinto and Anglo American – is around $360 million a year. Over the next 4 years the Government will spend more on the Fuel Tax Credit Scheme than on overseas aid

The ACF says that the way the scheme is designed means most coal mining companies that use imported fossil fuels for their operations are eligible to receive a tax credit that essentially refunds them the entire amount of tax paid on the fuel.

“Australia’s largest coal mining companies are having their fuel subsidised by the taxpayer while they mine a highly polluting substance that is damaging the climate,” said ACF CEO Kelly O’Shanassy.

“If the government wants to create a fairer budget this year, it should reform this subsidy which encourages pollution and adds to the profits of already profitable private companies.

“ACF proposes a $20,000 cap per claimant, so those making small claims, like farmers, would not be adversely affected.

“Legal advice provided to ACF by Environmental Justice Australia shows legislative reform of the Fuel Tax Credits Scheme would be relatively straightforward.

“Changing the scheme would save the budget $15 billion over the forward estimates.

The report proposes that the $20,000 subsidy cap be introduced gradually, over a period of time; starting with a limit of $80,000 in FY 2015-2016, and moving to $60,000 in 2016-2017, $40,000 in 2017-2018 and $20,000 in each financial year from 2018-2019 onwards.

“Australian taxpayers’ hard-earned dollars should be used to build a better life for all of us, not to add to the bottom lines of multinational coal companies,” O’Shanassy said.