Global infrastructure investment company UIL Limited has bought a 5 per cent stake in ASX-listed wave energy developer Carnegie Wave Energy, after buying up the last of the shares formerly owned by UK company Renewable Energy Holdings.

In an ASX announcement on Monday, Carnegie said UIL (formerly Utilico Limited) had acquired 100 per cent of Renewable Energy Holdings’ stake in CWE, a 5.07 per cent stake of 101,330,192 shares. That makes UIL the second largest shareholder in the wave energy company.

UIL has also agreed to a 12 month voluntary trading escrow, preventing sale of their shares for 12 months.

Renewable Energy Holdings (REH) began selling its 25.8 per cent stake in Carnegie Wave in mid-2012, just as Carnegie revealed it had won a $9.9 million federal government grant towards the development of a grid-connected CETO wave power array.

At that time, most of the REH shares were snapped up for the bargain price of 1c by former Carlton footballer and founder of Hastings Funds Management Mike Fitzpatrick, and co-investors Tim Holmes and Tim Roberts.

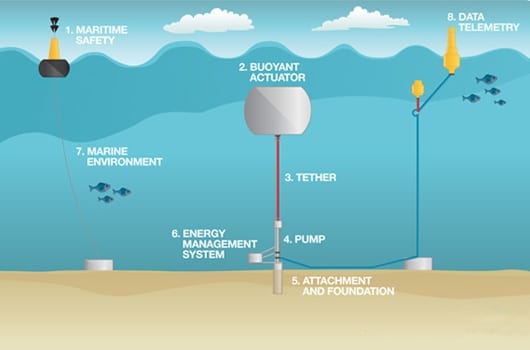

Carnegie has since built the CETO 5 wave power array, which feeds energy to the grid at Garden Island, off Perth, and which is now being transformed into the world’s first wave-integrated renewable energy microgrid project to be connected to an electricity network.

The Garden Island Microgrid Project will combine Carnegie’s CETO 6 array, which is currently in progress, solar and battery storage, and the existing reverse osmosis desalination plant that is currently operating on Garden Island after being switched on in October 2015.

At the time of publishing, Carnegie Wave’s share price remained steady at 0.037 cents.