Well it’s been a long time coming, but SunWiz can now confirm that the Clearing House has shifted, rewarding those who had been holding out since early 2011 to get $40 for their STCs. Here’s what’s happened and what it means:

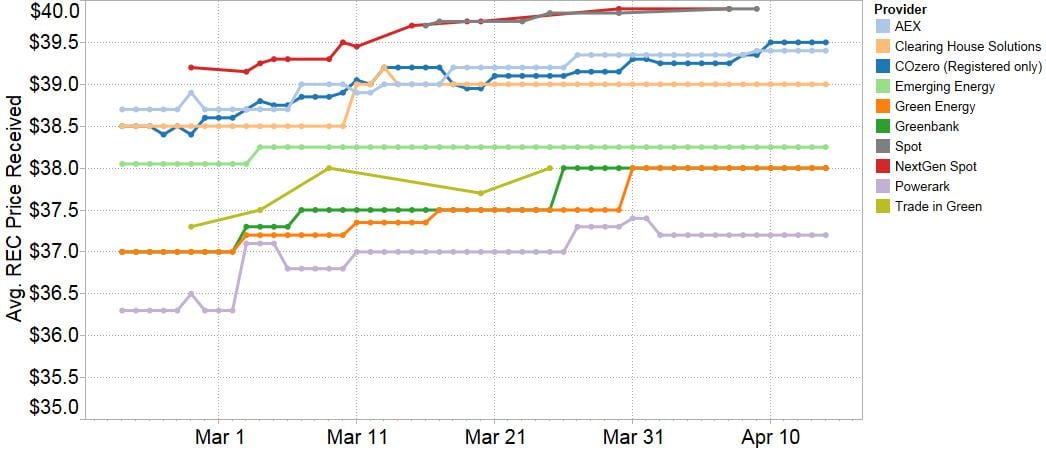

We are mid way through the Q1-2015 STC surrender period (which ends April 28th), and it seems as though some Liable Entities have decided that the STC spot price is so close to $40 that they may as well buy the STCs from the Clearing House. The chart below shows recent movements in the STC price from major suppliers. The spot price is hovering marginally below $40.

Previously, the only reason the Clearing House has reduced in volume has been because STC owners have given up waiting, and sold to an STC agent or Liable Entity for a price less than $40. People have been waiting in the Clearing House for years, and those at the back of the queue would give up and take whatever the spot market price was.

As this happened, the Clearing House volume peaked at 7M in late 2011 and has been falling ever since. The green line in the graph below shows the volume in the Clearing House all the way back to 2011. The red line is the ‘excess’ STCs available beyond the requirements (assuming a daily surrender). You can see that since the start of 2015 the excess STCs have been drying up.

But as the STC over-supply has dried up, some Liable Entities have decided that rather than reach out to those holding STCs outside the Clearing House (and save a dollar per STC, rather than $6 per STC as was previously the case), they would prefer to take the easier route of buying from the front of the Clearing House queue.

We can see (from the lower part of the graph below) that 150,000 STCs have been pulled out of the Clearing House in the past 5 weeks. Not all of this has been Liable Entities buying from the front of the Queue, but SunWiz can confirm that ERM, Hydro Tasmania and Ergon have bought from the Clearing House by the bucket load. And some liable entities still need to buy over 1M STCs in the next week.

Now, before everyone rushes to put their STCs back into the Clearing House, its almost certain that the Clearing House won’t clear entirely in Q1. There are still plenty of STCs available in private hands – banks and aggregators hold one million between them. The blue line in the upper pane of the graph above shows the projection of the excess, and while the excess is decreasing, there will still be STCs available outside the Clearing House in sufficient quantities to meet the Q1 Liability.

Subscribers to ClearView know exactly who is holding STCs outside the Clearing House. Greenbank is the largest of them (other than Liable Entities). Interestingly, one STC creator holds 15,000 STCs and has never sold any (and they’re not in the Clearing House). ClearView subscribers also know the current holdings and required surrender volume for each liable entity, and which entities are buying from whom and in what quantity.

Source: Sunwiz. Reproduced with permission.